AUDUSD, USDCAD and USDJPY remains caught within broader range themes into early November in the wake of the late October FOMC meeting. Although in the very near term, the tone is positive for these currencies versus the US Dollar (USD negative); a more forceful break from the broader ranges is needed for a clearer directional picture.

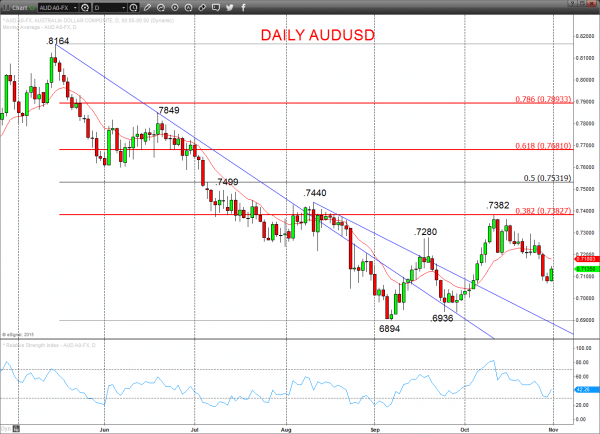

AUDUSD

Notable losses through midweek below .7179, .7162/47 and .7097 (as predicted), but a rebound Friday from .7063 support (from .7064), to leave a positive tone Monday.

This maintains the broader range theme into early November.

For Today:

- We see an upside bias for .7159; break here aims for .7196, which we would look to cap.

- But below .7100 opens risk down to .7064/63.

Short/ Intermediate-term Range Parameters: We see the broader range defined by .6936 and .7382.

Range Breakout Challenge

- Upside: Above .7382 aims higher for .7440/99 and .7681.

- Downside: Below .6936 sees risk lower for 6894, .6857 and .6645.

Daily AUDUSD Chart

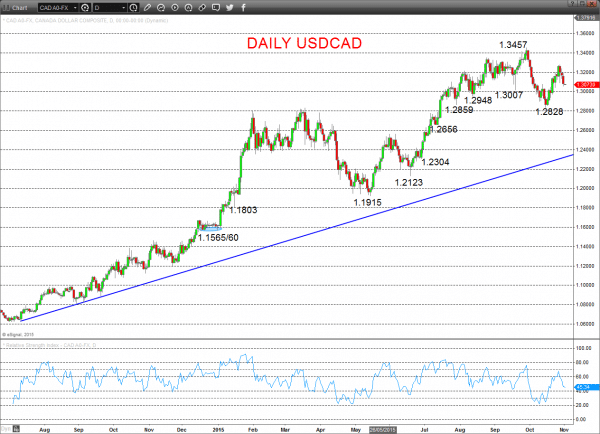

USDCAD

A significant setback through the latter part of last week, below 1.3129 and 1.3086 supports leaves a more negative tone for Monday.

However, the previous uptrend from mid-October, signalled a shift to a broader range into early November.

For Today:

- We see a downside bias for 1.3036; break here aims for 1.3000/1.2989.

- But above 1.3140 opens risk up to 1.3193.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.3457/62 and 1.2828.

Range Breakout Challenge

- Upside: Above 1.3457/62 aims higher for 1.3819 and 1.4000/4030.

- Downside: Below 1.2828 sees risk lower for 1.2656 and 1.2304.

Daily USDCAD Chart

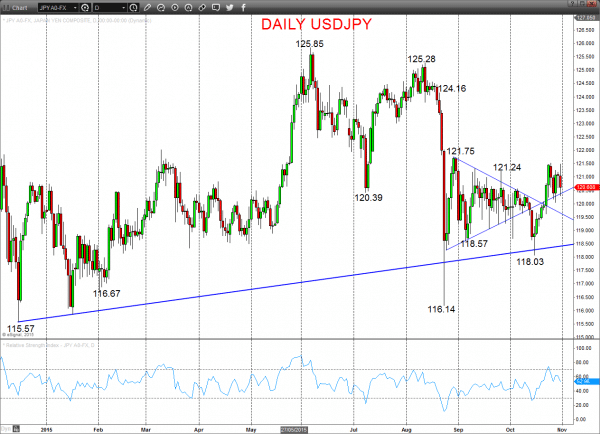

USDJPY

A dip and a bounce Thursday and a rally and setback Friday, reinforces a neutral tone into Monday.

The mid-October push above the 121.24 level set a broader range theme for late October, whilst the dip and bounce Wednesday, sees risk again of bullish shift (above 121.75/77).

For Today: We see a neutral tone between 121.49/54 and 119.99/79 (with a negative bias)

- Break above 121.49/54 aims for key 121.75/77 and maybe 122.47, which we would look to try to cap.

- Break below 119.99/79 aims for 119.10/118.88, which we would look to try to hold.

Short/ Intermediate-term Range Parameters: We see the range defined by 121.75/77 and 118.03.

Range Breakout Challenge

- Upside: Above 121.75/77 aims higher for 123.08 and 124.16.

- Downside: Below 118.03 sees risk lower for 116.14.

Daily USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.