The Bank of Japan (BoJ) increased its Policy Rate to +0.00%/0.10% in March, pulling the rate out of negative territory. While many, including the Research Team at FP Markets, expected the Japanese yen (JPY) to rally on the back of this, we instead witnessed a fall in the currency, consequently drawing the USD/JPY higher. Many desks labelled the move as a dovish hike due to the BoJ offering limited forward guidance regarding further policy firming.

BoJ Intervention Has Traders Nervous

The depreciation in the JPY is causing concern for the BoJ, with warnings coming from the central bank about a possible intervention to support the yen. The FP Markets Research Team added the following in another post (italics):

It will be interesting to see how the BoJ react to the recent data this week (jobs numbers on Friday) and, of course, the push higher in the USD/JPY pairing, which is now on the verge of testing the ¥152.00 handle. Traders were clearly tentatively trading in this market following the release of the job numbers, as we’ve seen officials repeatedly warning of a potential intervention to rescue the beleaguered yen.

The last intervention was seen in late 2022.

USD/JPY Chart Watch

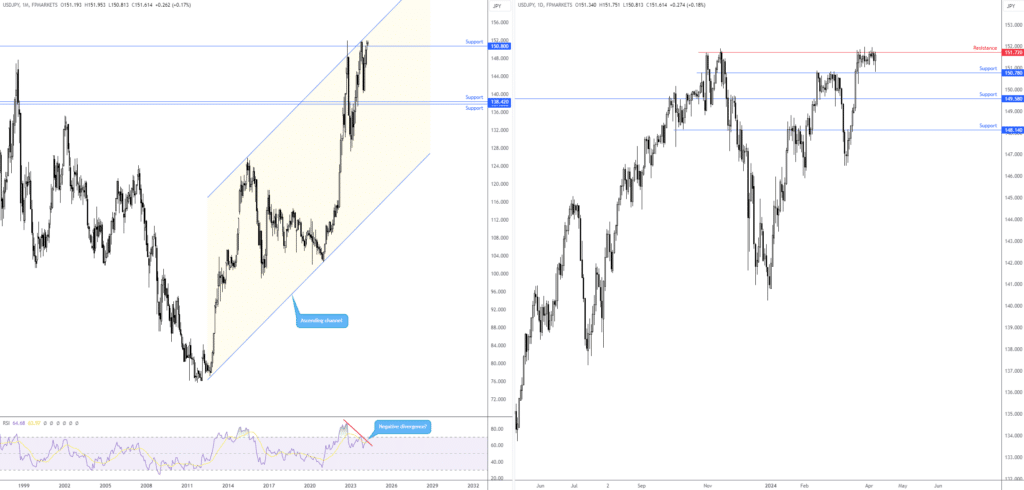

March finished the month up nearly +1.0%, following gains in January and February (Q1 added +7.4%). With resistance taken out on the monthly chart at ¥150.80, limited overhead resistance unearths a possible bullish scenario in the direction of channel resistance, drawn from the high of ¥125.85.

Although the trend is notably in favour of buyers, and has largely been the case since bottoming in early 2012, the Relative Strength Index (RSI) is showing signs of negative divergence, which could mean a reversal or simply a breather (consolidation) is on the horizon.

Across the page on the daily chart, resistance coming in from ¥151.72 will be a key watch this week. Eclipsing this base unlocks the trapdoor for the unit to approach the monthly timeframe’s channel resistance and essentially hands over the keys to breakout buyers until around the ¥153.00 mark. This, and the yen hitting lows not seen since 1990, is where things are likely to become very interesting for the BoJ.

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk