The foreign exchange market (forex) is by far the largest and most liquid market in the world. Trillions of dollars’ worth of currencies are traded for one another on a daily basis, and because of this, both novice and experienced traders are drawn toward this lucrative market.

For a trader just getting started, however, it can be overwhelming at first to decide which currency pairs are the best to trade, just because of the sheer number of pairs available.

In this article, we will take a look at what the major forex pairs are, the most popular traded pairs, and how to trade the major currency pairs.

What Are Major Forex Pairs?

A currency pair consists of two different currencies, whereby the value of one currency is quoted against the other. Take the EUR/USD, for example. The currency on the left (the euro) is called the base currency and the currency on the right is called the quote currency.

The major forex pairs simply refer to the currency pairs that are the most heavily traded for speculative purposes or contribute towards the most volume related to economic transactions.

Overall, there are three forex pair types: major forex pairs, minor forex pairs and exotic forex pairs.

The Most Popular Major Forex Pairs

At present, there are four major forex pairs: the EUR/USD, USD/JPY, GBP/USD and USD/CHF.

As mentioned before, these pairs account for the most traded volume on the forex market on a daily basis. The EUR/USD, however, is by far the most heavily traded currency pair in this group, accounting for over 20% of all forex transactions, which also makes it the most popular pair among retail traders.

The remaining three major currency pairs represent the US dollar vs the Japanese yen (USD/JPY), the British pound sterling vs the US dollar (GBP/USD), and the US dollar vs the Swiss franc (USD/CHF).

Although these four pairs are regarded as the major pairs, some traders might argue that the USD/CAD, AUD/USD and NZD/USD pairs should also be included in the major forex pairs list.

These three pairs are also known as commodity pairs due to their commodity-based economies, and their trading volumes can sometimes overtake that of the USD/CHF and GBP/USD.

All of the most popular forex major pairs therefore involve the US dollar.

Related Articles

- What Are Minor Forex Pairs?

- What Are Forex Cross Pairs?

- What Are Commodity Forex Pairs?

- What Are Exotic Forex Pairs?

How to Trade Major Forex Pairs

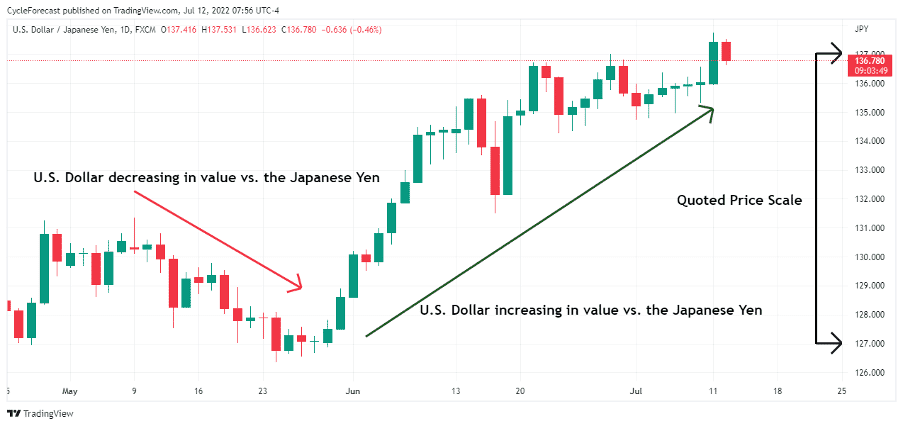

Image for illustration purposes only

Before we discuss the basics of how to trade major forex pairs, let’s quickly look at what the quoted prices of a currency pair look like on a chart, and what it means for each particular currency when prices move up or down.

As these currency pairs are heavily traded, the quoted price for the pair will continuously fluctuate. Luckily for us, we can keep track of these price fluctuations on a trading chart, as seen in the example above.

With this example, the value of the US dollar is quoted against the Japanese yen. When prices decline, the US dollar will decrease relative to the Japanese yen (red arrow). The opposite is true when prices increase – e.g., the US dollar will increase relative to the Japanese yen (green arrow).

The quoted prices for the currency pair appear on the right-side axis of the chart (black arrows).

Let’s say that the USD/JPY is trading at 136.00 – all this means is that it would cost ¥136.00 (Japanese yen) to buy $1 (US dollar).

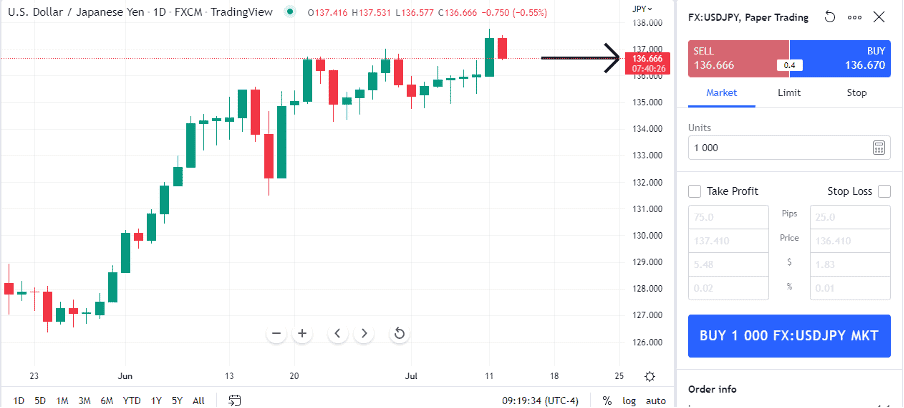

Image for illustration purposes only

Our second chart example shows the bid and ask prices for the USD/JPY (on the right side of the image), which indicated the best potential prices that the USD/JPY could be sold and bought for at that point in time.

When the time arrives to place a trade, a trader will firstly open an order box (similar to the one above) via a broker’s platform. The second step would be to decide at which price to sell or buy the currency.

Thirdly, a trader will have to know the right order type to use, and lastly the position size. Once all of these factors have been considered, an order can be submitted via your broker’s platform and the order will become active if accepted by the market.

The chart image below shows an example of a trade position.

Image for illustration purposes only

Our final chart image shows an open long position on the EUR/USD. The blue horizontal line represents the price level at which the EUR/USD was bought.

The number 10 000 refers to the position size of the trade, and the green and orange horizontal lines represent the take profit and stop loss levels.

With this example, the price of the EUR/USD would need to move higher for the position to become profitable, but a decline in price will result in a loss until the stop loss level has been reached or the position is closed manually.

Please note that the example above might differ in appearance from your broker’s platform. With most trading platforms, it is also possible to see these order levels within your position and order panel (not shown in the example).

Before we end this article, here is a quick list of additional benefits that traders should be aware of when trading the major forex pairs:

- Tight Spreads: The difference between the sell and buy price, or the spread, is often very small when trading the major forex pairs. The smaller the spread is on a currency pair, the better the liquidity. Exotic currency pairs, for example, generally have larger spreads.

- Lots of Liquidity: Liquidity is directly related to volume, and it is an important factor that traders take into account. The higher the liquidity is in a market, the easier it is to execute large position sizes without affecting the price of a currency pair too much.

- Less Slippage: Slippage refers to instances where a market or stop loss order is executed at a worse rate than the order was set for. This generally happens when there is a sudden and fast change in price during highly volatile periods. The risk of slippage is considerably lower in currency pairs with a lot of volume/liquidity.

Conclusion

The major forex pairs that we mentioned previously consist of the currencies that represent some of the world’s largest and most powerful economies, which account for the majority of the daily volume transacted on the forex market.

Knowing which currency pairs have the highest trading volumes and the benefits that they offer, such as tight spreads, liquidity and reduced slippage, will help any aspiring novice trader to make better trading decisions.

Trade Major Forex Pairs With Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.