- As expected, US Fed raises interest rates by 25 basis points.

- The move was already priced in, but increasingly dovish guidance has caused a mood shift in the markets.

- Strength in alternative safe-haven currencies could reflect the start of a new trend.

The meetings held by the US Federal Reserve’s FOMC committee every eight weeks signal the exact point at which interest rates are adjusted. However, as was the case on Wednesday, the accompanying guidance often offers more clues as to how the markets might react.

Fed changes its wording on parameters for future rate hikes

The key takeaway from the most recent summit of Fed officers was a slight, but noticeable, shift in the wording used to explain which factors will determine the need for future interest rate increases. When Jerome Powell and his team met in March, the guidance stated that “The Committee anticipates that some additional policy firming may be appropriate”, which indicated that further rate rises would be likely.

After Wednesday’s announcement that US base interest rates would be increased by 25 basis points, it was suggested that the Fed could be increasingly reluctant to increase rates, and will instead be “determining the extent to which additional policy firming may be appropriate”.

The reference to “appropriate” policy firming highlights how the threat of a US recession is now being given greater weight. Higher rates and more expensive borrowing would cut off investment and jobs creation, and whilst that would bring about lower inflation, the Fed appears increasingly unwilling to disregard the impact that their policy might have on the ‘real’ economy. The ‘S’ word, stagflation, may be receiving considerably more airtime among financial analysts in the near future.

Forex markets react to apparent pivot in Fed policy

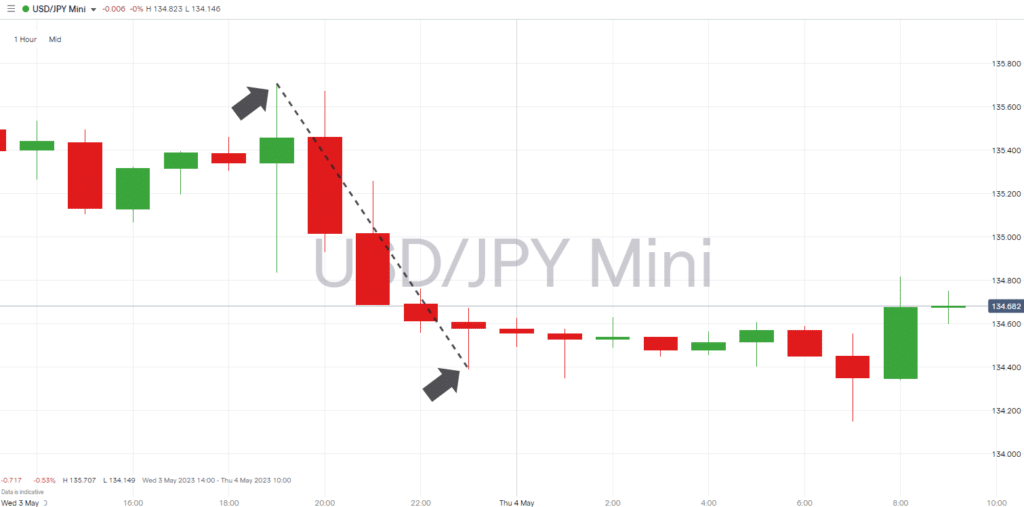

The immediate reaction in the forex markets was a slump in the value of the US dollar. Alternative safe-haven currencies such as the Japanese yen and the Swiss franc both benefited from an influx of demand from investors who are able to easily move their spare capital between different countries. Within five hours of the Fed releasing its statement, the USDJPY currency pair value had fallen by 0.97%.

USDJPY – Hourly Price Chart 03/05/2023 – Immediate fall in value

Source: IG

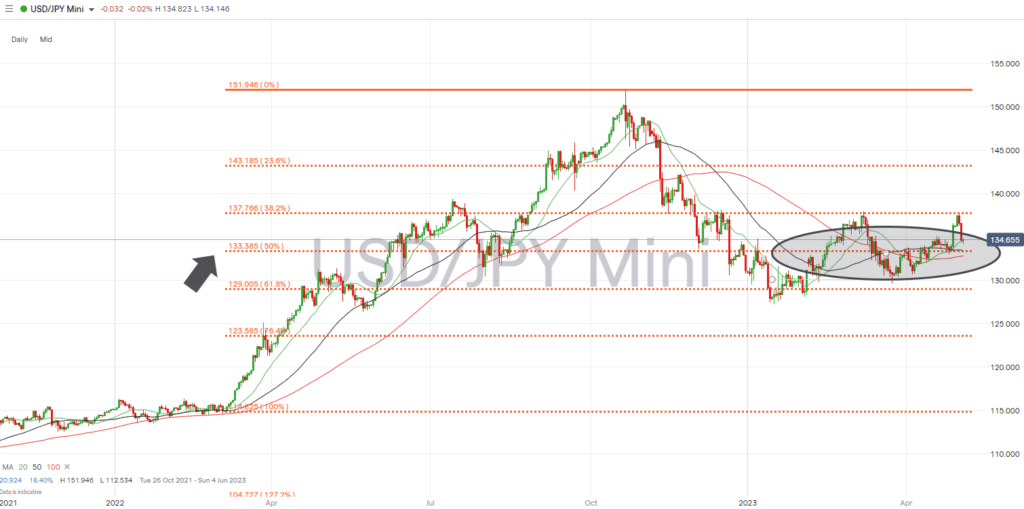

The 133.38 price level in the USDJPY currency pair now looks like a key support level to watch. This change marks the point of the 50% Fibonacci retracement of the rally in dollar-yen, which started in March 2022 and peaked at 151.94 on 21st October 2022.

USDJPY – Daily Price Chart 2022 – 2023 – Fib retracement

Source: IG

Price moves between 13th March and 27th April 2023 were heavily influenced by the support/resistance offered by 133.38. A confirmed break of the 50% Fib level on the back of the Fed’s update would leave room for a test of the support that was offered by the swing-low on 127.22 16th Jan 2023. After that, there are few other support metrics in place to prevent a freefall in the price of USDJPY.

People also Read:

- Strong Euro Price Action Heading into Key Data Releases

- Forex Market Forecast for May 2023

- The Week Ahead – 1st May 2023

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk