The Dow Jones stock index had a barnstorming Friday session on the back of better-than-expected US job numbers. The monthly Non-farm Payrolls report came out as many global markets were closed for an extended Easter weekend holiday, but the equity futures markets which were still open rallied hard into the close.

In the 90 minutes following the announcement, the biggest winners were the:

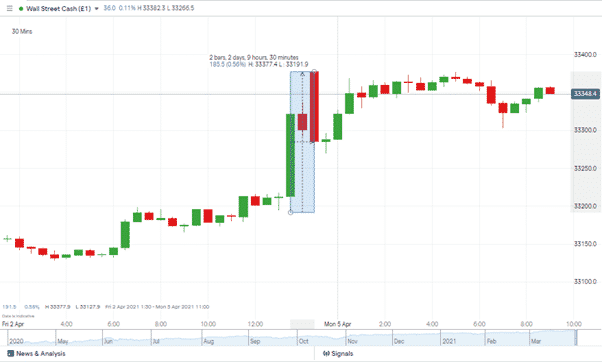

- DJIA – up 0.56%

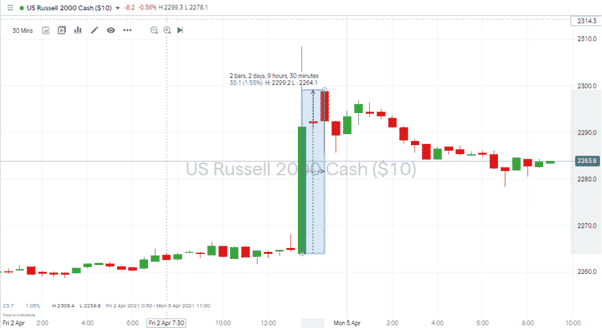

- Russell 2000 index up 1.55%

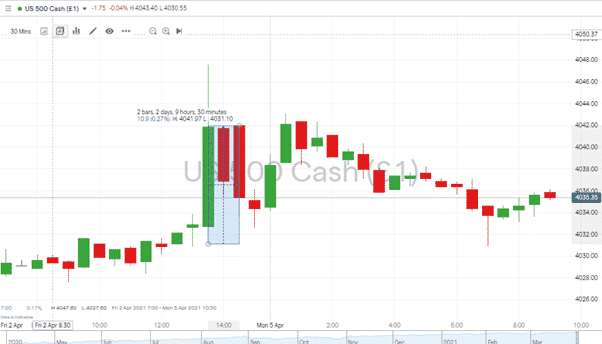

- S&P 500 index – up 0.27%

Wall Street index – 30m price chart

Source: IG

Russell 2000 index – 30m price chart

Source: IG

S&P 500 index – 30m price chart

Source: IG

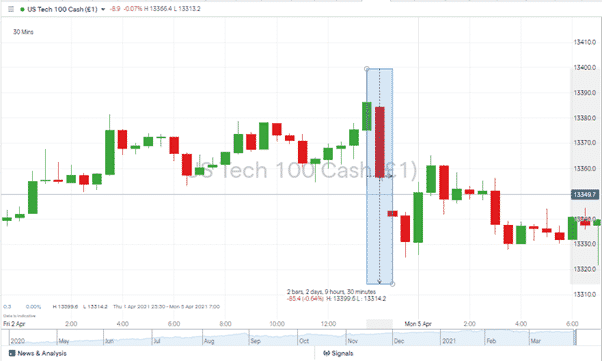

Moving in the opposite direction were US tech stocks. The potential for the lockdown to be over sooner than expected is bringing home to investors the risk that the ‘new normal’ of staying home to watch Netflix and collect Amazon deliveries might not be as hardcoded into consumer behaviour as some have thought.

The Nasdaq 100 index fell by 0.64%. While it has recovered some ground, on Monday morning, it was trading at 13358, still below the 13400 level it was printing at before the job numbers were published.

Nasdaq 100 index – 30m price chart

Source: IG

Is the Good News on Jobs Already Priced in?

The Russell 2000 and DJIA’s relative outperformance point to investors rotating into High Street and Main Street names. The question is whether the shift is done or whether Friday’s report was the starting gun for a change from growth stocks to cyclical stocks.

Forex

A quick cross-reference to other asset groups offers some interesting benchmarks. Over the last week, risk-on currencies GBPUSD and EURUSD have diverged. The former up against the US dollar and the latter down.

Metals

Silver’s weakness forms part of a multi-week trend – but one which might be bottoming out. The price of gold over seven days was unchanged.

| Instrument | 29th March | 5th April | Hourly | Daily | % Change | |

| GBP/USD | 1.3762 | 1.3830 | Strong Buy | Neutral | 0.50% | |

| EUR/USD | 1.1781 | 1.1748 | Strong Sell | Strong Sell | -0.27% | |

| FTSE 100 | 6,744 | 6,781 | Strong Sell | Strong Buy | 0.55% | |

| S&P 500 | 3,953 | 4,033 | Strong Buy | Strong Buy | 2.02% | |

| Gold | 1,727 | 1,727 | Neutral | Neutral | 0.00% | |

| Silver | 2,485 | 2,474 | Strong Sell | Strong Sell | -0.44% | |

| Crude Oil WTI | 59.72 | 60.56 | Strong Sell | Neutral | 1.41% | |

| Bitcoin | 55,376 | 57,182 | Strong Sell | Buy | 3.26% |

Source: Forex Traders

The US job numbers are possibly the most eagerly awaited economic report of any month. Its release on a day when many exchanges were closed will offer investors a chance to mull over the data. It does look like jitters caused by the collapse of Archagos, and the IPO flop of Deliveroo, are being seen through the rearview mirror.

The US Labor Department report showed the number of Americans on non-farm payrolls increased by 916,000 in one month. The jump in jobs numbers in March was the largest since August of 2020. The unemployment rate fell to 6%, which was in line with analyst forecasts, but the 916,00 extra jobs were some way above analyst forecasts of 675,000.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk