- GBPUSD hits price levels not seen since 1985

- Obvious price targets on short cable strategies have been hit and could lead to a profit-taking-induced reversal

- While a bounce could be imminent, trading that retracement would be best using a short-term time horizon

Wednesday saw the newly instated UK Prime Minister Liz Truss from a new government as the pound slipped to price levels not seen since the first female UK Prime Minister, Margaret Thatcher, held office in 1985. Some have drawn comparisons between the combative nature of Truss and the iron will of Thatcher, but the forex crisis is one connection the new leader won’t welcome.

Take Profits on Short Trades and Prepare for a Short-term Bounce

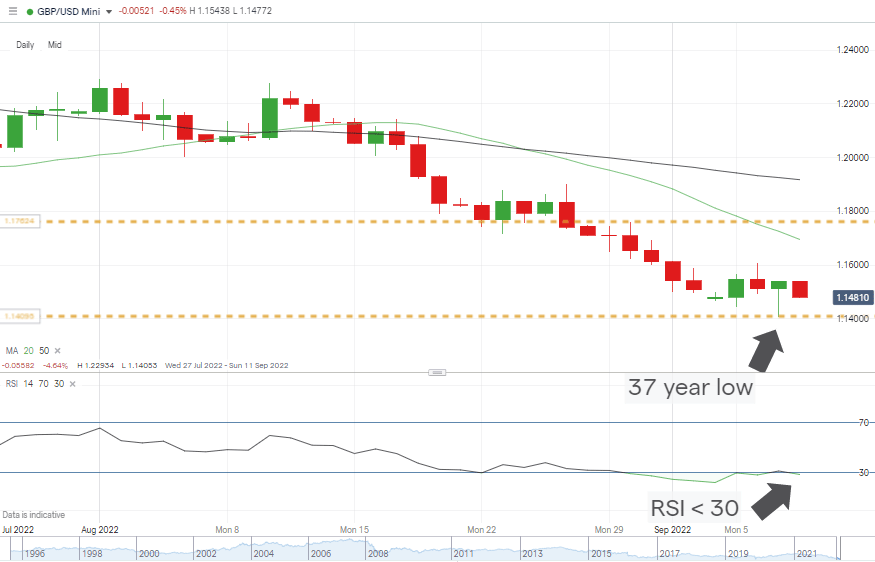

The short-term analysis points to markets not being ready to roll over quite yet. The low of 1.14053 printed on Wednesday marked a move below the support level of 1.14098 printed on 19th March 2020 but was met by a short-term rally, with GBPUSD finishing the session at 1.15406.

The RSI on the Daily Price Chart currently sits at 29.27, which shows the GBPUSD currency pair is oversold on that timeframe. If GBPUSD is ever going to bounce, then the confluence of a sub-30 RSI and a key multi-year support level would suggest that now is the time for it to happen.

Also Read: GBPUSD Forecast and Live Chart

GBPUSD Chart – Daily Candles – Potential Bounce?

Source: IG

The sell-short GBPUSD strategy outlined in the Technical Analysis and Trading Ideas Reports of 30th August and 5th September was entered into somewhat fortuitously. A short-term price spike only just triggered the price entry point on 30th August. But selling into that burst of strength has resulted in a profitable trade and both price targets being met.

The second price target of 1.14098 has been reached, and with the technical indicators and price charts pointing to a potential relief rally, there appears little reason not to lock in profits on that trade at this stage.

Reversing the approach and going long GBPUSD goes against the long-term trend, but there will be many using the new multi-year price low of 1.14053 as a base level below which to set stop-losses. The advantage of this strategy is that the stop loss instruction could be set within close proximity of the trade entry point, which minimises the potential downside.

The potential upside of a long GBPUSD trade is capped by weak UK fundamentals meaning a scalping strategy would appear optimal. The UK government is still taking shape and is untested, and US markets have swung over to pricing in a +80% probability of the Fed increasing interest rates there by 0.75% in the FOMC meeting later this month.

People Also Read:

- Take Profits On GBPUSD Trades As BoE Prepares To Hike Interest Rates

- GBPUSD – Failed Break Out Raises Serious Questions About USD

- Forex Explained – What Are Major Forex Pairs?

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk