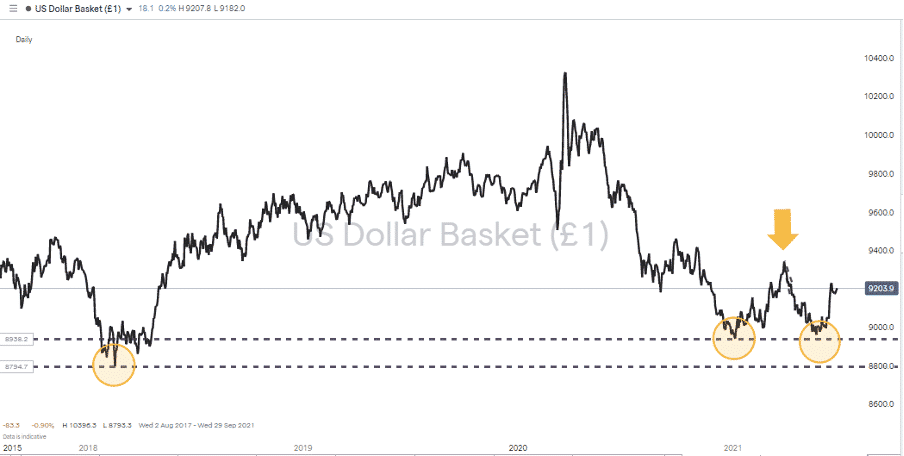

The US Dollar Basket index continues to act as a pivot for the rest of the financial markets. The potential triple-bottom pattern is still building momentum with a short-term pullback generating buying pressure overnight Monday as global investors bought the dip.

Source: IG

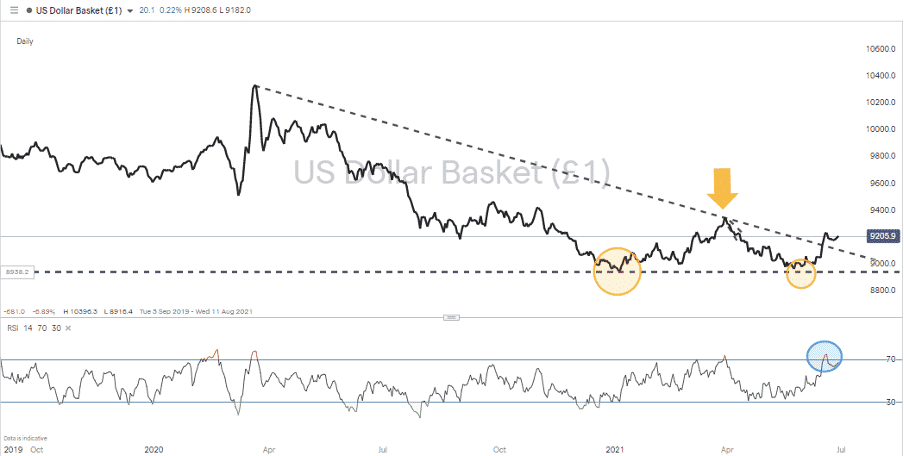

The trend-line break on the daily chart took place on the 18th of June and coincided with the RSI breaching 70. A short-term pullback was therefore unsurprising. The events at the tail end of that week also included the US Federal Reserve stating that it was “talking about, talking about interest rate increases”.

With technical and fundamental influences aligned so neatly, the only surprise is that the pullback wasn’t greater than it was. A kiss of the trend line still can’t be discounted, but with the daily RSI back below 70, the path of least resistance appears to be upwards.

Source: IG

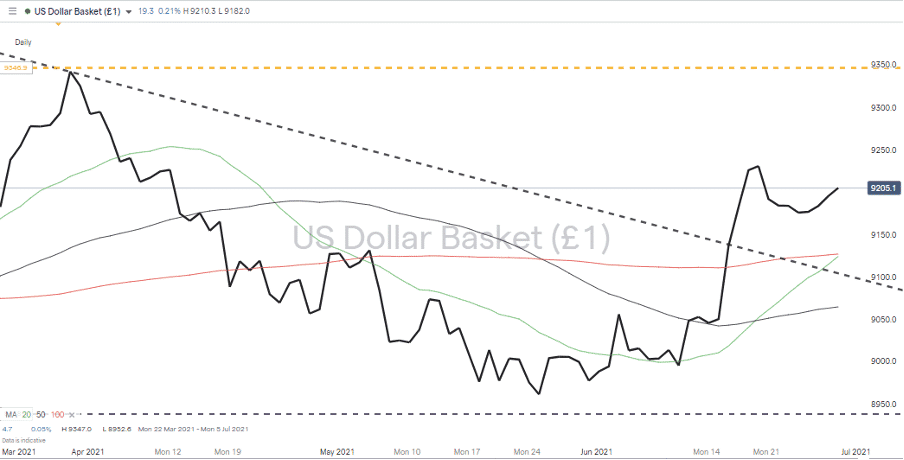

The key resistance from a charting perspective is 9346, the high of the 30th of March, which is still the year-to-date peak. The Daily moving averages are pointing towards further upward momentum. Price is currently above the Daily 20, 50 and 100 SMA, and the imminent intersection of the 50 by the 20 will add to the list of positive indicators building up behind the USD price surge.

Source: IG

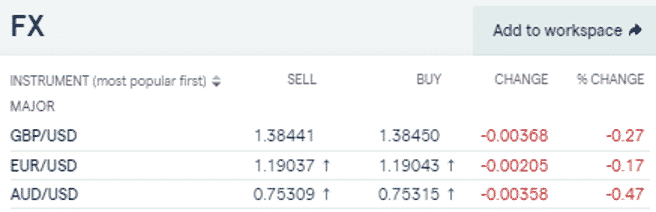

GBP, EUR, and AUD have all lost ground to the US dollar. The relatively large move in the Australian currency is caused by Covid concerns and news that the Delta variant has broken through the country’s, to date, impressive public health shield.

Source: IG

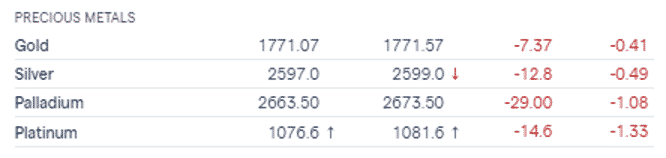

Gold & Silver

The inverse correlation between USD and the price of gold and silver has also come into play overnight. Silver has slipped below the critical 2600 price level, and both metals have lost 50 basis points of value since Monday’s close. Palladium and platinum posted even more severe losses than that.

Source: IG

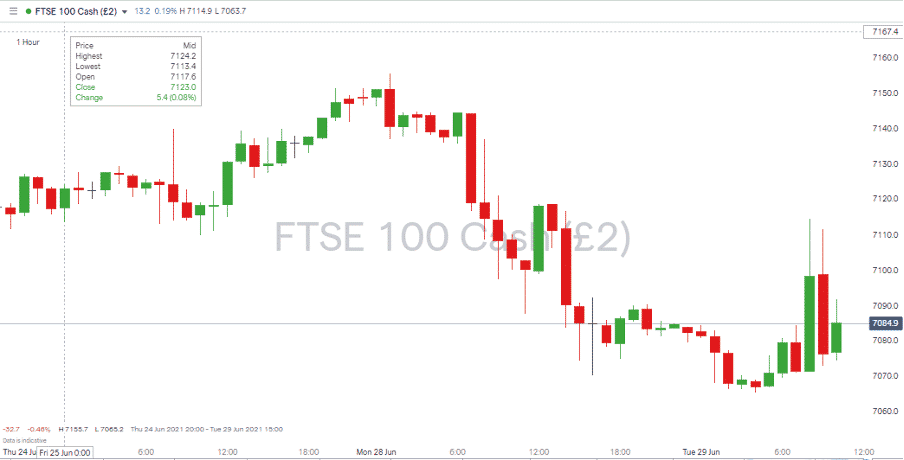

FTSE 100

Tuesday’s big winner from USD strength was the FTSE 100. The index lost ground on Monday but rebounded overnight. Time will tell if the long wicks on the upper end of the hourly candles prove as bearish as they appear at first glance. If USD continues to show strength against the pound, then the UK’s benchmark equity index could be expected to continue moving upwards. The negative correlation between GBPUSD and the price of the FTSE 100 being based on the fact that so many of the constituent firms generate profits in non-GBP denominated markets.

Source: IG

Nasdaq 100 & Facebook

With the dollar holding sway over so much of the forex, commodity, and equity markets, it was up to the Nasdaq 100 to provide the exception to the rule.

The index was up almost 1% as anti-trust campaigners failed to drag Facebook through the US courts. Two decisions in favour of the social media giant mean it won’t have to sell off any assets. As a result, the stock was up 4% and recorded a $1trn market capitalisation for the first time in its history.

If you want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk