FOCUS ON: Markets Pause Ahead of US Inflation Numbers and UK Rates Decision

- US CPI inflation report due Wednesday is the key data point of the week

- Bank of England updates on interest rates on Thursday

- UK GDP figures on Friday and continued updates as part of US earnings season

A busy fortnight for the markets continues this week, with the US consumer price inflation report on Wednesday the most likely driver of asset prices. Following last week’s US and Eurozone interest rate announcement, and the Non-Farm Payroll numbers released on Friday, asset prices have formed short-term consolidation patterns. An uptick in volatility could be around the corner.

Forex

GBPUSD

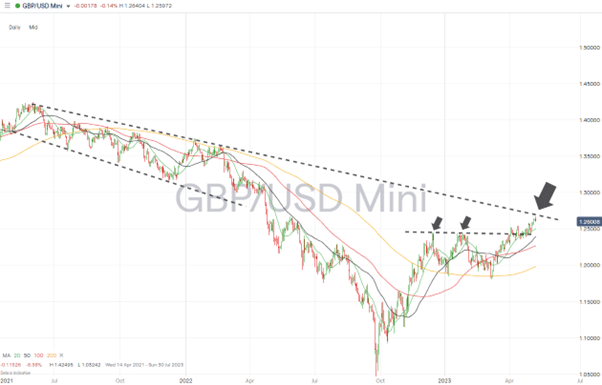

The Bank of England meets on Thursday, with most analysts expecting a 25-basis point increase in UK borrowing rates. Other central banks have hinted at a more dovish approach in the future in an effort to allay fears about the health of the banking sector; however, with double-digit inflation in the UK, that doesn’t look like an option for the BoE and could lead to further GBPUSD strength.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

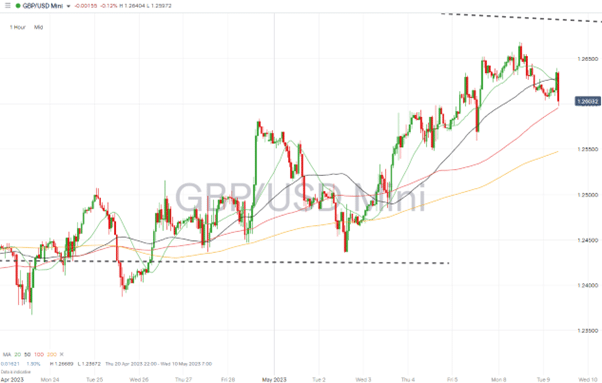

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Thursday 11th May – 12 noon GMT – Bank of England rate decision. Rates are expected to rise to 4.5%, though signs of dissent could indicate a more dovish stance regarding medium-term policy.

- Friday 12th May – 7 am GMT – UK GDP (Q1, preliminary). Analysts forecast growth to have been 0.1% quarter-on-quarter and -0.5% year-on-year.

UK company reports:

- Tuesday 9th May – Direct Line trading update.

- Wednesday 10th May – TUI, Compass, and ASOS, quarterly earnings update.

- Thursday 11th May – John Wood Group and ITV trading update.

EURUSD

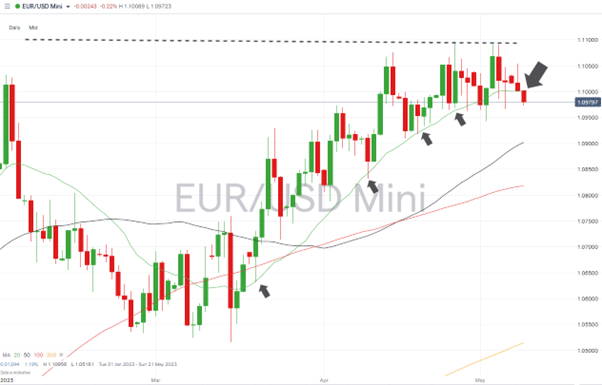

The absence of euro-specific data won’t mean there are few chances of trading euro-based currency pairs. EURUSD prices can be expected to react to the release of the CPI (Consumer Price Index) inflation numbers due on Wednesday. Economists forecast a year-on-year increase of approximately 5% for the CPI, which would match last month’s rate.

EURUSD Chart – Daily Price Chart – Break of 20 SMA

Source: IG

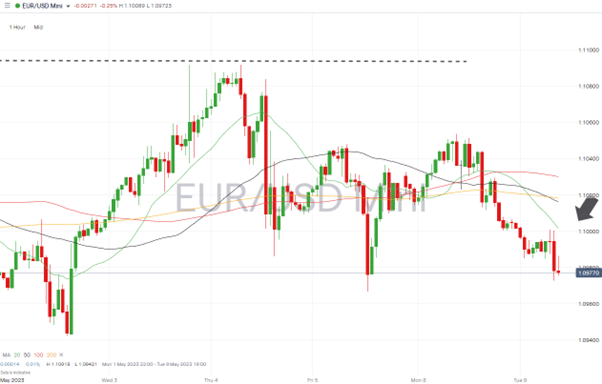

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Wednesday 10th May – 1.30 pm GMT – US CPI (April): Analysts forecast prices to have risen 4.9% year-on-year from 5% last month and fall to 0.2% from 0.4% on a month-on-month basis.

Indices

S&P 500

Earnings season is drawing to a close, and the biggest names have already updated investors, so attention in stock markets will turn to economic fundamentals. The CPI inflation numbers due on Wednesday will be watched closely by Fed policymakers as they decide whether to pause US rate hikes next month. A hot inflation number could threaten recent gains in stock prices.

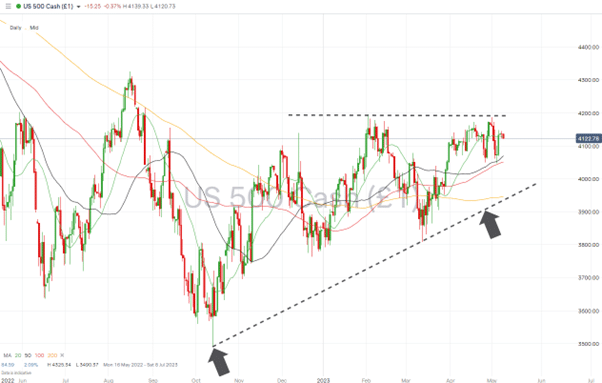

S&P 500 Chart – Daily Price Chart – Ascending Wedge Pattern

Source: IG

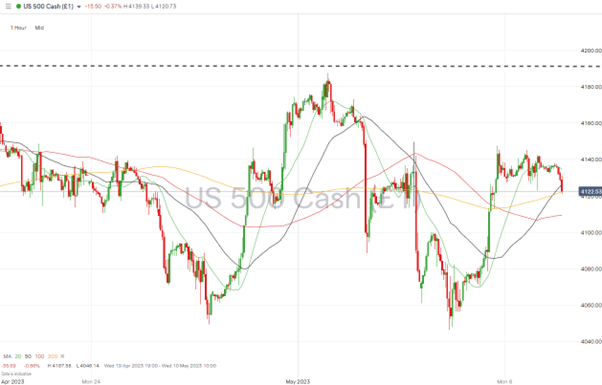

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Wednesday 10th May – 1.30 pm GMT – US CPI (April): Analysts forecast prices to have risen 4.9% year-on-year from 5% last month and fall to 0.2% from a 0.4% on a month-on-month basis.

US company reports:

- Monday 8th May – PayPal quarterly earnings.

- Wednesday 10th May – Wald Disney quarterly earnings.

People Also Read:

- The Best and Worst Performing Currency Pairs in April 2023

- What’s in a Word? Fed Guidance Suggests Dovish Approach Could be Around the Corner

- Strong Euro Price Action Heading into Key Data Releases

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk