Over the last few days, bitcoin bulls have managed to push the price of the world’s top cryptocurrency over the $4k psychological resistance level, and – more importantly – they’ve kept it there, even against the backdrop of low-volume trading.

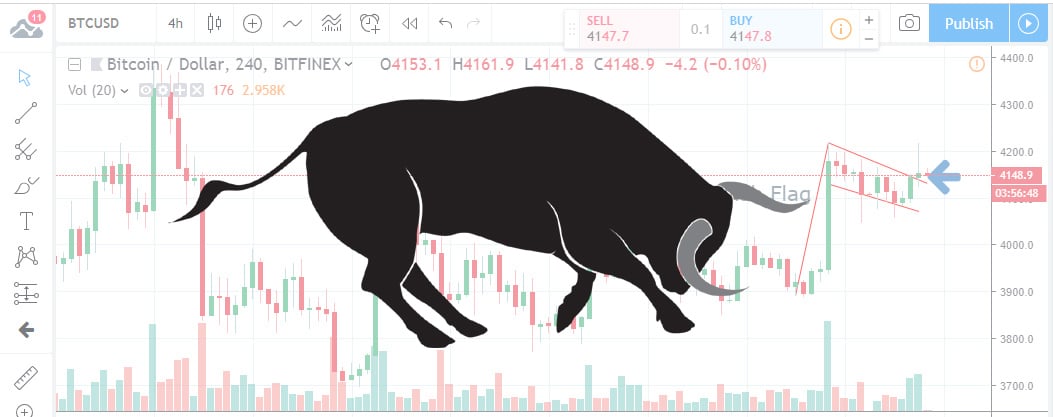

– the price action produced a prominent bull flag on the 4-hour charts.

– the fundamentals are solid and the crypto grapevine has added a few bullish crumbs to the mix too.

– the immediate target for an upward breakout is the $4,140 price-level, defined by the neckline level of an inverse head-and-shoulder pattern, on the daily charts.

Technical Analysis – for what it’s worth – has yielded a trove of bullish chart patterns lately, of which the above mentioned bull flag was but a culmination. Indeed, as strong a signal as it already is, the bull flag saw its credibility further boosted by a series of higher lows drawn over the last week or so.

These lows are the December 27 low of $3,566, followed by the January 1 low of $3,629 and the January 6 low of $3,753.

The inverse head-and-shoulder pattern is taking shape on the daily charts, and if the price clears the $4,140 level, it will have broken out from this pattern as well, taking aim at the $5,000 psychological hurdle. According to some analysts, the momentum generated by the said breakout may even take the price as high as $6,000.

Obviously, there’s always a downside to every technical picture, and in this instance, this downside requires to price to effectively violate the above mentioned pattern of successively higher lows, dropping below the said December 27 low.

Everything considered – in terms of technical factors, of course – such a drop seems quite unlikely at this point.

Putting one’s faith into TA is risky business in this vertical though. At the very least, the clues dropped by this shaky “science” should be coupled with those delivered in a seemingly much more reliable and reality-anchored manner, by the fundamentals.

Interestingly, despite the expected (and apparently always on-schedule) FUD dropped by various high-profile financial experts and some crypto “gurus”, the fundamentals behind the crypto vertical as a whole have been growing more solid lately.

Over the last few days, the crypto news landscape has been dominated by the alleged plans of Japan’s FSA (Financial Service Agency) to approve a physically-settled bitcoin ETF before the US’s SEC. Indeed, some have credited the recent price-bounce of the top crypto entirely to this bit of news, which – if it did indeed come to fruition – would be quite the coup de grace to this whole ETF saga.

Perhaps more significant than the approval of a BTC ETF, would be the fact that the Japanese regulator would exclude futures from the mix. Considering that many blame the currently depleted state of the crypto markets on futures and on the “paper bitcoins” they brought about, the future ramifications of such a course of regulatory action could indeed be massively positive as far as price-evolution is concerned.

In other bullish news, Travis Scher, the vice president of Digital Currency Group chimed in on the ongoing crypto debate, effectively stating that he saw the future of cryptos in general and BTC in particular as bright, despite the slew of disappointment delivered by 2018’s bear market.

Scher also laid out a number of steps the industry should probably take to hasten adoption. The first of these steps is apparently a rather touchy and contentious one: more thorough engagement with regulators world-over.

Proper preparations for the influx of institutional money were also on Sher’s list of recommendations.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.