- In our last look at AUDUSD and NZDUSD on 29th November we highlighted the ongoing intermediate-term bullish outlooks for the Australian Dollar and the New Zealand Dollar versus the US Dollar in the wake a more dovish tone by Jerome Powell, the Fed Chairman.

- However, a broader shift to a “risk off” scenario across global asset classes in early December (highlighted by equity market selloffs) has seen setbacks for the “risk currencies” amongst the Majors, for both AUDUSD and NZDUSD.

- For AUDUSD, the intermediate-term bull trend has been neutralised, whilst the immediate risks for both AUDUSD and NZDUSD are skewed to the downside.

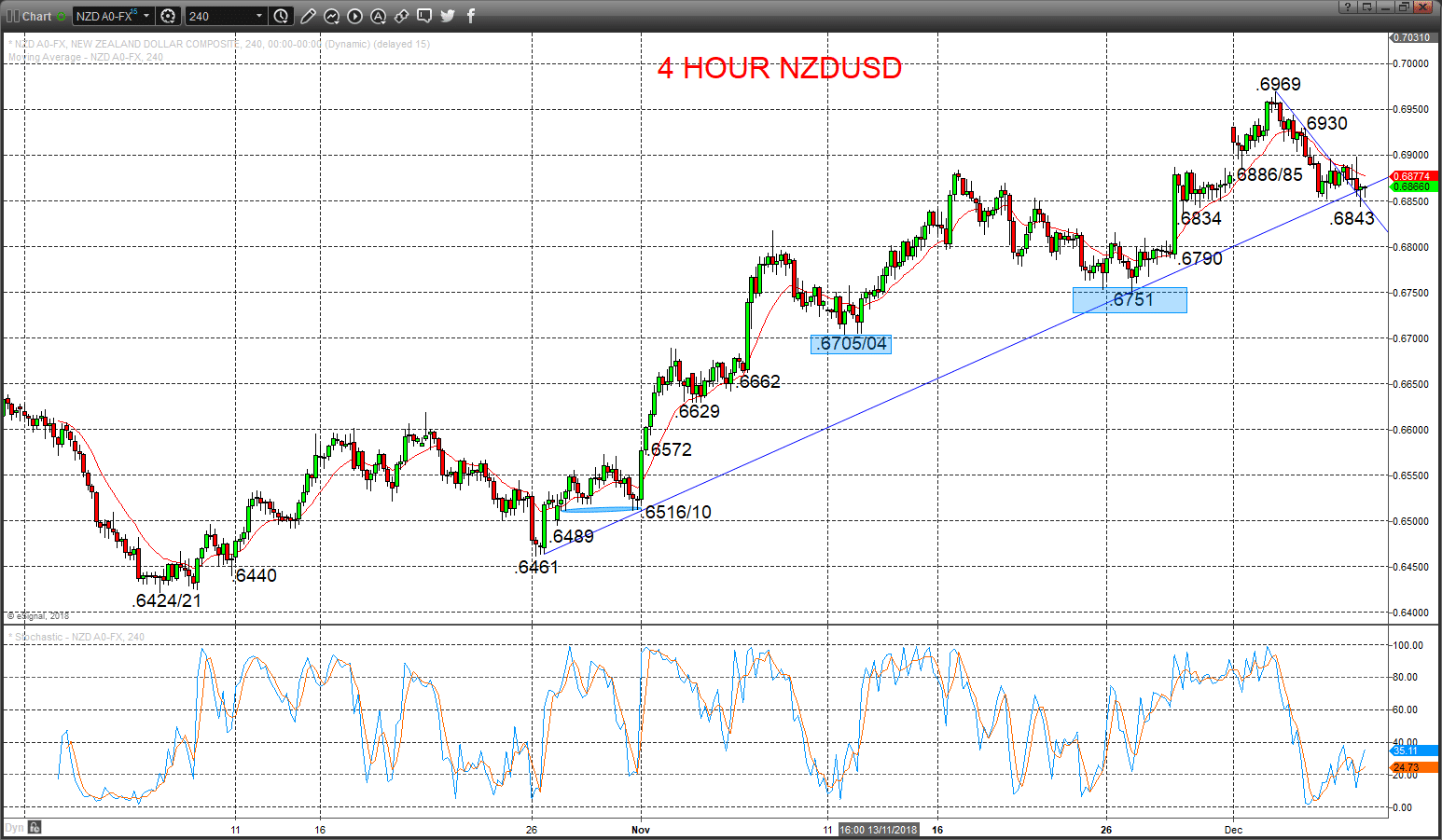

AUDUSD Intermediate-term bearish shift threat to key .7161

A Friday rebound failure from just above our .7240 initial resistance (from .7242), to sustain negative forces from the Tuesday-Thursday plunge through key .7197 support (and trend lines from October and November, to keep the bias lower Monday.

The early December plunge to probe below .7197 switched the intermediate-term view to a range theme (defined as .7394 to .7161), BUT with risks skewed towards an intermediate-term bearish shift.

For Today:

- We see a downside bias for .7191/85 and key .7161; break here quickly aims for .7149, maybe .7119.

- But above .7242 opens risk up to .7276 and .7301.

Intermediate-term Range Breakout Parameters: Range seen as .7394 to .7161.

- Upside Risks: Above .7394 sets a bull trend to aim for .7484, .7668, .7813 and maybe .8000.

- Downside Risks: Below .7161 sees a bear trend to target .7077, .7018/00 and .6827.

Resistance and Support:

| .7242* | .7276* | .7301* | .7356 | .7394*** |

| 7191/85* | 7161*** | 7149 | .7119 | 7077** |

4 Hour AUDUSD Chart

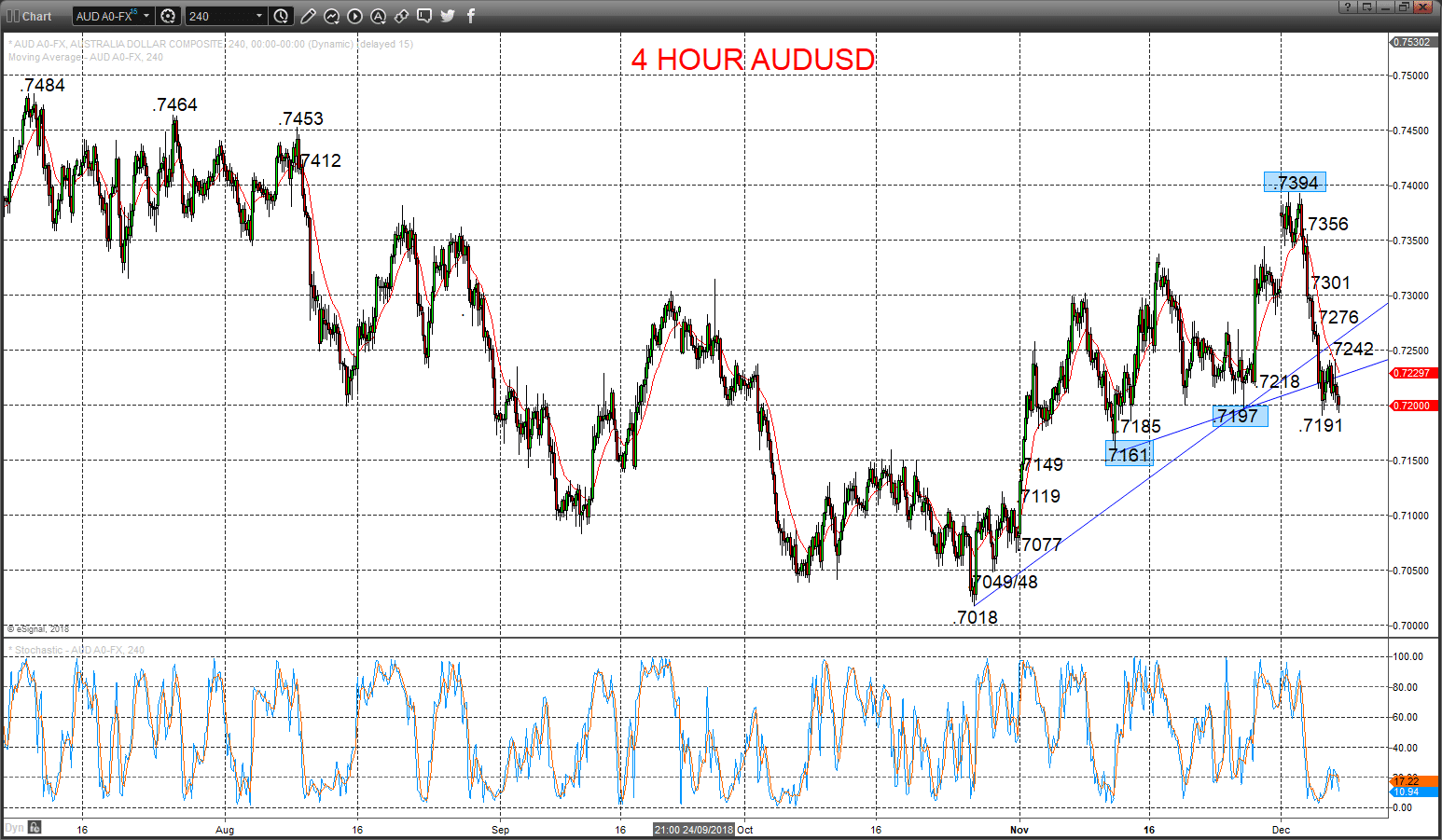

NZDUSD Immediate bias still towards a correction lower

A negative consolidation Friday to probe the up trend line from late October, after Thursday’s push down through the .6886/85 support area and the early December setback from a new cycle high, to leaves the bias for a correction lower Monday.

The early November aggressive surge above .6618 set an intermediate-term bull trend.

For Today:

- We see a downside bias for .6843; break here quickly aims for .6834, possibly towards .6790.

- But above .6930 opens risk up to .6969 and .6995/7000.

Intermediate-term Outlook – Upside Risks: We see an upside risk for be .7060.

- Higher targets would be .7437 and .7558.

- What Changes This? Below .6751 shifts the outlook from bullish to neutral and only through .6705/04 to a bear theme.

Resistance and Support:

| .6899 | .6930 | .6969* | .6995/7000** | .7044* |

| .6843 | .6834 | .6790 | .6751*** | .6704*** |

4 Hour NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.