FOCUS ON: US Jobs Numbers and Debt-Ceiling Negotiations

- The apparent progress on US debt-ceiling talks has calmed market nerves.

- With the deal yet to be ratified, there is room for some noise from the Capitol to influence market prices.

- In an otherwise quiet week regarding economic data releases, the US Non-Farm Payroll jobs number takes centre stage.

Debt-ceiling talks appear to be progressing at a rate which will allow the US government to avoid defaulting. Comments from high-level negotiators suggest enough compromises have been agreed upon to ensure federal payments will continue to be made after 1st June. All that is required is for lower-level government officers to be persuaded to vote for the deal.

There is still room for an upset, though markets appear to be pricing in a resolution, and analysts are instead turning their attention to the US jobs numbers due on Friday. That Non-Farm Payrolls number will offer an insight into the health of the US economy and offer clues as to what approach the US Federal Reserve might take regarding interest rate policy.

Forex

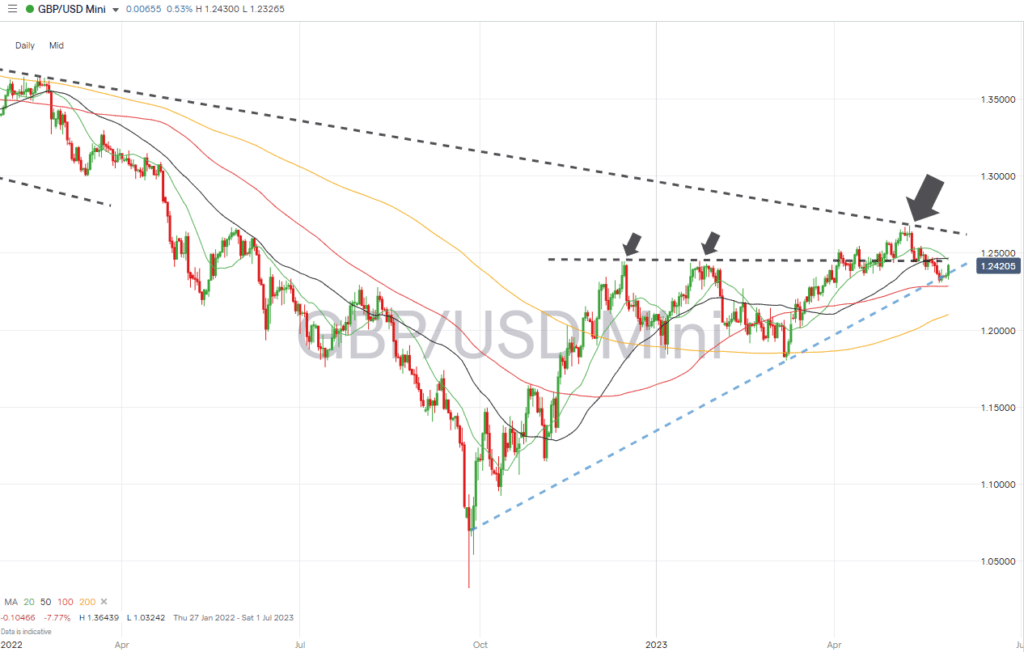

GBPUSD

The national holiday in the UK and the US on Monday set the tone for the coming week. Few GBPUSD influencing data points are due out before the US Non-Farm Payrolls jobs number that will be released at 1:30pm (BST) on Friday.

That key unemployment report released on the first Friday of every month acts as an important milestone for traders who will this month be concerned about the risk of stagflation. A combination of a weakening jobs market and inflation rates remaining high would result in the US Federal Reserve having to balance two equally demanding challenges.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

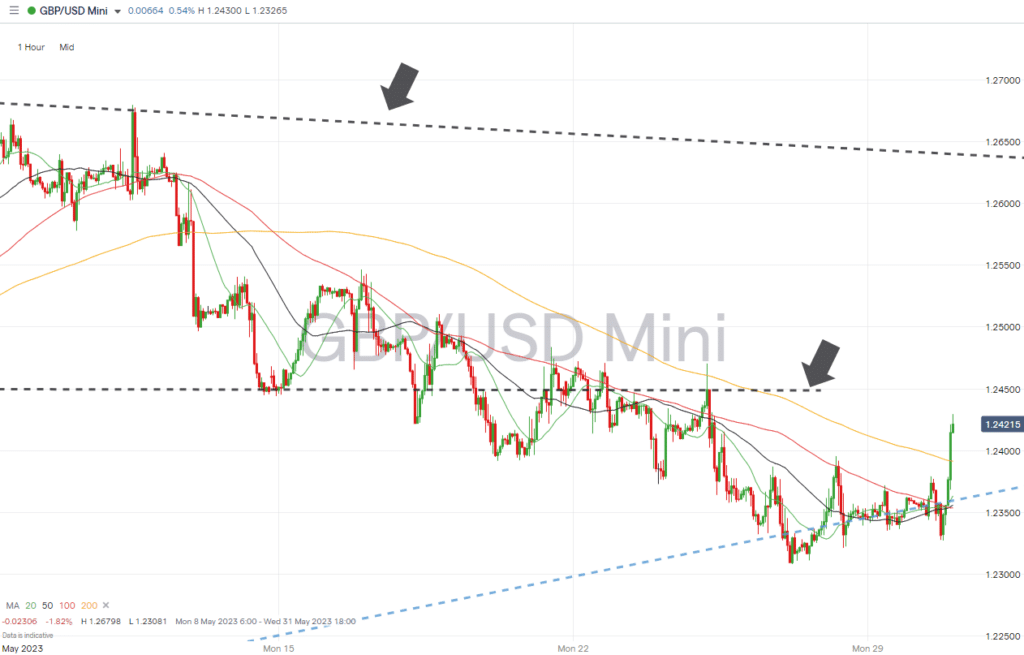

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Friday 2nd June – 1:30pm BST – US Non-Farm Payrolls (May) – analysts forecast payrolls to fall to 180,000 from 253,000 and the unemployment rate to rise from 3.4% to 3.5% with average hourly earnings increasing 4.4% year-on-year and 0.4% month-on-month.

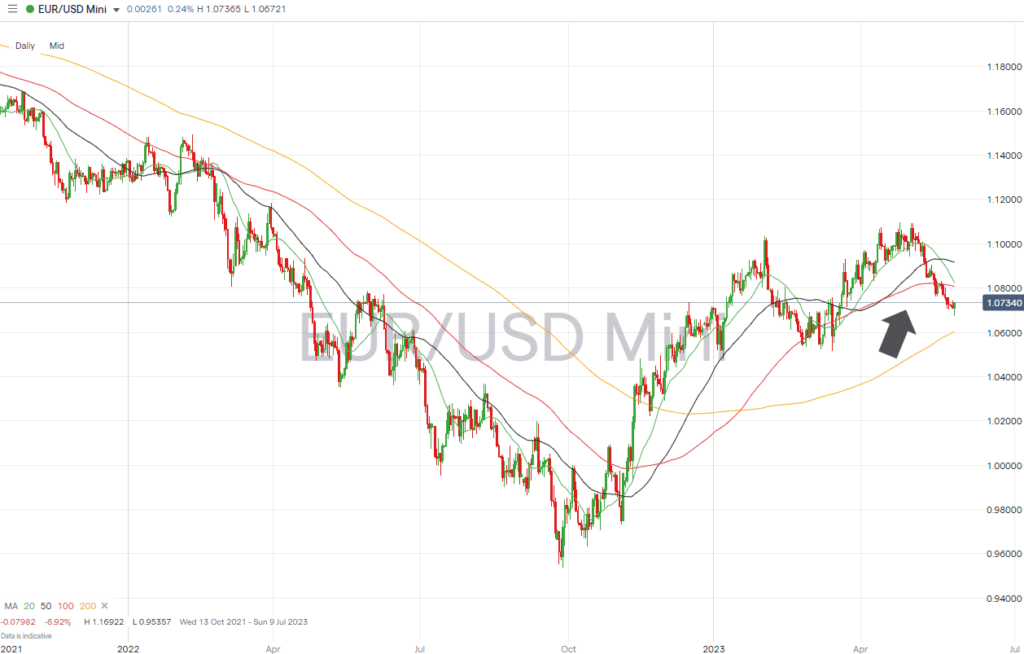

EURUSD

Eurodollar traders will be paying close attention to the US NFP jobs report due on Friday. However, they also have a selection of Eurozone-specific employment, and inflation reports to navigate. Germany’s role as the powerhouse of the Eurozone can’t be understated, so the unemployment and CPI inflation reports due on Wednesday can be expected to trigger moves in EURUSD. The CPI and unemployment reports for the entire Eurozone will be released on Thursday.

EURUSD Chart – Daily Price Chart

Source: IG

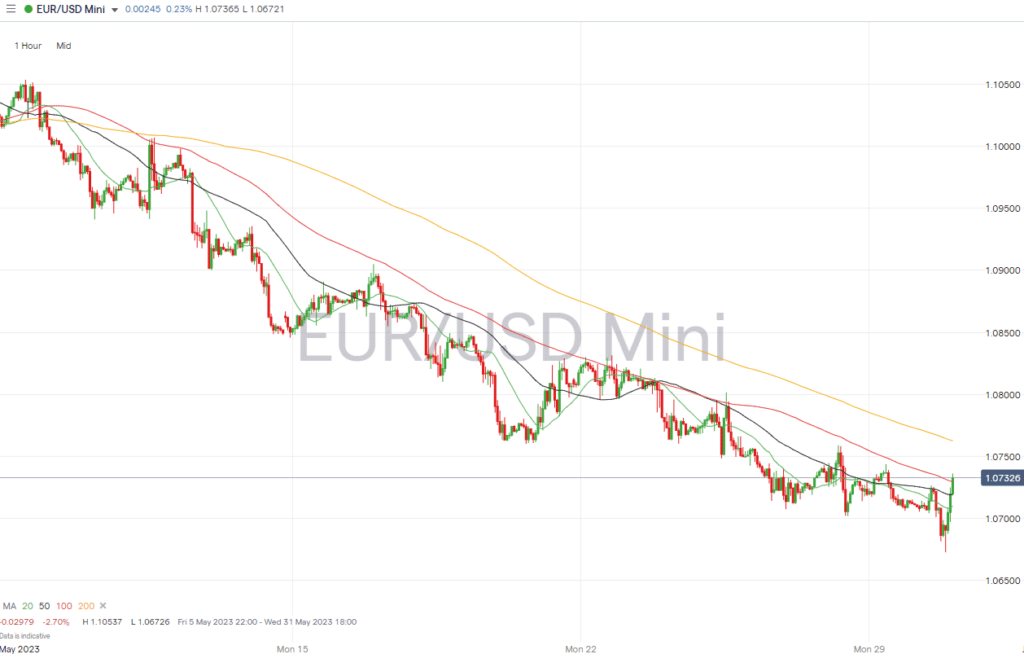

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Wednesday 31st May – 8:55am BST – German Unemployment (May): Unemployment levels forecast to hold at 5.6%.

- Wednesday 31st May – 1:00pm BST – German CPI (May): Analysts forecast consumer prices to rise 0.4% month-on-month and 6.7% year-on-year, from 0.4% and 7.2%, respectively.

- Thursday 1st June – 10:00am BST – Eurozone Inflation (May): Inflation is forecast to slow to 6.5% year-on-year from 7.0% last month.

- Thursday 1st June – 10:00am BST – Eurozone Unemployment (May): Unemployment is expected to remain unchanged at 6.5%.

Indices

S&P 500

The S&P 500 index spent much of last week testing key resistance levels but failed to confirm a breakout to the upside. The coming week sees consumer confidence and unemployment reports being released, which could act as the catalyst needed to trigger a more confident move by investors.

S&P 500 Chart – Daily Price Chart – Ascending Wedge Pattern

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Tuesday 30th May – 3:00pm BST – US Consumer Confidence (May): Analysts forecast the index to weaken to 100 from 101.3.

- Thursday 1st June – 3:00pm BST – US ISM Manufacturing PMI (May flash): Index expected to fall to 47.0 from 47.1.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.05.29

- Surprise German GDP Data Triggers Euro Sell Off

- Is Now the Time to Buy into the Debt-Ceiling Bounce?

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk