The fireworks let off during the US 4th July holiday have historically signalled a mood shift in the financial markets. The summer doldrums associated with the holiday season that stretches over the following months reflects that at any one time, a proportion of ‘rainmakers’ will be holidaying, rather than deciding where exactly to allocate millions, if not billions, of dollars. This year, things could be different, and traders would do well to approach July and August of 2022 as they see it, rather than as they expect it to be.

COVID-19 Hangover Is Still Working Through the System

The shock to the system caused by the COVID-19 pandemic blew seasonal trends out of the water in 2020 and 2021. Between March and September 2020, risk on assets surged in value and anyone expecting the traditional flatlining during July and August to come into play would have missed out on significant trading opportunities.

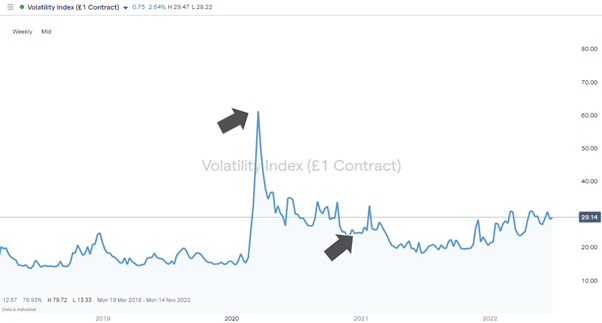

VIX Volatility Index – Weekly Price Chart – 2018-2022

Source: IG

The precedent for the summer months not being quiet anymore was set when the VIX ‘fear index’ dropped in value from more than 60 to below 25 in the last three quarters of 2020. At the same time, the pipeline of cheap cash pumped into the financial system saw demand for the US dollar plummet as traders moved away from the relative security offered by the greenback.

As a result, the US Dollar Index crashed from 103.26 in March 2020 to 89.97 in December of that year, a 12.8% price move. That liquidity is now draining out of the market and analysts are split on whether the US Federal Reserve will follow up on June’s record-breaking 0.75% interest rate hike with another 75 basis point rise or ‘only’ a 0.50% adjustment.

US Dollar Basket Index – Weekly Price Chart – 2018-2022

Source: IG

Any July 2020 forex forecast does well to factor in that a massive realignment is taking place regardless of the time of year and that the absence of some staff from trading desks might exacerbate rather than reduce volatility. This summer, it’s fundamental factors, rather than traders, that are driving prices.

Key Dates in July

With fundamental analysis looking to be a greater influence than technical analysis pivot points in July, it’s worth looking ahead to identify the announcements that might have influence. The key announcements to follow continue to be ones relating to the dominant themes of growth and inflation.

The Non-Farm Payroll job numbers due on 8th July will provide a clue as to what direction central bank policy next heads. Before that date, the ISM data release on 6th July could offer a clearer representation of the state of the US economy. The Federal Reserve’s FOMC meeting isn’t scheduled until 26th-27th July, which offers some breathing space in terms of time, but not necessarily in terms of price volatility.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk