Significant data Thursday for the UK and to a lesser extent for the US sees a bias for a notable GBPUSD price move.

The UK Construction PMI release is due at 9.30 local time (GMT+1), with a forecast seen at 59.7

From the US, we see Trade balance data and Weekly Unemployment Claims as the focus.

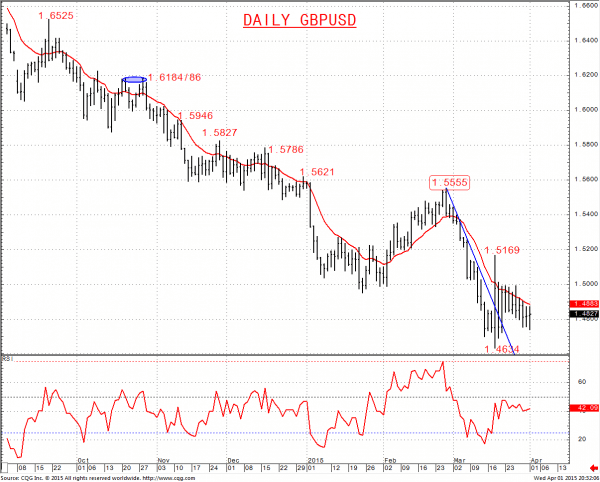

GBPUSD Bearish Risks

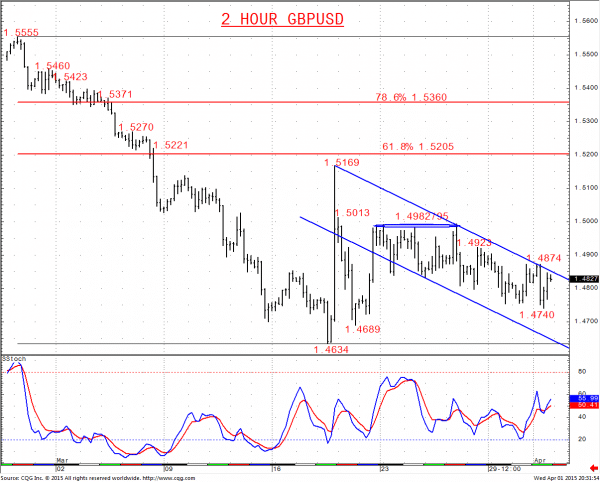

A grind lower Wednesday, to another new setback low, and despite a minor bounce, whilst minimally capped by 1.4874, we see downside risk into early April.

Moreover, with price action since the 18th March FOMC spike higher capped by resistance at 1.4982/95 ahead of 1.5013, we see a more negative bias for early April.

For Today:

- We see a downside bias for 1.4740; break here aims for 1.4722, maybe 1.4689.

- But above 1.4874 aims at 1.4923 and opens risk up to 1.4982/95, which we would look to again try to cap.

Short-term Outlook – Downside Risks:

- We see a downside bias to the rebound range and to the mid-March low at 1.4634.

- We see a more negative tone with bearish threat to 1.4500.

- A break aims for key long term supports, 1.4295/28.

What Changes This? Above 1.5270 eases bear risks; through 1.5371 signals a neutral tone, only shifting positive above 1.5555.

Daily Chart

2 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.