It’s showtime! Tuesday marks the date of the annual launch of upcoming Apple products, when the firm’s new range of iPhones, Apple Watch and AirPods will be shared with the public. The much-hyped autumn launches traditionally involve a lot of swooning by fans of the brand and generate enough media attention to take the products to the top of the Christmas sales charts. This year’s jamboree couldn’t have come at a better time for the firm – its share price tanked on Friday thanks to judicial announcements in the US. That decision, which challenges its control of payments for its Apps, has spooked the broader market and Apple shareholders.

With a market capitalisation of over $2trn, Apple consistently ranks as the largest firm in the world. The knock on from that is that it is also one of the most widely held stocks, with retail and institutional investors across the globe holding positions. Will the big reveal work its magic once more and get Apple and tech stocks out of the hole they are currently in?

Source: theappentrepreneur

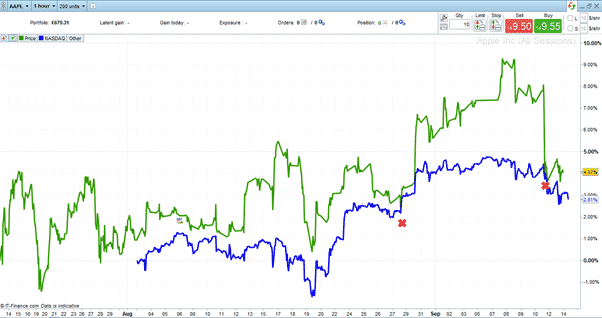

Comparing the Apple share price to that of the Nasdaq 100 index as a whole shows the California based firm has outperformed the broader sector. In the last two months, there have been two instances of the Apple share price falling to be in line with the Nasdaq 100. In each instance (August 29th and 10th September), Apple’s share price bounced to maintain its position at a premium to the rest of the stocks in the index.

Source: IG

It would be a brave decision to back any strategy based on the Apple product launch being a flop. In reality, the buzz around the well-orchestrated event starts a long time before the actual presentation. Online rumours and information leaks create levels of excitement that generally get the product launch over the line.

In the unlikely event that the launch is a disappointment to the brand’s fans, and Apple breaks lower to trade beneath the rest of the index, then markets could be in for a shock. The question is likely to be how much bounce the new product range provides to the Apple share price. A small bounce could signal all is not well.

What to Watch Out For at the Apple Product Launch

While Apple has diversified its income base to include divisions such as home streaming and payment systems, the handsets are still a totemic part of the brand loyalty which has made the firm the success it is today.

- iPhones accounted for half of Apple’s sales revenue in 2020. If the new iPhone has enough upgrades to justifiably be pitched as a new iPhone 13, rather than an upgrade of iPhone 12, then that would represent a confidence boost for the product, and hopefully, the share price.

- Apple Watches accounted for 11% of sales in 2020 and are a growth sector. A new Series 7 product is predicted – and is priced into the share price, so for investors, that one will need to impress.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk