Even newcomers to the forex trading arena are aware of major and minor currency pairs; however, there are several other classifications which are used to denote specific characteristics that pertain to the pairings at hand. One of the more popular terms is a “commodity forex pair”. It is often used when describing currency pairings for a country that exports a great deal of raw materials to trading partners across the globe.

In these cases, the forex pair will often correlate closely with the pricing trends observed for the pertinent commodity. For traders that follow fundamentals closely, opportunities are present when there is a supply or demand issue for a major commodity like oil and gas, minerals, precious metals, or even agricultural products.

In this article, you will learn about these commodity forex pairs, develop an understanding of what drives their pricing behaviour, what some of the most popular ones are today, and, lastly, how to go about cashing in on specific trends related to commodity forex pairs.

What Are Commodity Forex Pairs?

To assert yourself in trading foreign currency pairs, a trader must have an edge. When spreads and leverage are factored into the equation, the odds in your favour are less than 50% on average. How do veteran traders develop this edge? Strategies using technical indicators, supplemented by a keen knowledge of the fundamentals, have proven to be a solid formula over time. One such approach is to follow fundamental correlations between a commodity currency and the demand for the raw material of the country in question.

Several commodity currencies can be highly correlated with a country’s import/export trade when it depends on natural resources, either from deep in the earth or grown upon it. The major ones that come to mind are the Canadian Dollar (CAD), the Aussie Dollar (AUD), and the New Zealand Dollar (NZD). There are several minor and exotic commodity pairings, but the spreads are often large, and liquidity is low – not a good recipe for profitable forex trading. Please be aware that trading is risky and can result in significant losses.

Commodity currency pairs that come to mind here are the Mexican Peso, the Russian Ruble, the Brazilian Real, the Norwegian Krone, the Venezuelan Bolivar, and the Saudi Riyal when priced versus the US Dollar (USD). The pairing does not necessarily have to be the USD, but liquidity and spread issues often dictate that a portion of the pair should be the USD. In some ways, the Japanese Yen is treated like a commodity currency since the country must import nearly all of its oil and gas. Traders often look at the pairing of the CAD with the JPY since both would naturally move in an opposite fashion, thereby making the impact of oil prices in the market on this pairing more pronounced.

These currencies may be sensitive to how their related commodities are priced in global markets. The trader must also remember that currency values depend on more than just one variable. Commodity currencies have been known to diverge and quickly lose their correlation with commodity prices, the nature of both commodity and currency markets. A trader must constantly monitor both indicia to ensure an appropriate entry and exit point.

Commodity prices can fluctuate for numerous reasons. Economic fundamentals can have a significant impact, whether related to basic changes in the world economy, interest rates, political strife or elections, war or insurrection, natural disasters, pandemics, crises, and even the weather. Seasonality also plays a hand in prices, especially for agricultural products, if harvests fail, occur infrequently or are delayed. The uncertainty in this arena is why options markets were created to help producers and users find stability in future price points.

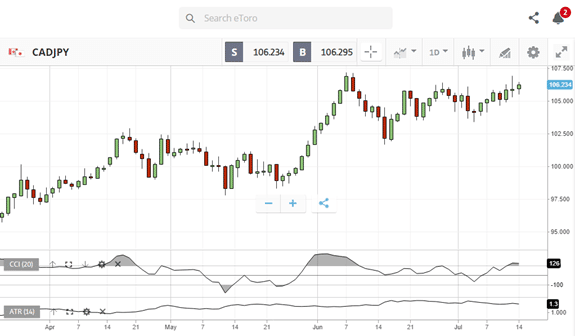

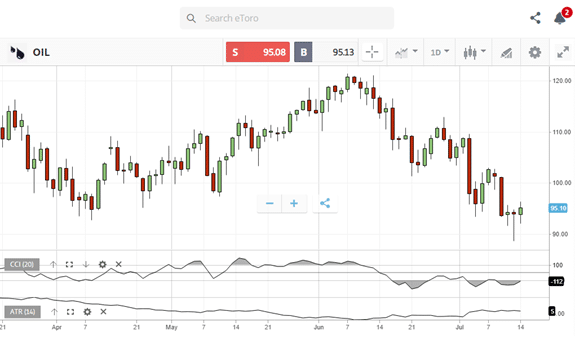

Accepting these uncertainties, however, becomes an integral part of any forex trading strategy related to gaining an edge. Trends can develop quickly and just as promptly reverse, but timing is everything. The recent conflict in Europe is a good case in point. It became obvious that oil supplies on a global scale would be constrained. Oil prices rose significantly, and the Canadian Dollar suddenly gained new strength. Oil prices have dropped 30% in the past month, but the Loonie has only flattened out versus the Yen.

[See chart below]

What are the Most Popular Commodity Forex Pairs?

We have already mentioned the most popular commodity forex pairs – the CAD, the AUD, and the NZD, each matched up with the USD. Tight spreads and ample liquidity on the global scene make strategies in these three pairs possible and profitable. Please be aware that trading is risky and can result in significant losses. To trade in these waters, however, a trader needs to understand the countries involved and the nature of the respective commodity market or markets.

The present geopolitical situation in Europe has emphasised how fickle and erratic the oil industry can be, but the same is true for other commodities. Being a major producer on the global market is one thing, but one must also understand the demand dynamics emanating from the destination country or countries for these exports. Let’s take a moment to illustrate the issues surrounding these three major commodity currencies:

- Canadian Dollar or Loonie (CAD): If you want a pure Oil and Gas play, then the CAD is your best bet. Canada is continually ranked the fifth largest exporter of oil on a global basis, and 75% of the exports are destined for the United States. It is no wonder that the Loonie is tied to oil price behaviour and strongly correlated.

- Australian Dollar or Aussie (AUD): Australia’s economy is inextricably tied to the export of minerals, precious metals, and just about anything else mined from its territories. China’s industrial complex feeds off the raw material flow from the country, as do other regional economies. Australian iron ore, coal, and gas are the primary exports, and China buys a third of the output.

- New Zealand Dollar or Kiwi (NZD): New Zealand is the world’s largest exporter of milk and dairy products, but it also leads in meat and wool. Whereas Australia feeds the machinery of Asia, New Zealand feeds its inhabitants. For a wager in the agricultural sector, the Kiwi tops the list of commodity-related currencies.

Any discussion of commodity forex pairs would not be complete without a mention of Japan. Japan continues to be an economic powerhouse, but it must import nearly every drop of its oil. For this reason, the Yen (JPY) can be sensitive to energy price fluctuations and make for an attractive pairing with another commodity currency.

Related Articles

- What Are Major Forex Pairs?

- What Are Minor Forex Pairs?

- What Are Exotic Currency Pairs?

- What Are Forex Cross Pairs?

How to Trade Commodity Forex Pairs

Since the oil industry is so relevant, forex commodity pairs based on crude oil deposits make for an appropriate example for demonstration purposes. Novices like to think that importing countries can somehow control oil prices; however, the oil market beats to many drums – OPEC, stockpile inventory data, political tensions in the Middle East or war, the status of China’s industrial complex, and even investor sentiment, driven by speculators trying to manipulate the market.

Within this backdrop, let’s choose the Canadian Dollar, but let’s also pair it with the Japanese Yen to observe if there is a multiplier impact. Here is a chart of the “CAD/JPY” currency pair on a daily basis, courtesy of eToro:

And here is the corresponding chart for a popular Oil ETF, also courtesy of eToro:

Russia invaded Ukraine in February of 2022, but the impact on oil prices wavered until late March and early April. The fundamentals suggested going long on the “CAD/JPY” pair at this juncture, as early interest in the pair picked up at that time. Oil prices then produced a strong upward trend for two months, peaking on June 7th. The same was true for the “CAD/JPY” currency pair. The CCI indicator was already signalling an overbought condition – time to sell.

It is important to note that oil prices have dropped 30%, but the “CAD/JPY” pair only went into ranging mode after a slight dip. The correlation obviously broke down. This strategy requires you to monitor for any cracks in correlation behaviour to determine when to exit. Use a charting system that allows for comparisons of rates of change to make this determination.

Conclusion

Every forex trader is always looking for an edge in the market, and one area that offers promise is trading commodity currency pairs. The CAD, AUD, and NZD, each paired with the USD, are excellent places to start. Pick one and focus on the fundamentals for both countries, as well as on the respective commodity. Develop a strategy and practice it on a demo system.

Major moves in the commodity markets tend to be abrupt and sometimes lengthy, lending themselves to position or swing trading strategies, but remember that the correlations can break down in the blink of an eye. Monitor the markets for opportune entry points and have an exit strategy already worked out for later. Trading commodity forex pairs can be exciting, but you must be disciplined and depend upon your step-by-step trading plan to succeed.

Trade Commodity Forex Pairs with Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.