Early trading on Thursday points to the markets making a slow start to September. For those keeping an eye on the historical performance of the ninth month of the year, it might be something they’d gladly accept. Billed “the worst month of the year”, September has seen the S&P 500 fall 0.5% on average, whereas every other month over the past 50 years posted a positive return.

The Covid inspired shake-down has changed the investment landscape. But the question for many is whether things have now settled down to the extent that the peculiarities of September are going to come into play.

Reasons to be Cautious

September just spooks the markets.

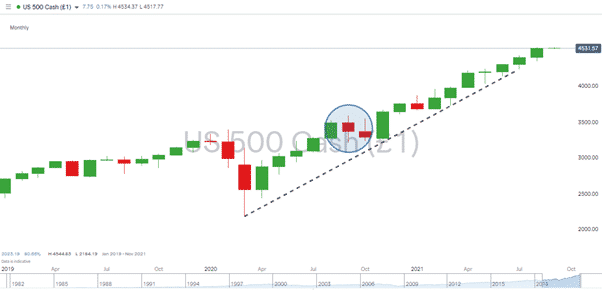

Even during the recent bull run, September managed to be a bogey month for the markets. Last year the S&P 500 posted a 4% fall on the month, part of the +107% rally between March 2020 and August 2021 in the same index. There were only three down months during that price surge, and September was one of them.

Source: IG

Concern about Fundamentals

The markets are going into September at record highs. It isn’t a case that the only way is down, but valuations are beginning to cause some concern. The S&P 500 is going into September with P/E ratios well above the 5-year and 10-year averages.

Technical Analysis metrics are beginning to creak. Price action above long-term moving averages is, of course, seen as bullish, but there is a risk of price reverting to mean. The monthly price chart for the S&P 500 points to price being some way above the 20, 50 and 100 monthly simple moving averages.

Source: IG

At the same time, the RSI on a monthly chart has been trading above 70 since March of this year.

Source: IG

Bulls could, of course, retort that the index has continued to rally and posted returns of 17.19% since crossing that key metric, but the air could be getting thin for equities.

Covid has not gone away

Reports of a new Covid variant greeted traders as they stepped into what is historically a perilous month. The WHO’s announcement that the new variant, called mu, may evade immunity provided by vaccines or previous infection was not the news investors wanted. There is an argument that such news appearing was more a case of “when” not “if”, but the new strain has appeared just as the northern hemisphere moves into autumn and the traditional flu season.

Central Bank Policy

This variable is one that might offer some comfort to investors. The US Federal Reserve led the way at its recent Jackson Hole Symposium by announcing it wasn’t looking to reign in monetary policy quite yet. Some of the data it considered points to a need for tapering and higher interest rates, and the fact that they didn’t take that step could point to the Fed having concerns about the economic outlook. If the smartest guys in the room say that we’re not out of the woods yet, then the Fed’s asset-price boosting policies can be taken as a contrarian indicator.

Reasons to be Cheerful?

September doesn’t have to be lousy, but it could be. Selling into a price slide doesn’t need to be the only response. For those with a longer-term outlook, a dip in prices might be seen as a buying opportunity, and for them, some seasonal blues may well be a good thing.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk