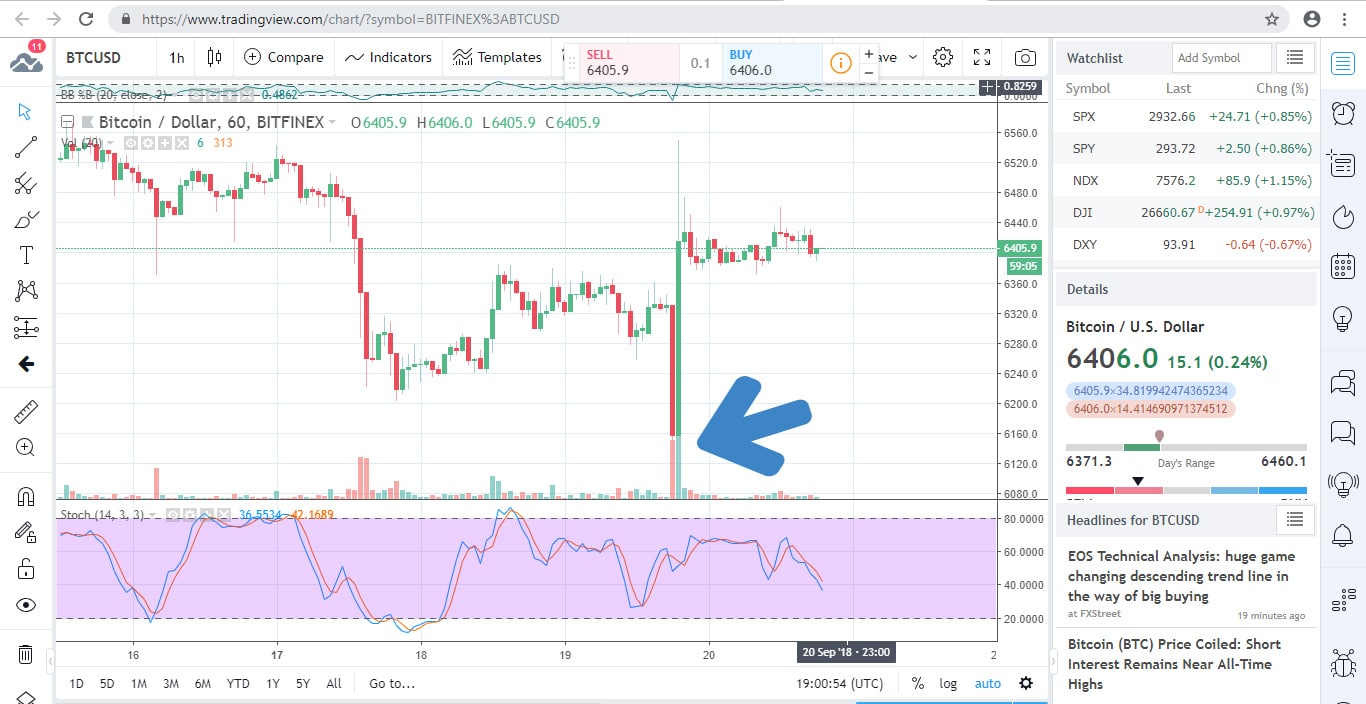

Over the last couple of days, the volatility of the world’s top cryptocurrency was yet again displayed in all of its dubious glory. Yesterday, those keeping their eyes on the price movement, would witness a massive drop from around $6.3k to $6.1k, and within about 10 minutes a jump from the one-month low all the way to $6.5k. What exactly happened?

Although such knee-jerk moves are unfortunately relatively common in the crypto world, lately, they ended up eliciting their effects almost exclusively downwards. That is exactly what happened when BTC’s latest rather timid bull run came to an abrupt end, and that’s what seemed to take shape yet again yesterday.

According to those in the know, this latest drop was triggered by a CBOE BTC future expiration – and it occurred just minutes after the latter came to fruition. This time around however, the clear demand above $6k violently bounced the price back up. Currently, BTC is trading around the $6,422 mark.

What exactly does all this see-sawing action tell us then, and how are the technical factors shaping up as a result of it?

Apparently, as it dropped to $6.1k, the price of BTC broke squarely through the $6.2k support level, which had been considered a solid support indeed. By rebounding from $6.1k though, it set that latter mark as a very solid future support.

Despite the spectacular nature of the rebound, the price will have to advance to $6.6k to kick the ball into the bulls’ court. Right now, it does seem to be moving in the right direction, but it lacks determination, so it may yet end up hovering about in no man’s land again.

Furthermore, the jump to $6.5k which followed the above detailed drop, was one that took place against the backdrop of solid trading volumes, so in and of itself, it can be taken as a sign of bearish exhaustion.

That said, the bears may return in force, if the bulls fail to capitalize on this rather unexpected opportunity and the price drops below the trend line support of $6,225.

If that happens, the path will be opened for the bears to $5,858 and even lower.

On the upside, if the price successfully climbs past $6.6k, the bulls will probably run with it all the way to $7.1k.

What is the overall technical picture provided by a generous selection of MAs and oscillators?

3 of the oscillators (the Awesome oscillator, the MACD Level and the Bull Bear Power) are pointing to Sell. The Momentum is pointing to Buy while the rest are undecided.

The Moving Averages are a lot more Sell-biased: some 13 of them recommend this course of action, while only one (the Hull MA) points to Buy. The Ichimoku Cloud Base Line is undecided.

What about the fundamentals? After all, they were apparently behind the above detailed price fluctuation too…

As usual, the news are a mixed bag.

In the US, a group of lawmakers has sent an open letter to the commissioner of the IRS, urging him to commence the creation of a comprehensive tax-guide, aimed at people who earn money off cryptocurrency trading or investments.

The group claims that despite having had plenty of time to work out clear rules regarding cryptocurrency profits, the IRS has thus far failed to take adequate steps in this direction, focusing instead on the enforcing of set of preliminary rules released back in 2014.

In other news: during the first half of 2014, cyber attacks on various crypto-related platforms (wallets, etc) have increased threefold in Japan, resulting in losses totaling more than $540 million.

Such vulnerability is indeed a major problem for the industry and for the time being, there does not seem to be a proper solution for it on the horizon.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.