On Friday 1st May at 9.30 am BST (GMT+1) local time the Manufacturing PMI Data for the UK is released. Although we see a digestion theme for Friday, this could give impetus for either a further corrective setback or a re-energized bull trend.

GBPUSD Bull Theme Intact, But Digestion Bias

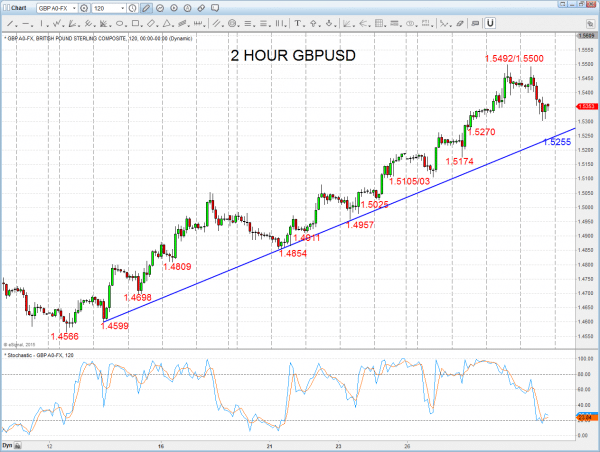

The push this week through 1.5371, 1.5398, 1.5425 and 1.5459 resistance levels to hit 1.5500 maintains a bullish theme into early May.

The corrective setback and consolidation Thursday is likely to extend into Friday (and the UK holiday on Monday), but the strong rally from mid-April through the 18th March peak at 1.5164 has set a more bullish tone for May.

For Today: We see a neutral tone between 1.5270/55 and 1.5492/5500 (with a rebound bias)

- Break above 1.5492/5500 aims for 1.5552/69, which we would look to try to cap.

- Break below 1.5270/55 aims for 1.5174, which we would look to try to hold.

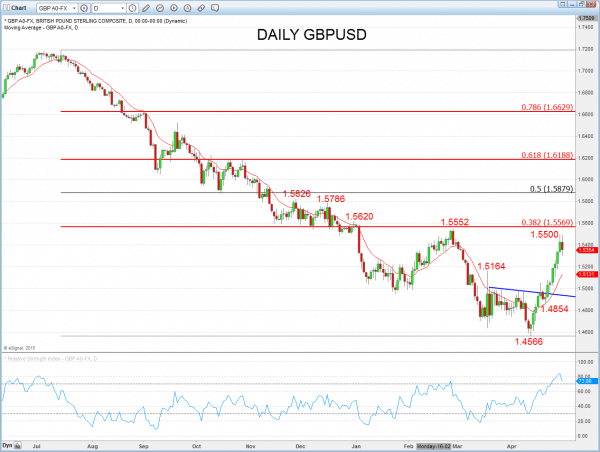

Short/ Intermediate-term Outlook – Upside Risks:

- We now see a more positive tone with the bullish threat through 1.5500.

- Above here targets 1.5552/69, 1.5620, 1.5786, 1.5826, 1.5879 and maybe 1.6000 into May.

What Changes This? Below 1.4911 eases bull risks; through 1.4854 signals a neutral tone, only shifting negative below 1.4566.

Momentum: The 8-day RSI, short-term momentum is rising and has scope to go still higher this week.

2 Hour GBPUSD Chart

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.