Technical Analysis

Technical analysis is a way of predicting the future forex market movements based on previous market movement patterns and trends. From a Technical Analyst’s viewpoint all fundamental aspects are already a part of the previous market movements and therefore needs no special consideration. The main tool by which to analyse the forex market is forex charts.

EURUSD: Negative Tone

Hi there traders this is Steve Miley on behalf of forextraders.com and here we’re looking at the Euro versus the US dollar; Euro…

NZDUSD: Bull tone, despite another setback

Hi there traders, this is Steve Miley for forextraders.com and here we’re going to take a look at the New Zealand dollar against…

USDCAD: Risks stay higher after TWO Central Bank decisions

Hi there, this is Steve Miley for forextraders.com and here we’re looking at USDCAD; the US dollar / Canadian dollar spot FX rate…

GBPUSD: Risks Stay Higher

Hi there traders this is Steve Miley the market charters on behalf of forextraders.com and in this article and this video we’re going…

USDJPY: Bull tone

A strong rally Monday through the October recovery peak at 109.00, to reinforce last Wednesday’s rebound from just below our 108.27/23 support area…

EURUSD: Risks stay lower

Hi there traders this is Steve Miley, the market chartist on behalf of forextraders.com and in this article and video we’re going to…

Macroeconomic Outlook and Recap: 28/10/19

Brexit was in the spotlight for financial markets last week with a light macroeconomic data calendar. This week sees Brexit stay to the…

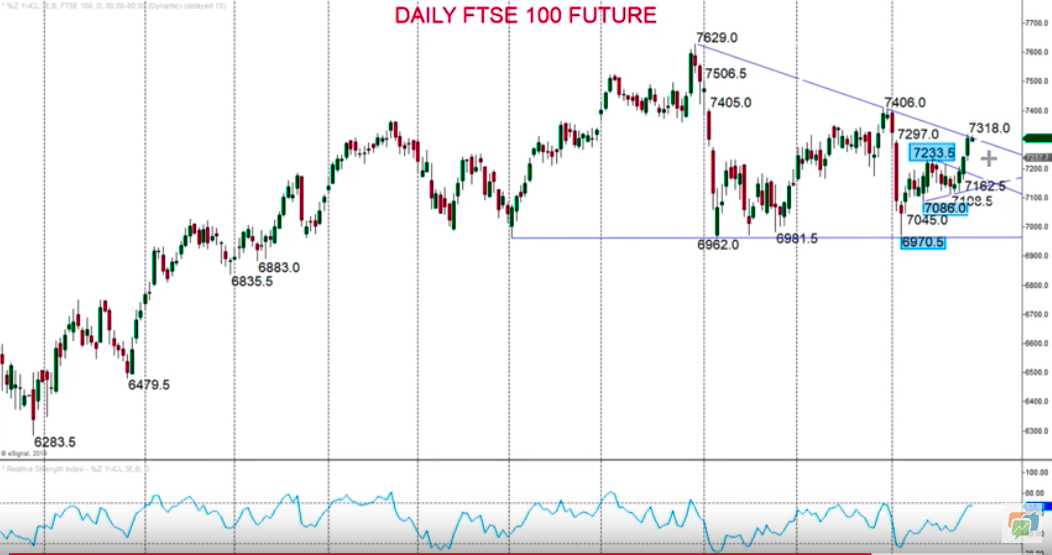

FTSE 100: Intermediate-term bull shift reinforced

Hi there traders this is Steve Miley for forextraders.com and here we’re having our Friday look at the equity markets. A strong move…

AUDUSD: Looking for a rebound

Hi there traders this is Steve Miley for forextraders.com and we’re here looking at the Australian dollar US dollar spot FX rate. Well…

GBPUSD: Rebound bias

Hi there traders, this is Steve Miley for forextraders.com and here we’re looking at the pound against the US dollar. The cable spot…

USDCAD: Bear trend extension

Hi there traders this is Steve Miley for forextraders.com and we’re now looking at the short term view for the US dollar against…

Macroeconomic Outlook and Recap: 21/10/19

The major theme dominating financial markets last week was the progression of the previous week’s breakthrough in Brexit negotiations driven by the UK…

USDJPY: Upside risks, despite a dip

Hi there traders this is Steve Miley for forextraders.com. Here we’re looking at the US dollar against the Japanese Yen spot FX rate…

DAX: Bull extension and risks still higher (despite a dip)

Hi there traders this is Steve Miley for forextraders.com and we’re now here looking at our equity watch in here for today….

AUDUSD: Further Rebound Risks

Hi there traders this is Steve Miley for forextraders.com and here we’re looking at the Australian dollar against the US dollar spot FX…

Between 74-89% of CFD traders lose

Between 74-89 % of retail investor accounts lose money when trading CFDs Between 74-89% of CFD traders lose

Between 74-89 % of retail investor accounts lose money when trading CFDs

|

|

||||

Your capital is at risk

Europe* CFDs ar... Your capital is at risk

Europe* CFDs ar...

|

|

||||

Your capital is at risk Your capital is at risk

|

|

||||

Your capital is at risk Your capital is at risk

|

|

||||