Volatility rocked the world’s markets last week. Everyone had an opinion as to why the boat was rocking, but no one got into the water to check out the hull of the boat. First, Chinese officials were at fault for hastily trying to revive their failing economy. Then, every pundit on the planet brought out their fifteen reasons why stocks in the S&P 500 Index were overvalued and had to fall or else, a storyline that has not found support for four years running. The Euro and the Yen were winners for a brief period of time, yet answers for their sudden strength were dubious at best, unless you are willing to accept that highly marginal trades were suddenly unwound in their favor.

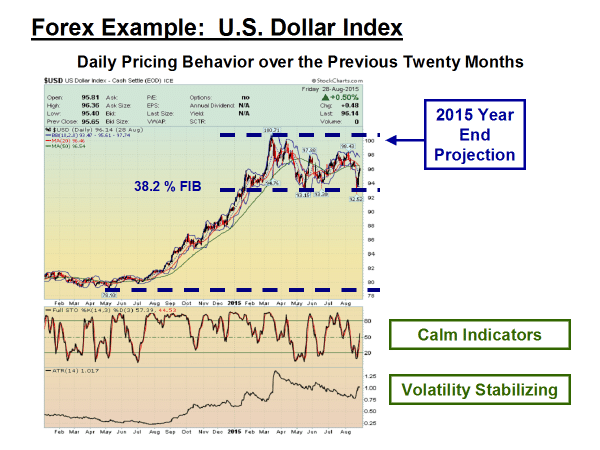

Why then the market turmoil? Uncertainty can be an ugly beast at times, but volatility is often a sign of markets adjusting to some major undercurrent that impacts everything across the globe. Could markets finally be adjusting to the strength of the U.S. Dollar? Very few analysts have touched on this theme, but as the Monday-morning quarterbacks jump into the game with the benefit of hindsight, a clearer picture begins to emerge. A quasi calm has returned to the market. The U.S. Dollar Index is mid-ranging it again, just between its recent peak and the 38.2% Fibonacci level. As the oxygen comes back into the room, the technical aspects of last week’s temporary havoc appear as basic as just one more re-test of support before another expected rise (See chart below):

When all was said and done, the doubt that grabbed the chains of the market had more to do with the Fed changing its mind regarding an interest rate increase in September, something that everyone and their Grandmother had accepted as a lead pipe cinch. Yes, Chinese officials were intervening in the market and having to sell off U.S. Treasuries to balance their books. Interest rates on Treasuries did rise, and the USD succumbed when the expected move was just the opposite. When turmoil strikes, the weak handed among us are supposed to head for safe havens, buying precious metals and U.S. Treasuries like they were going out of style. But, such was not the case.

What followed on the airways was actually a bit of comedy, as Rome burned, so to speak. Every forex specialist began pontificating why the markets were acting so strangely and not according to textbook. The ebb and flow of demand and supply forces determine foreign exchange rates, but it is extremely difficult to get a handle on the capital flows that are instantly impacting those forces. As a result, analysts have to take a snapshot of several key markets and then assess what is going on through a logical and intuitive process. The experienced ones usually get it right, fairly quickly, if there is an obvious logic to what is happening.

But obvious logic was in short supply. A few pieces of the puzzle were missing. Analysts had to guess, something that many are willing to do under the circumstances, as long as the fickle finger of accountability does not brand them as idiots once the real facts are on the table. They do realize, however, that real facts are rarely produced afterwards. What you get is a consensus that forms around the best ideas and a few clever insights from the most respected of the crew.

What were the most plausible explanations for the erratic USD pricing behavior?

At the outset, the Dollar collapsed, especially against the Yen and the Euro, but after a day or two, it had snapped back, as if nothing had ever transpired. The chart above reflects this result, but here are a few of the more plausible reasons given for the unanticipated moves that bounced the greenback back and forth:

• The Bank of China was the acknowledged catalyst for the chemical reactions that were soon ignited. Chinese officials are no different than those in other quadrants when it comes to reacting to undesired economic consequences in the marketplace. While trying to shore up falling equity prices, they re-set the Yuan’s quasi-peg to the USD. An avalanche was released, which required an interest rate adjustment to stem its flow. The BoC then had to intervene to protect the Yuan, which required the selling of a block of U.S. Treasuries to raise cash (The U.S. owes China more than $2 trillion in trade offsets). The selling forced down T-Bill values and, ultimately, the Dollar, as well;

• Timid investors quickly looked for the exits and began selling stocks. It seemed that the global economy was in peril and that the long anticipated market correction was finally in process. The forex futures market suddenly began to adjust its opinion as to when the Fed would raise rates. The last survey of economists from the NY Times had reported that 82% of the polled experts believed that a September rate change was imminent. The futures market, however, quickly adjusted that presumption back down to 25%, with pushback to December and even 2016, depending on how one interpreted the data adjustments on future contracts;

• The last domino to fall was the most curious of all. When it comes to carry-trade investing, there appears to be a “Last In/First Out” mentality when it comes to unwinding previous trades. The hypothesis that gained consensus was that marginal cash in the carry-trade community had been thrown at going long on the USD, in anticipation that a Fed rate increase was imminent and that there would be a nice profit bump gifted to the fleet of foot. The risk/reward aspects were on the low side, but a quick buck is a quick buck, that is until the balloon went up on Monday. All bets were then off. These low return deals were quickly unwound, to the benefit of the Euro and the Yen.

As abruptly as the market fell on Monday in early morning trading, it soon surprised everyone when it abruptly recovered, as well. Investors searched for new bargains. The S&P 500 Index regained strength. The jerk in the economic chain from China had been absorbed. Volatility subsided to a degree, and a calm normalcy returned to trading floors. The USD strengthened. Liquidity was not tested. The Bull market was still intact.

What are the near and long-term prospects for the U.S. Dollar?

There is a new hypothesis beginning to take shape about the future direction of the USD. The current forex bible reads that central bank policy divergence will drive USD valuations for some time to come. The Fed, along with its UK sidekick, is in the forefront of recalibrating interest rates, while nearly every other central bank is in the midst of considering more quantitative easing. A savvy group of experts, however, is proposing that the Dollar has been strong for too long and that this simple truth is at the core of all global economic problems. From this perspective, a weaker Dollar is the solution.

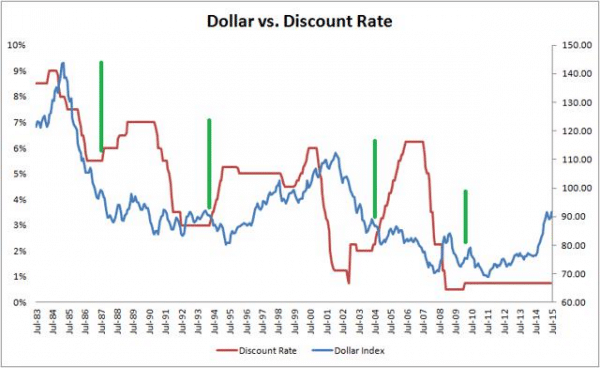

This week’s “Best Chart Award” goes to the following historical presentation:

Before we get into this diagram, we need to accept that we tend to be myopic when it comes to understanding how the economy works. Emerging markets have been the hotbed of GDP growth for decades with annual growth figures easily 3% to 4% above the average data for developed economies. The last few years have been devastating for these markets, including China, India, and Brazil. Andy Xie, a former Morgan Stanley chief economist, describes best the consequences of a strong Dollar:

“In a dollar bear market, the liquidity goes into emerging economies, causing their currencies and asset prices to appreciate. The double gains attract more inflow, eventually causing inflation. These economies lose competitiveness along the way. It is not noticed when asset appreciation supports domestic demand. When the dollar changes direction, so does liquidity. The virtuous cycle on the way up becomes a vicious one on the way down. The emerging economies already suffer inflation. The liquidity outflow leads to currency depreciation, which worsens inflation. . . . The confidence game (needs to) work when speculators want to play. It requires the global environment to be supportive. The most important supporting factor is the weak dollar.”

The health of the global economy depends on an appropriately valued Dollar. Global trade and commodity markets have spent the last year adjusting to the dramatically appreciating USD, which nearly hit the 30% mark, but has settled down around a 20% run up since May of 2014. Fast forward to the present, and we have a Fed that is about to raise the discount rate.

Now for the chart – It depicts that every time the Fed raised rates significantly in the past (designated by the “Green” vertical lines), the Dollar actually depreciated by roughly 12% over the subsequent two-year period. As for why, one analyst explains, “The reasons that drive this are multifaceted, but essentially increasing rates tends to slow the economy. As the economy slows, foreign funds exit for more active pastures putting bearish pressure on the dollar.” If the insight in the above chart holds, then we must assume that any increases in interest rates have already been baked into the current USD valuation, despite what the futures market might be implying.

Concluding Remarks

At times, we cannot see the forex forest for the trees. If the above hypothesis is correct, then we should embrace the need for a weaker U.S. Dollar. If and when the Fed acts on interest rates, the reaction in the forex market may be more of a “sell on the news” type of reaction, a recipe for shorting the Dollar over the ensuing 24-month period. The time to react to this type of scenario, if it plays out, may be over the twelve months.

As appealing as this logical argument purports to be, one must also remember that we are living in unusual times. The Great Recession has wreaked havoc in our global markets, and central bankers have responded by tying it up in the tightest Gordian knot on record. Market forces have been manipulated to such an extent that the risk of a severe explosion, followed by a liquidity crunch, is a real possibility. Under these conditions, anything could happen. Be cautious, and be prepared is the best advice.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk