FOCUS ON: Quiet News Week Leaves Room for Technical Indicators to Guide Price Moves

- Closure of US exchanges on Monday for Labor Day sets tone for a quieter week of news announcements

- Canadian and Australian central banks to set interest rates

- Purchasing Managers Index (PMI) will provide clues on health of the US economy

Last week’s US Non-Farm Payroll report capped off a busy news week for investors that saw signs of a return of risk appetite. The coming trading week is foreshortened by the US Labor Day national holiday, but a range of medium-weight announcements can be expected to play some part in guiding price.

Forex

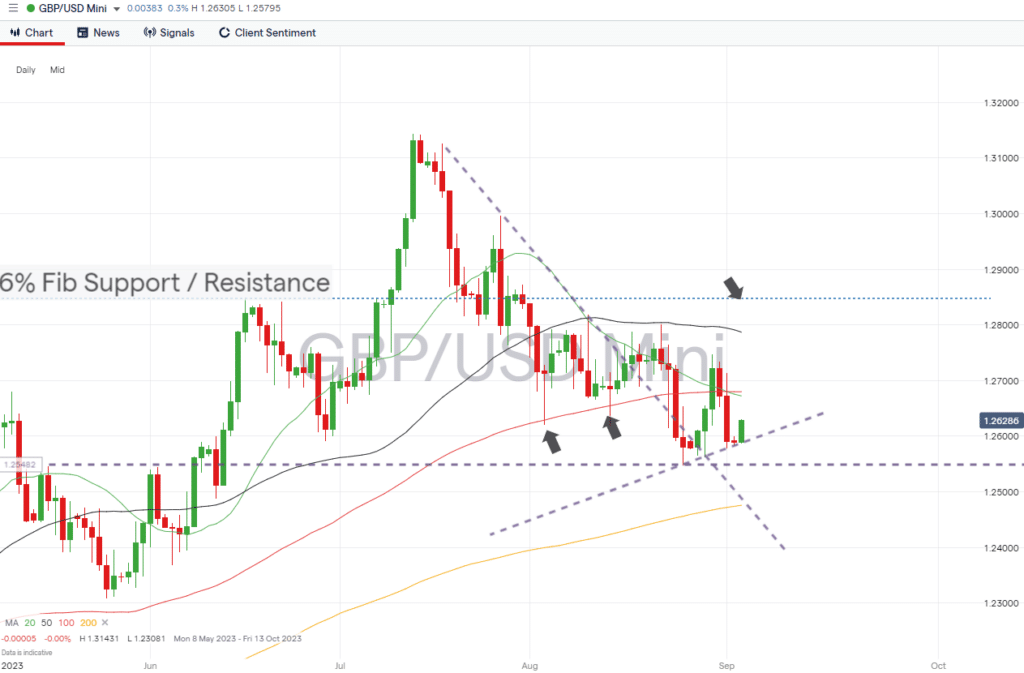

GBPUSD

GBPUSD currency traders will see few UK-centric reports released this week. However, news from other economic superpowers can be expected to influence the price of sterling-based currency pairs.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

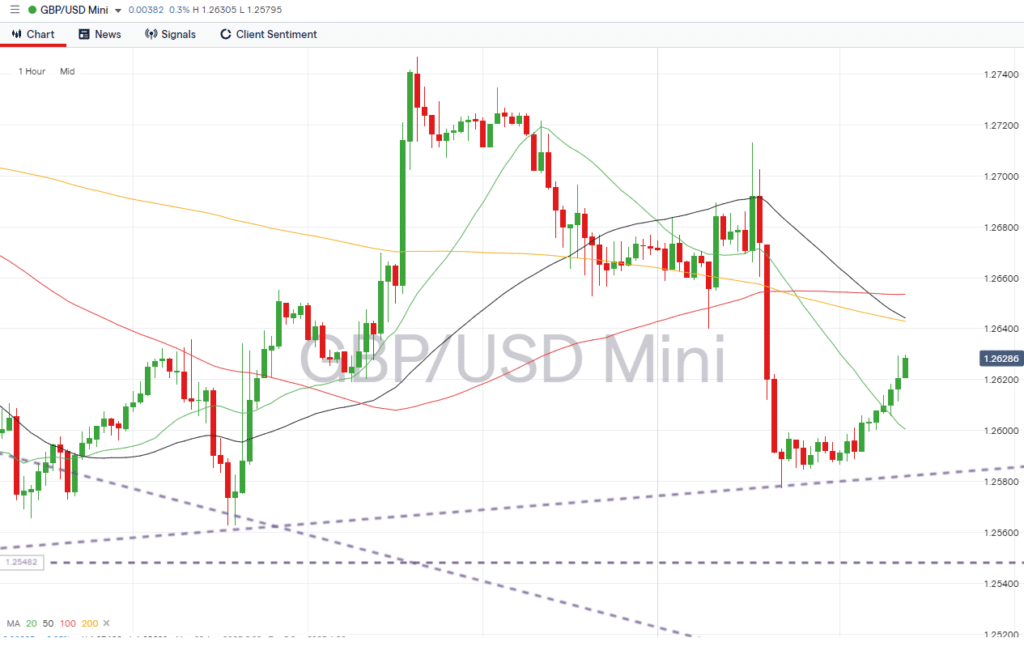

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs, all times BST:

Monday 4th September

- US Labor Day holiday, US exchanges closed.

Tuesday 5th September

- 5.30 am – Reserve Bank of Australia, interest rate decision.

- 3.00 pm – US Factory Orders (July) – Analysts expect orders to rise 0.1% month-on-month.

Wednesday 6th September

- 9.30 am – UK construction PMI (August) – Analysts forecast a fall from 51.7 to 51.2.

- 3.00 pm – US ISM services PMI (August) – Forecast to fall from 52.7 to 52.4.

- 3.00 pm – Reserve Bank of Canada interest rate decision.

Thursday 7th September

- 4 am – China trade balance (August) – Exports are forecast to fall 10%, an improvement on July’s 14.5% drop.

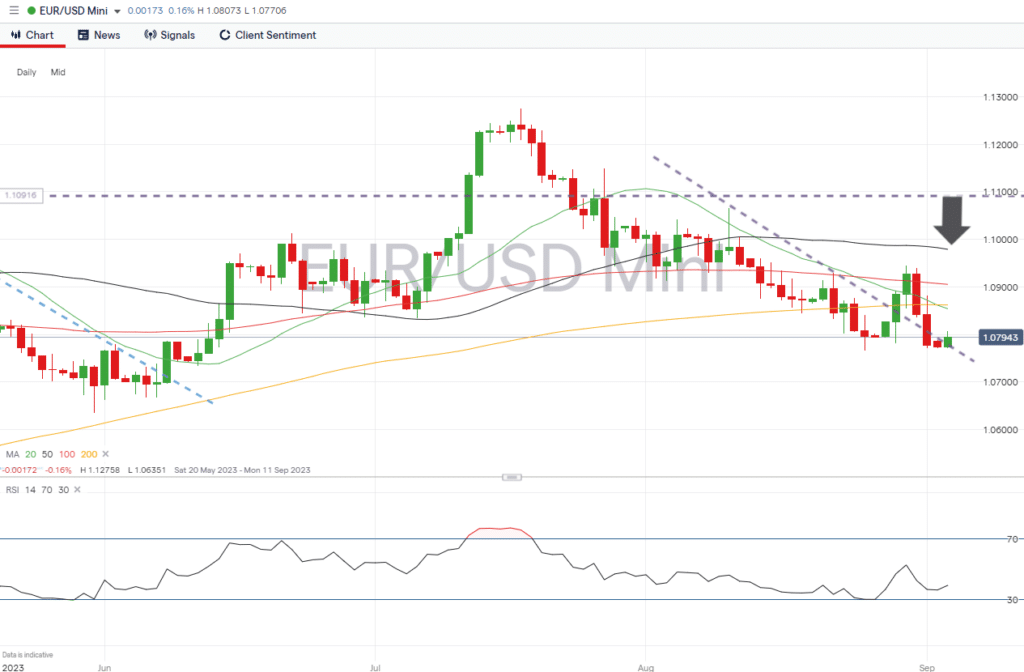

EURUSD

The next announcement on Eurozone interest rates is due on 14th September, and the coming week looks like an opportunity for traders to get into positions in the build-up to that major publication. There is little euro-focused data due out, but sentiment reports out of the US can be expected to influence the price of EURUSD.

EURUSD Chart – Daily Price Chart

Source: IG

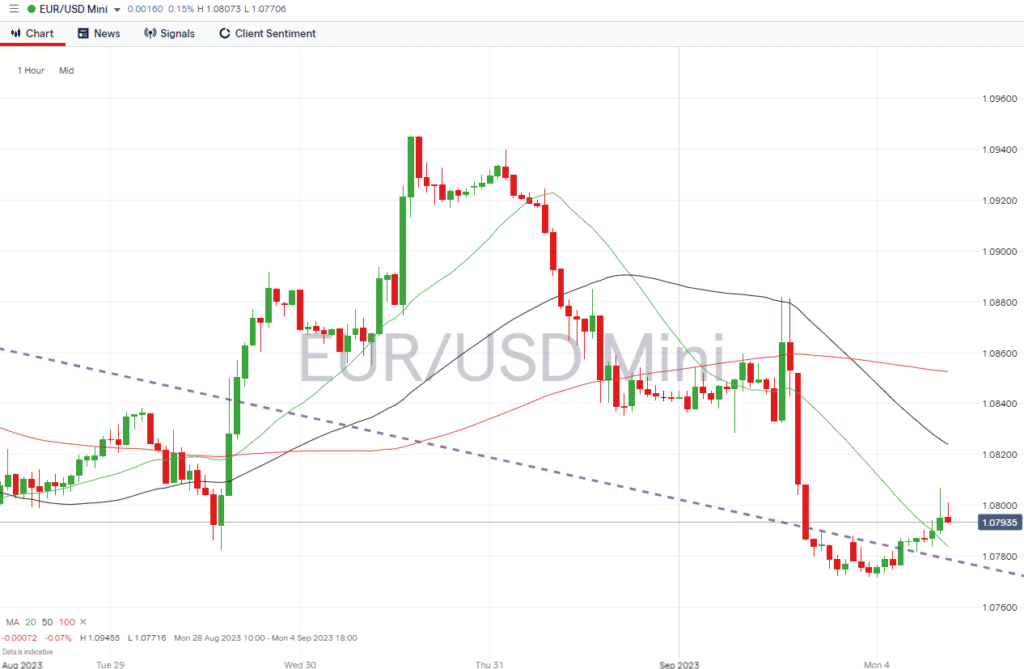

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

Monday 4th September

- US Labor Day holiday, US exchanges closed.

Tuesday 5th September

- 5.30 am – Reserve Bank of Australia interest rate decision.

- 3.00 pm – US Factory Orders (July) – Analysts expect orders to rise 0.1% month-on-month.

Wednesday 6th September

- 3.00 pm – US ISM services PMI (August) – Forecast to fall from 52.7 to 52.4.

- 3.00 pm – Reserve Bank of Canada interest rate decision.

Thursday 7th September

- 4 am – China trade balance (August) – Exports are forecast to fall 10%, an improvement on July’s 14.5% drop.

Indices

S&P 500

The US ISM Purchasing Managers Index (PMI) report, due on Wednesday, is the main report of the week for stock investors and traders. Updates from Australian and Canadian central banks can also be expected to influence stock prices, and the China trade balance report due on Friday will offer an insight into the health of the global economy.

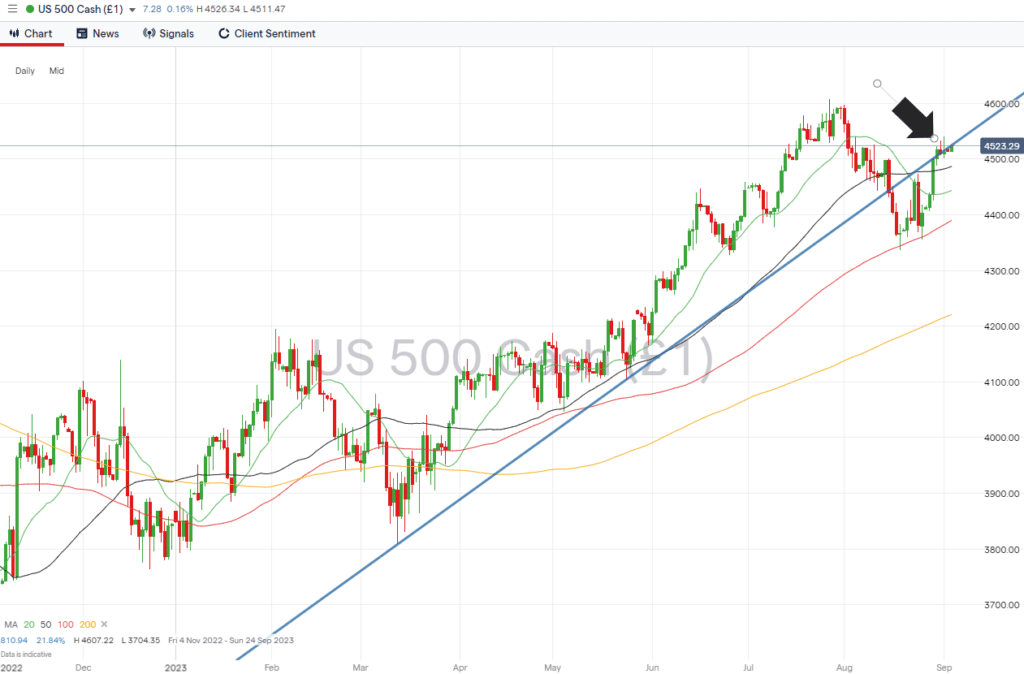

S&P 500 Chart – Daily Price Chart

Source: IG

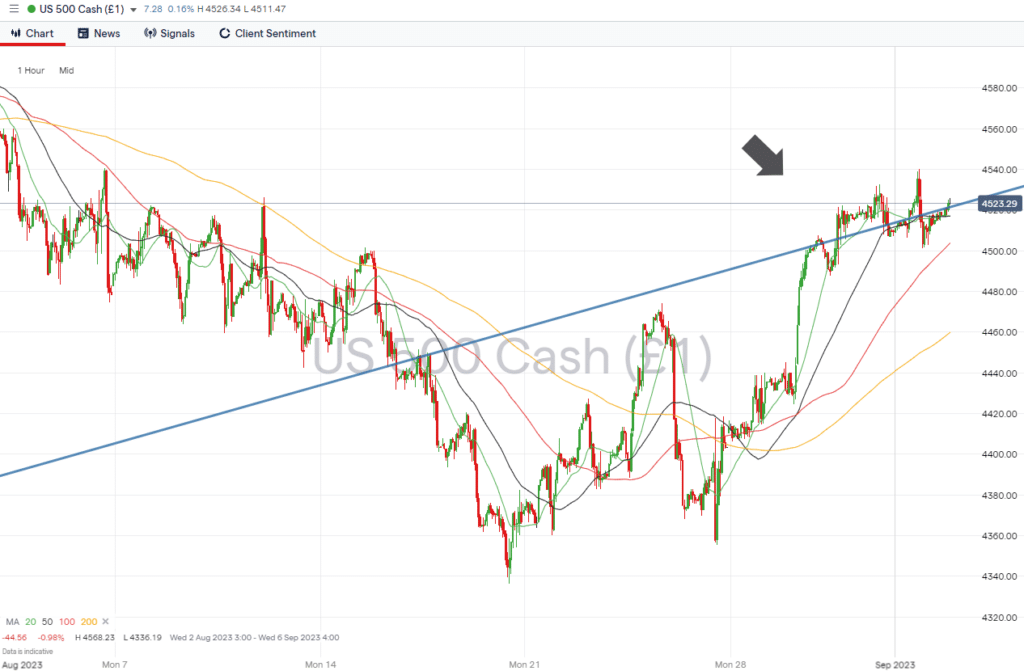

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

Monday 4th September

- US Labor Day holiday, US exchanges closed.

Tuesday 5th September

- 5.30 am – Reserve Bank of Australia interest rate decision.

- 3.00 pm – US Factory Orders (July) – Analysts expect orders to rise 0.1% month-on-month.

Wednesday 6th September

- 3.00 pm – US ISM services PMI (August) – Forecast to fall from 52.7 to 52.4.

- 3.00 pm – Reserve Bank of Canada interest rate decision.

Thursday 7th September

- 4 am – China trade balance (August) – Exports are forecast to fall 10%, an improvement on July’s 14.5% drop.

People Also Read

- The Best and Worst Performing Currency Pairs in August 2023

- WEEKLY FOREX TRADING TIPS – 2023.09.04

- The Week Ahead – 29th August 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk