- The potential demise of crypto exchange FTX has spooked investors

- Fears of a dash to the dollar have resulted in risk-on currency pairs tumbling

- With the FTX management “considering every option”, investors are right to be concerned

A positive start to the week by risk-on currencies has been derailed by a surprising left-field intervention by the crypto markets. The potential demise of the major crypto exchange FTX has left investors fearing a liquidity crunch and a move by those with existing positions carrying out a fire-sale of those assets to support their favourite leveraged positions.

Gone are the days when cryptocurrencies could be regarded as something mainstream investors could simply ignore. The FTX exchange, which could go under and send shockwaves through the wider market, has more than a million users. Before the current meltdown, it held over $32bn of assets. It’s no longer possible for currency traders to consider the buying of cryptos as something people do or don’t do but which has little impact on their portfolio.

The uncertainty surrounding FTX’s prospects is alarming. Earlier in the week, it was a model of best practice, processing withdrawal requests in good time to try to allay fears that it was close to collapse.

By Wednesday, a deal was reported to have been reached, which would have seen arch-rival Binance buy FTX and prop up its ability to honour all requests by customers to get their coins back. While a rushed support package involving two of the sector’s most prominent players was alarming enough, Binance had walked away from the deal within hours. FTX boss Sam Bankman-Fried was then quoted as “exploring all options”.

GBP and EUR Plummet on Crypto Liquidity Fears

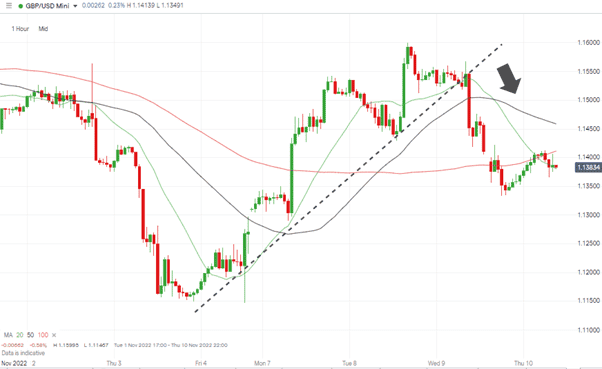

Sterling has been the worst hit of the risk-on currency pairs. Through Wednesday’s trading session, GBPUSD posted an intraday price fall of 1.83% as the FTX situation triggered a rush to the dollar’s security.

The week-to-date high of 1.5995 would have triggered a closing out of the Long Position Trade identified in the Weekly Forex Trading Tips report of 7th November. But the subsequent fall back to 1.13339 has taken the currency pair back to its Monday morning starting position.

GBPUSD – Hourly Price Chart 9th November 2022 – Trend Line Break

Source: IG

Also read: GBPUSD Forecast and Live Chart

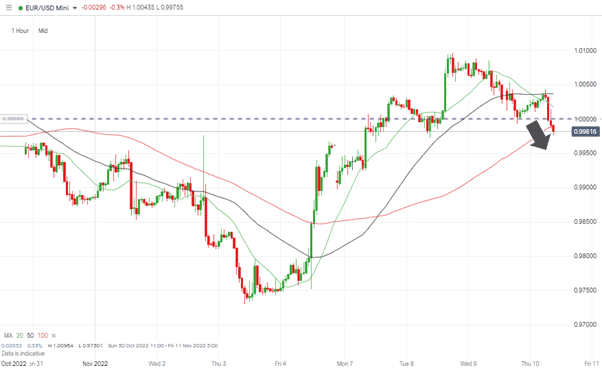

It was a similar story in euro-dollar. The surge in the price of EURUSD on Monday and Tuesday took that currency pair above the crucial parity price level. By Thursday morning, the after-shocks from liquidity concerns had taken it back to trading below 1.00.

EURUSD – Hourly Price Chart 9th November 2022 – Below Parity

Source: IG

With so much uncertainty about the future of FTX and its clients’ assets, there’s little chance of taking a confident view on how far the risk-off move in forex could go. But events do conclusively show that while crypto might not be fully mainstream yet, it can certainly impact markets in a previously unseen way.

People Also Read

- Forex Outlook – Technicals vs News Flow

- Fed Hikes And Dollar Strength – The Macro View On How It Impacts US Stocks

- The Best and Worst Performing Currency Pairs in October 2022

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk