Although the largest cryptocurrency has managed to reverse its bearish decline into a short-term bullish run, following a bullish breakout on Monday, its gains fell well short of the $7,000 mark – a critical resistance level that was supposed to give these short-term bulls a true test-and a possible boost. Unfortunately, the said farm animals ran out of steam well before that, topping their push at $6,785. What now? Where is the price likely to head next?

Having been denied at the above said $6,785 mark – which was the highest price level registered since June 22 – the price dropped back all the way below $6.5k, before regaining its footing.

Though seemingly random, the $6,785 price-level represents a rather strong resistance level, being at the 23.6% Fibonacci retracement of the price drop from $9,990 to $5,755. In addition to that, this price-level has acted as a magnet for all sorts of MAs and Bollinger bands.

Short story even shorter: to convincingly put the bulls back into the driver’s seat, BTC needs to conquer this resistance level and it needs to do it quickly. Despite having moved towards it several times during the past 24 hours though, it does not seem to be able to accomplish the feat.

Barring that, another pullback may be in the works, and an eventual close below the $6,275 mark (which was Monday’s low) could completely eliminate the bulls from the running.

That said, the overall short-term outlook is still a bullish one.

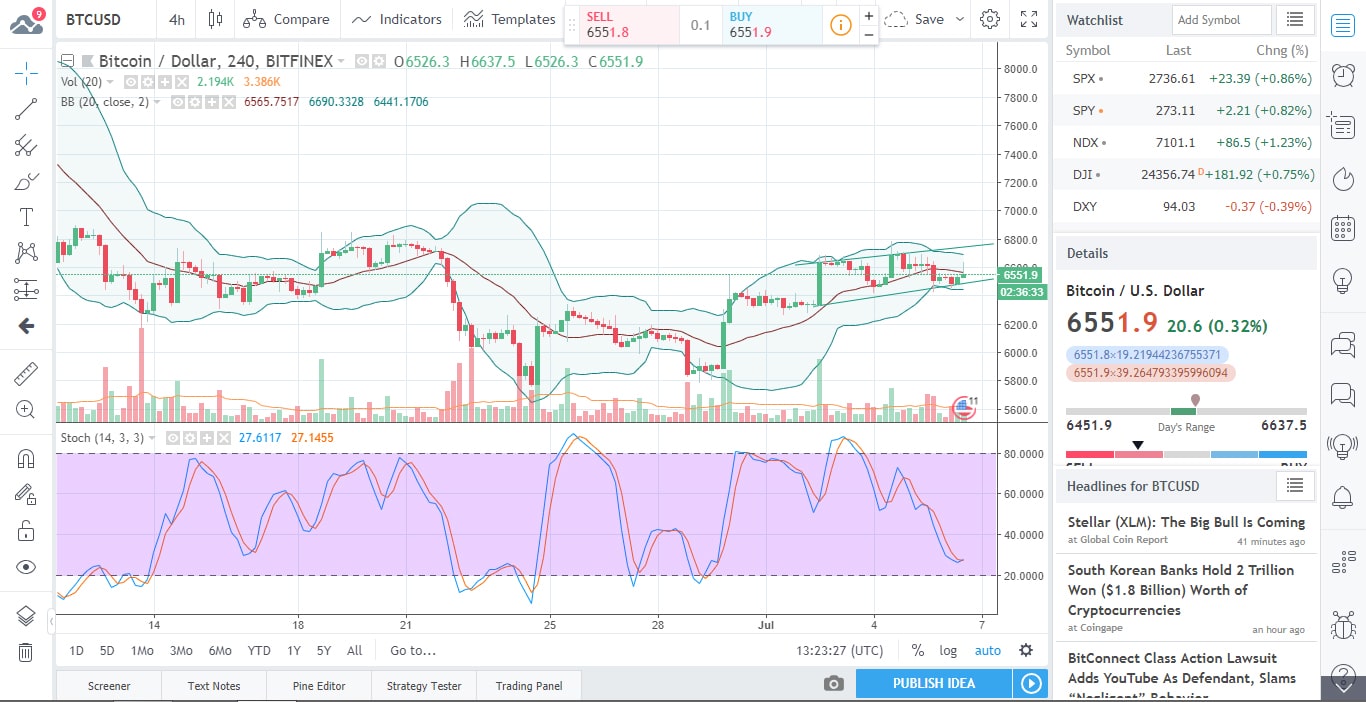

As visible on the 4h chart above, the price is still within a rising channel, though the Bollinger bands have recently started sloping downwards, which is not exactly good news for the bulls.

Not long ago, this would have been a relatively easy call in favor of the short term bulls, which may have carried the price above the $6,770 resistance, but now the waters have been disturbed and the bulls are once again looking weak.

If an aggressive upward move is made though, above $6,770, the $7k price-level will come within striking distance as well.

For now, a bird’s eye view of the technical analysis picture tells the most credible story, with its Sell-bias.

Interestingly, both the oscillators and the MAs point to the same conclusion. 2 of the former say Sell and 1 says Buy, while 8 of them are Neutral.

The MAs on the other hand, are much more extreme: 8 of them point to Sell, 6 to Buy and only 1 is neutral.

As far as fundamentals are concerned, we have something of a mixed bag. In addition to various crypto industry going-ons, we’re finally looking at some positive news-bits as well.

One such piece is about Fundstrat’s Tom Lee, who predicted at one point in the past, that BTC would be worth around $22k by this year’s end. The financial pundit has reiterated his prediction in a couple of CNBC interviews the other day.

Lee is one of the staunch BTC bulls, who famously predicted that the cypto blue-chip would be worth some $91,000 by 2020.

While this prediction is much more modest in scope than John McAfee’s $1 million prophecy, it is still incredibly bullish given the current bear market.

In his predictions, Lee relies quite a bit on BTC mining costs, an indicator which has proven to be a rather reliable one indeed.

In other positive news, the biggest ETF trader of the EU has made a move towards the crypto space.

Flow Traders MV of Amsterdam is expanding its trading product selection to BTC and ETH-based ETNs (Exchange-traded Notes).

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.