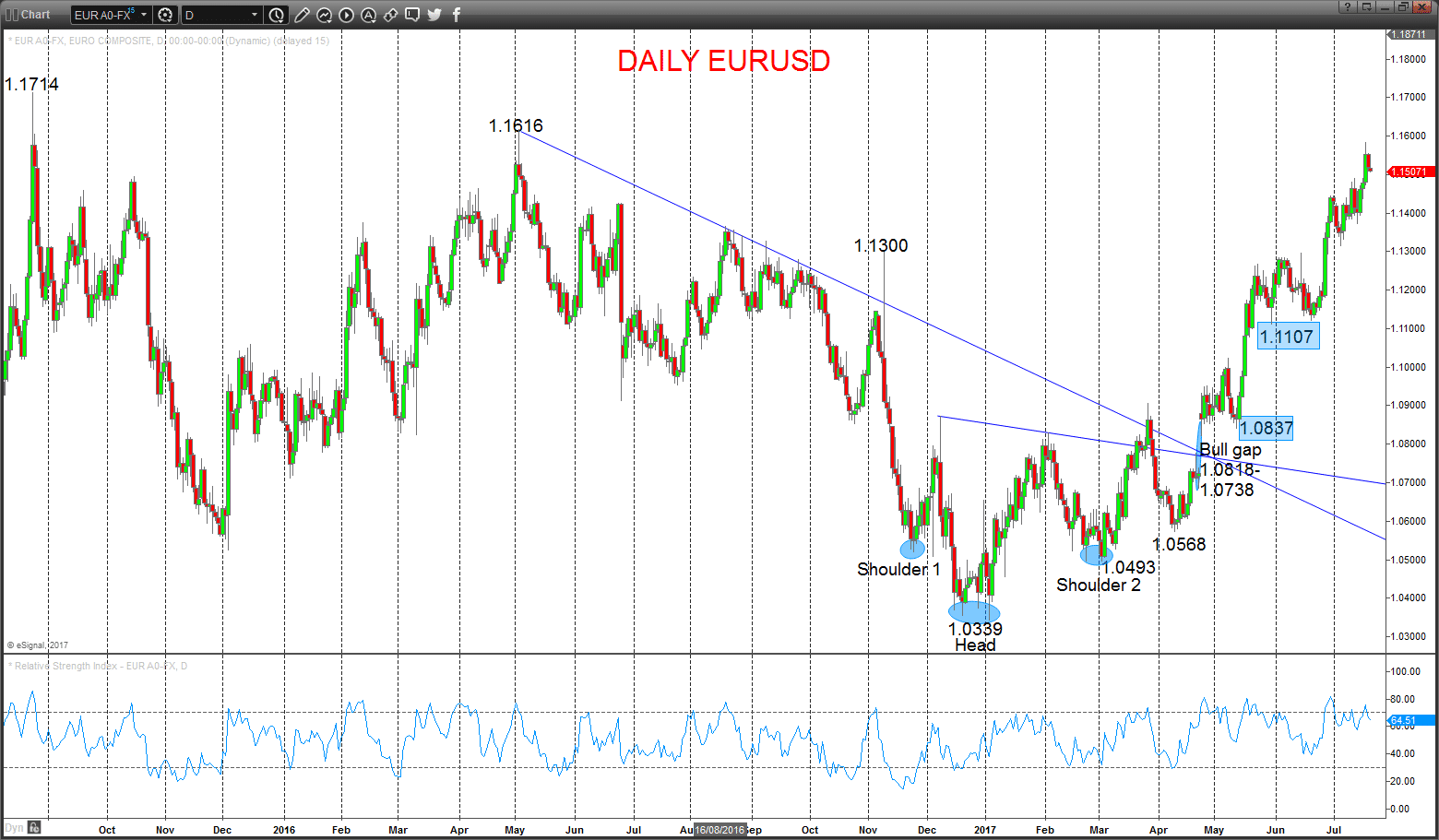

- The pan-European currency has produced strong gains against most G10 currencies over the past three weeks since ECB President Draghi indicated a potentially more hawkish tone in late June.

- This has produced significant technical gains through important longer-term resistance levels.

- Going into today’s ECB Meeting, the growing threat is for a July challenge to critical levels at 1.616 and 1.1714.

- Above 1.1714 would signal a still more bullish longer term outlook into August and potentially beyond.

EURUSD – Bullish threat

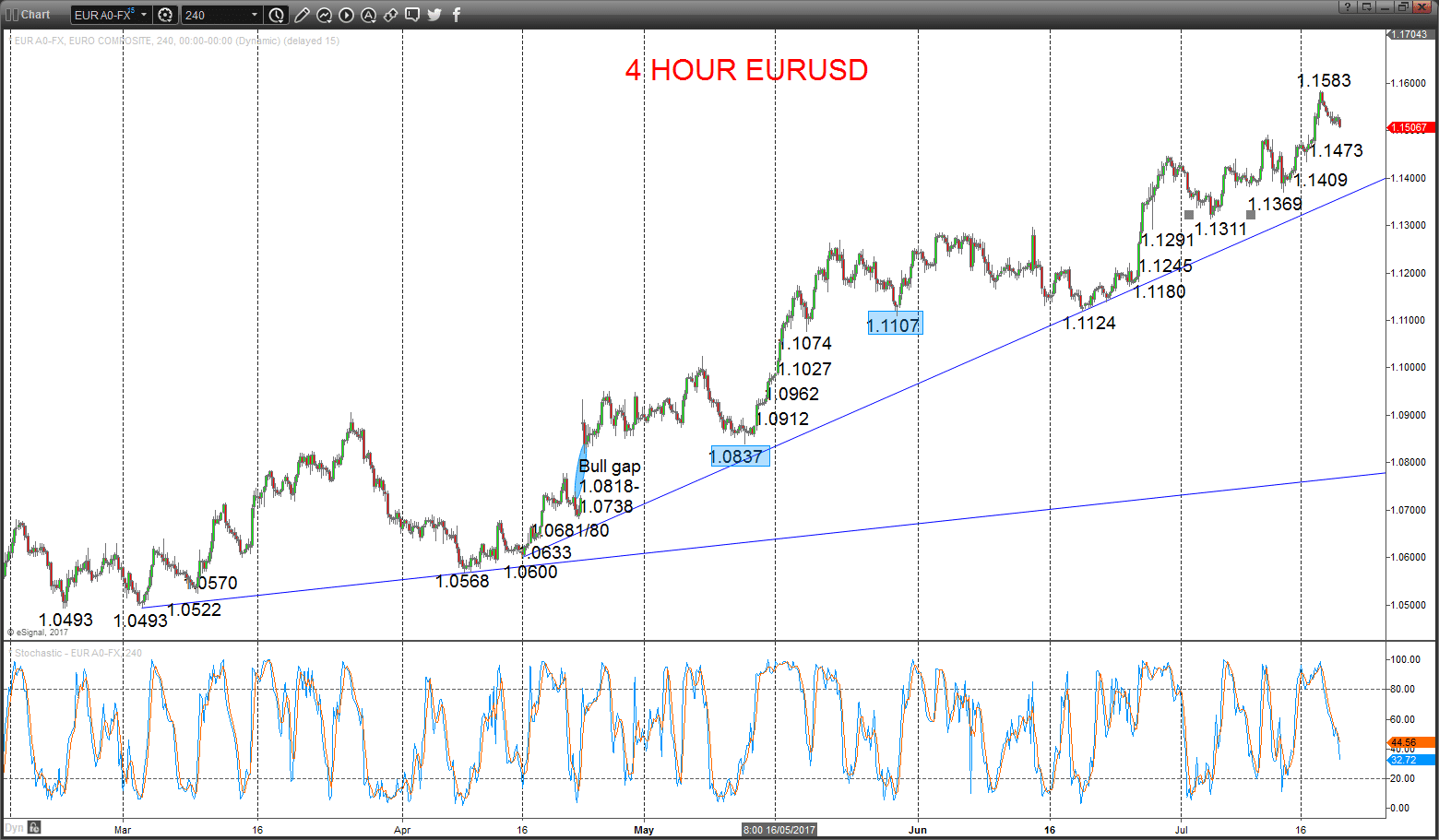

A dip lower on Wednesday to probe minor support at 1.1509, but whilst above 1.1473 we still see upside pressures from the Tuesday push through the 1.1490 peak, psychological/option target at 1.1500 and 1.1555, maintaining upside risks into Thursday’s ECB Meeting.

Moreover, we still see a bullish intermediate-term outlook into July.

For Today:

l We see an upside bias for 1.1583 and a key peak at 1.1616; a break above here would target 1.1665 and maybe the critical 1.1714 level

l But below 1.1473 opens risk down to 1.1409.

Intermediate-term Outlook – Upside Risks:

l Whilst above 1.1107, we see a positive tone with the bullish threat to 1.1366.

l Above here targets 1.1428/47, 1.1616 and 1.1714.

What Changes This? Below 1.1107 signals a neutral tone, only shifting negative below 1.0837.

Daily Chart

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.