Erratic, indecisive consolidation has become the dominant theme for the US$ within G3 (that is USD, EUR and JPY).

We look for EURUSD and USDJPY to continue within short-term ranges into this week, with the skewed bias for both to break to the downside on a “risk off” type move.

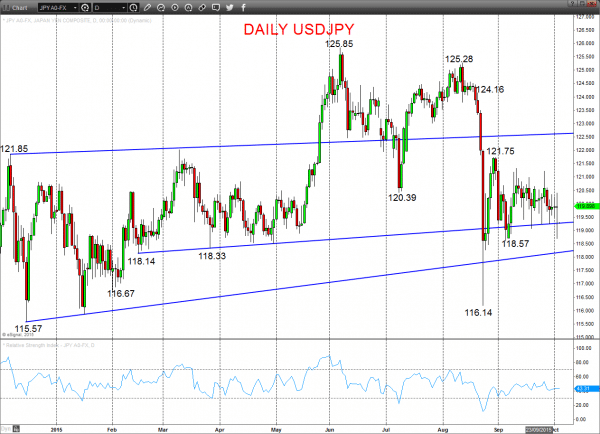

USDJPY

An extremely erratic tone last week and highlighted by the Friday price action, after a stall again back from 120.35/44 area to push through 119.21/20 support, to rebound from 118.57 support, but still to leave risk lower Monday.

Moreover, the latter August aggressive sell off through multiple 2015 supports (118.86, 118.14, 116.67) and setback from 121.75/77 resistance, still leaves an underlying bear tone into early October.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a more negative tone with the bearish threat to back down to the 118.43/118.21/117.83 area and 116.14 spike low.

- Below here targets 115.57 and 113.86.

What Changes This? Above 121.75/77 signals a neutral tone, only shifting positive above 124.16.

Daily USDJPY Chart

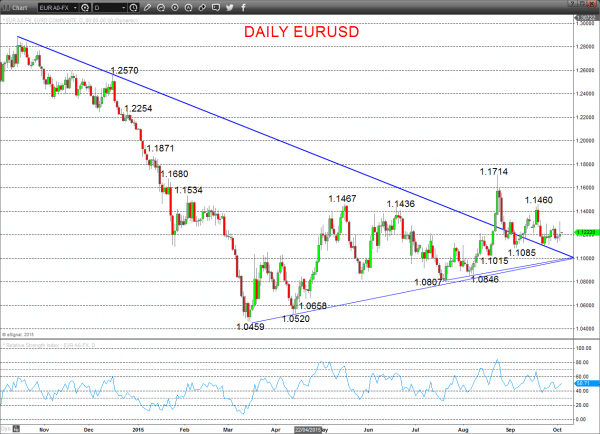

EURUSD

Further erratic consolidation activity Friday and for early October, to leave our short/ intermediate-term outlook as a range theme early this month.

The Friday head fake upside breakout appears a bullish failure to leave a negative bias fro Monday.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.1085 and 1.1460.

Range Breakout Challenge

- Upside: Above 1.1460 aims higher for 1.1714 and 1.1871.

- Downside: Below 1.1085 sees risk lower for 1.1015 and 1.0846/07.

Daily EURUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.