FOCUS ON: Quiet News Week After Period of Intense Activity

- Earnings season draws to a close.

- CPI and GDP reports due in what is set to be a relatively quiet news week.

- Technical analysis indicators and price levels set to play more influential role.

After a fortnight of intense news flow, things quieten down this week. There is still a range of reports due to be released, but in relative terms at least, a period of ‘summer trading’ could finally be about to start.

Forex

GBPUSD

The Bank of England posted another interest rate rise last week, and analysts will now turn their attention to the GDP number due out on Friday.

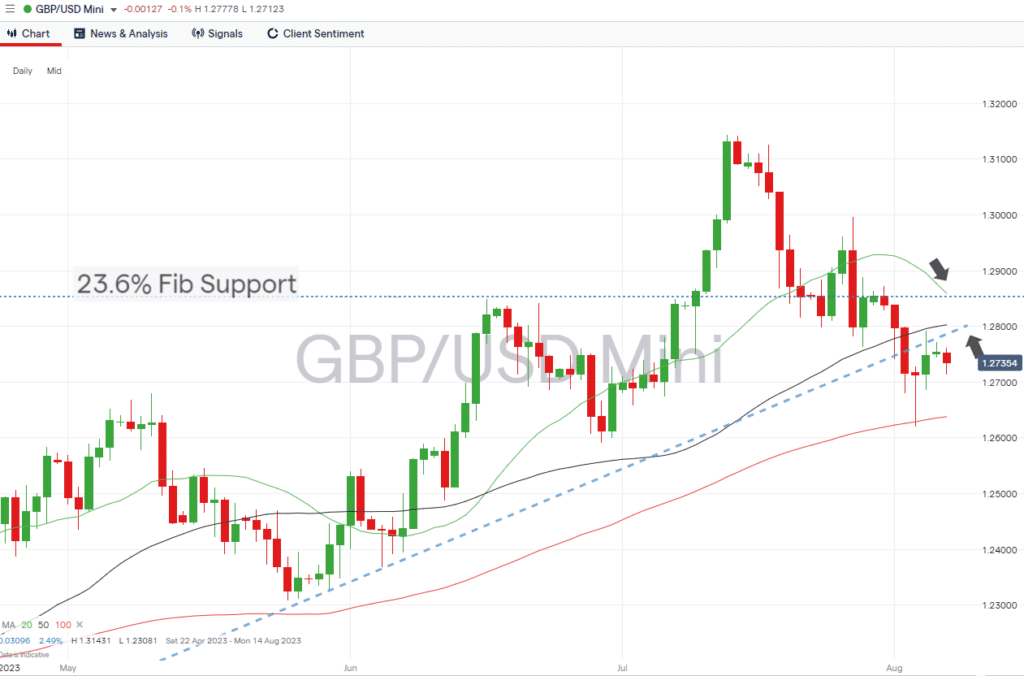

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance/Support

Source: IG

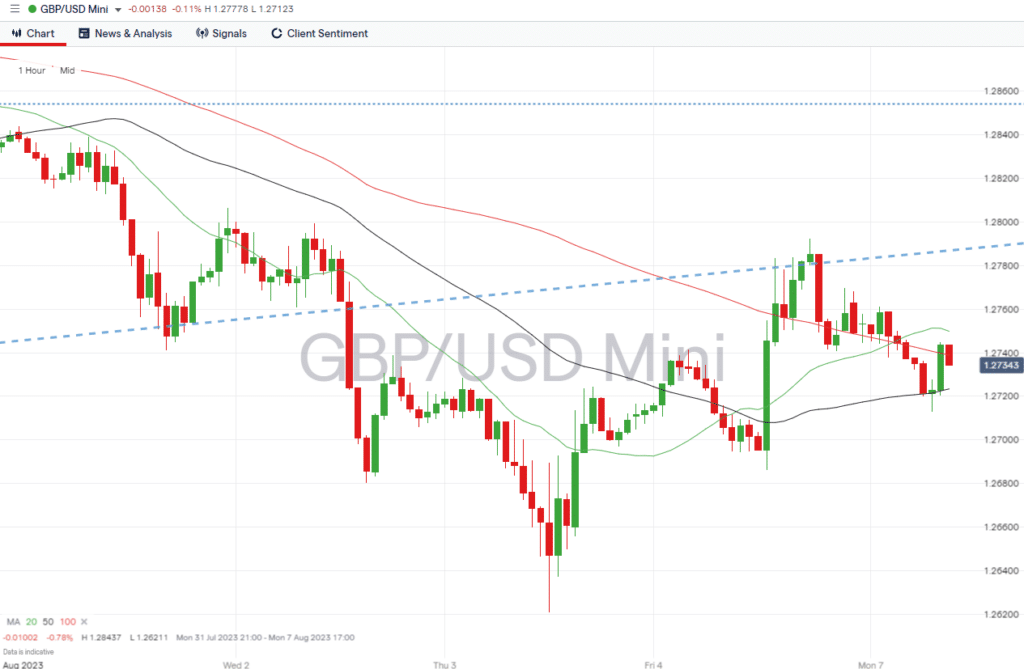

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Wednesday 9th August – 2:30 am BST – China COPI (July). Analysts expect prices to fall 0.3% year-over-year.

- Thursday 10th August – 1:30 pm BST – US CPI (July). Prices forecast to rise 2.8% year-on-year from 3%, and 0.1% from 0.2% month-on-month.

- Friday 4th August – 7:00 am BST – UK GDP (Q2, preliminary). Growth expected to be -0.8% year-on-year and 0.1% quarter-on-quarter.

EURUSD

In a week with little euro-specific news, analysts will continue digesting the EU GDP figure and German unemployment numbers released last week. The dollar leg of the EURUSD currency pair can be expected to fluctuate in price when key US inflation data is released at the end of the week.

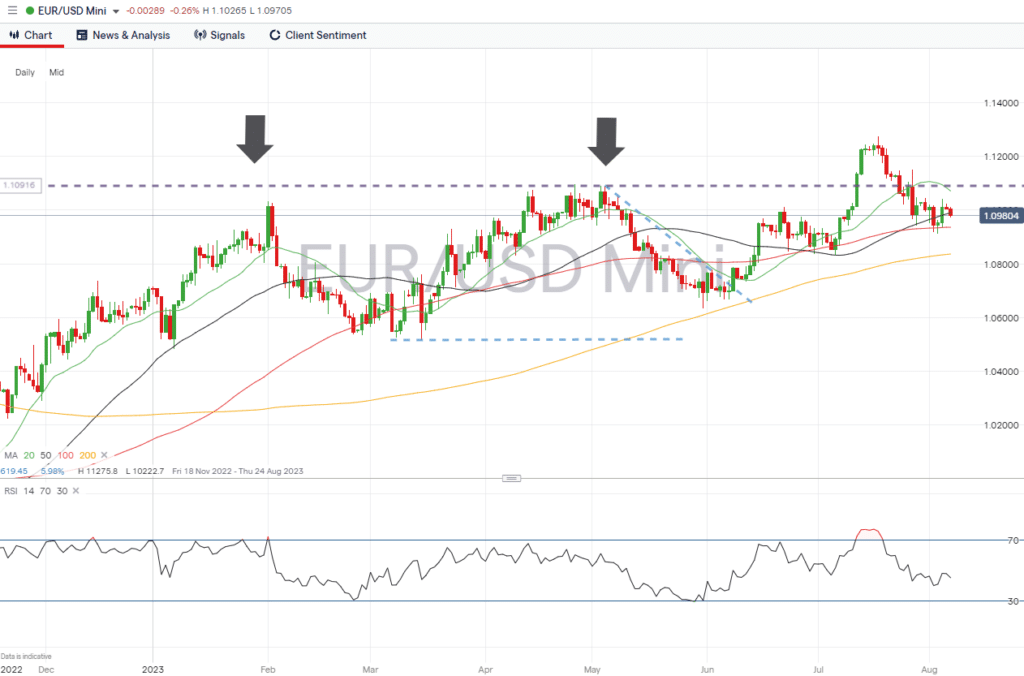

EURUSD Chart – Daily Price Chart

Source: IG

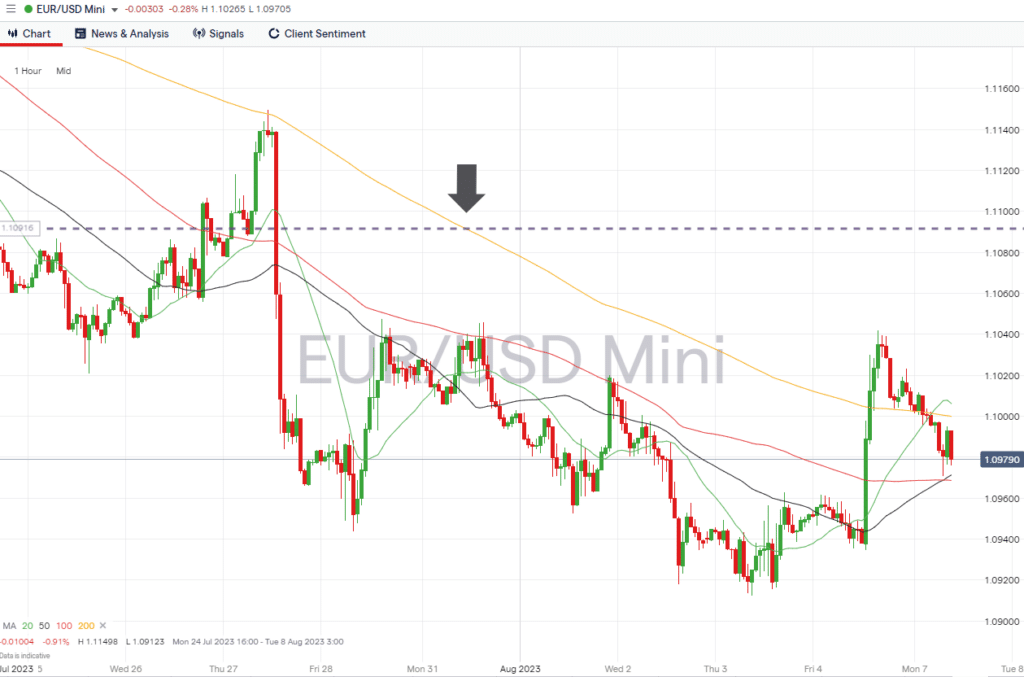

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Wednesday 9th August – 2:30 am BST – China COPI (July). Analysts expect prices to fall 0.3% year-over-year.

- Thursday 10th August – 1:30 pm BST – US CPI (July). Prices forecast to rise 2.8% year-on-year from 3%, and 0.1% from 0.2% month-on-month.

Indices

S&P 500

US earnings season is drawing to a close, but the Disney numbers due on Wednesday can be expected to provide some excitement for stock analysts.

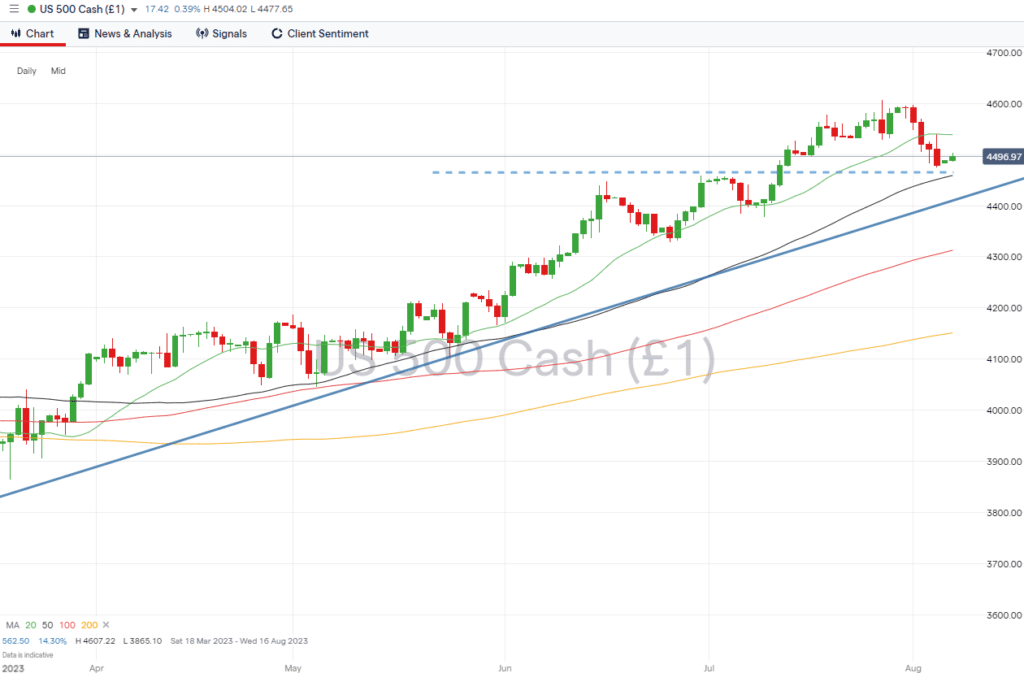

S&P 500 Chart – Daily Price Chart

Source: IG

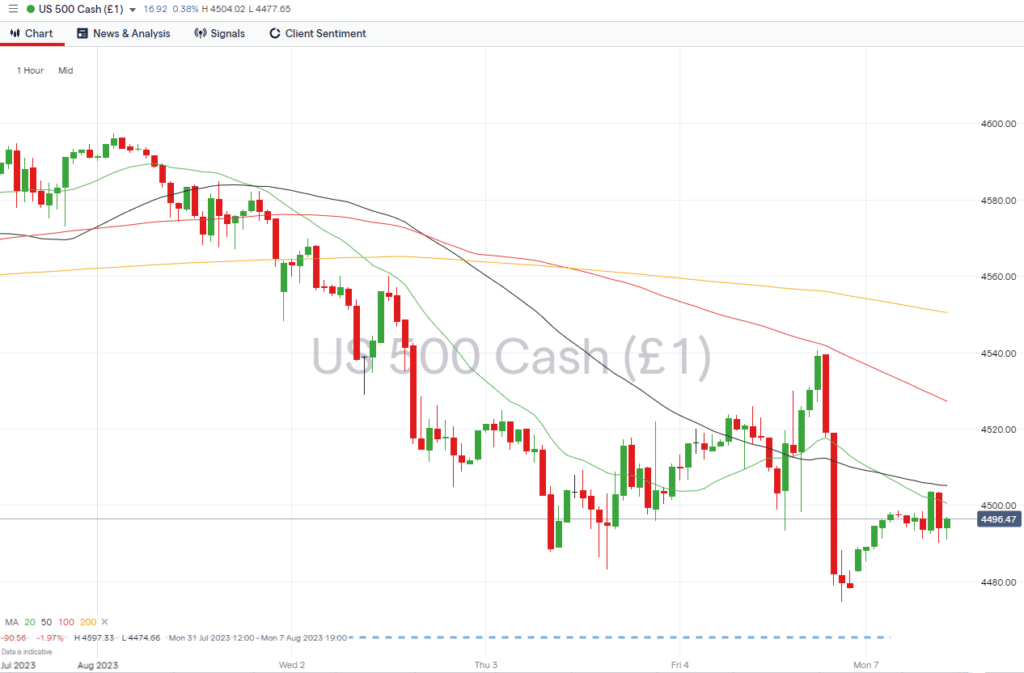

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Wednesday 9th August – 2:30 am BST – China COPI (July). Analysts expect prices to fall 0.3% year-over-year.

- Thursday 10th August – 1:30 pm BST – US CPI (July). Prices forecast to rise 2.8% year-on-year from 3%, and 0.1% from 0.2% month-on-month.

- Friday 4th August – 7:00 am BST – UK GDP (Q2, preliminary). Growth expected to be -0.8% year-on-year and 0.1% quarter-on-quarter.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.08.07

- Forex Market Forecast for August 2023

- The Best and Worst Performing Currency Pairs in July 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk