Over the last 48 hours, we were the witnesses of yet another attempt on the part of BTC bulls to move the price of the most popular crypto north of $8,000, only to fail yet again in what’s increasingly looking like hopeless thrashing-around amid a general bearish outlook, that never fails to ultimately impose its will. Having hit a high of $7.5k, BTC is now down to $6.8 again. What’s next?

A day ago, someone somewhere said that a move below 7k would definitely destroy BTC’s short-term chances of mounting an attack on the 8k mark, and that has indeed come to fruition about 12 hours ago.

All the bearish reversal patterns people were fretting over materialized as well, so it is safe to say that the short-live bullish trend we saw unfold over the last few days, has well and truly wrapped up. Where is the likely bottom of this brand-new bear run though? Analysts are generally cautious in this regard, pointing to the $7k mark, though with BTC now trading at $6.8k, it is safe to say that their worst predictions have been well surpassed. The interesting thing is though that with the bulls, the bears seem to have lost traction too, as 6.8k is where the price has mostly been hovering lately, save for a short-lived dip to 6.6k.

The MAs may provide some degree of justification in that regard. Despite this latest bear run, they still exhibit a bullish bias. The 50-hour and the 100-hour MAs certainly do, while the 200-hour MA has largely flat-lined, refusing to favor either side.

Staying within the realm of MAs: while the 5-day MA was bullish a few hours ago, the 10-day MA was already bearish, and now, with the price-move to 6.8k, the former has adopted a bearish stance as well.

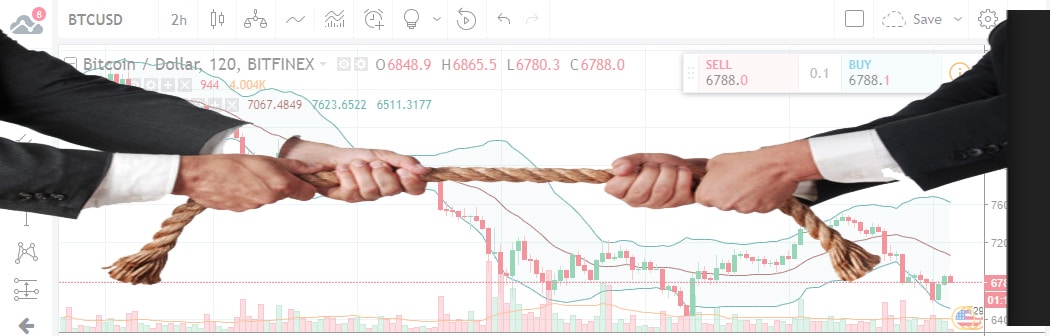

The chart above – being a 2-hour one – shows the stochastic oscillator struggling on the edge of oversold territory, as its lines are crossing back and forth. The bottoming out process though is a bust by every measure at this point, and further dips in price, possibly all the way down to 6k cannot be excluded.

Most technical indicators do indeed point to “sell” (some 16 of them, in fact), while only one (the CCI) indicates “buy”. That makes the bears’ case pretty solid right now.

What about the fundamentals?

The crypto news coming out from various sources have been overwhelmingly sour lately. It is indeed as if there were a concentrated FUD campaign being rolled out, though this sad vibe may in fact be the accurate reflection of the actual state of crypto affairs.

With just a quick glance over the headlines, we learn that the Bank of Montreal has expanded its ban on crypto purchases and that one of the members of the Federal Reserve’s Board of Governors has derided Bitcoin and its peers for “extreme volatility”.

BMO’s latest anti-crypto move means that its clients will no longer be able to use their Interac cards for the acquisition of crypto currencies. BMO clients have been banned from using their MasterCard credit- and debit cards for crypto purchases a couple of weeks ago.

According to a company-wise email leaked to Reddit, the ban was instituted as a result of the volatility of cryptos, to better protect the bank’s clients and to limit the exposure of the institution itself.

According to Fed governor Lael Brainard, cryptocurrencies raise several customer protection and money laundering-related issues, but they do not imperil the stability of the US economy, since they are not widely used for payments and very few have borrowed money to invest in them.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.