FOCUS ON: US Non-Farm Payrolls Employment Report

- Monthly jobs number is the highlight of trading news week.

- Non-Farm Payrolls employment data to shed light on the health of US economy.

- If job numbers hold up the door remains wide open for the Fed to continue its hawkish policy.

The start of a relatively quiet news week is also marked by the 4th of July US holiday. With many traders taking long-weekends the markets can be expected to take some time to get into gear. Friday’s Non-Farm Payrolls report could act as a catalyst for trends to form in asset prices and the release of the minutes of the Fed’s last meeting is another data point to closely watch.

Forex

GBPUSD

The UK economy’s recent red-hot inflation reports point to the Bank of England having to take interest rates higher for longer. That should normally support the price of GBPUSD, but some analysts are pointing to the inflation problem being of such a scale that it makes the UK an undesirable investment opportunity. In a week where there is very little UK-specific news, events in the US can be expected to provide the impetus for moves in cable.

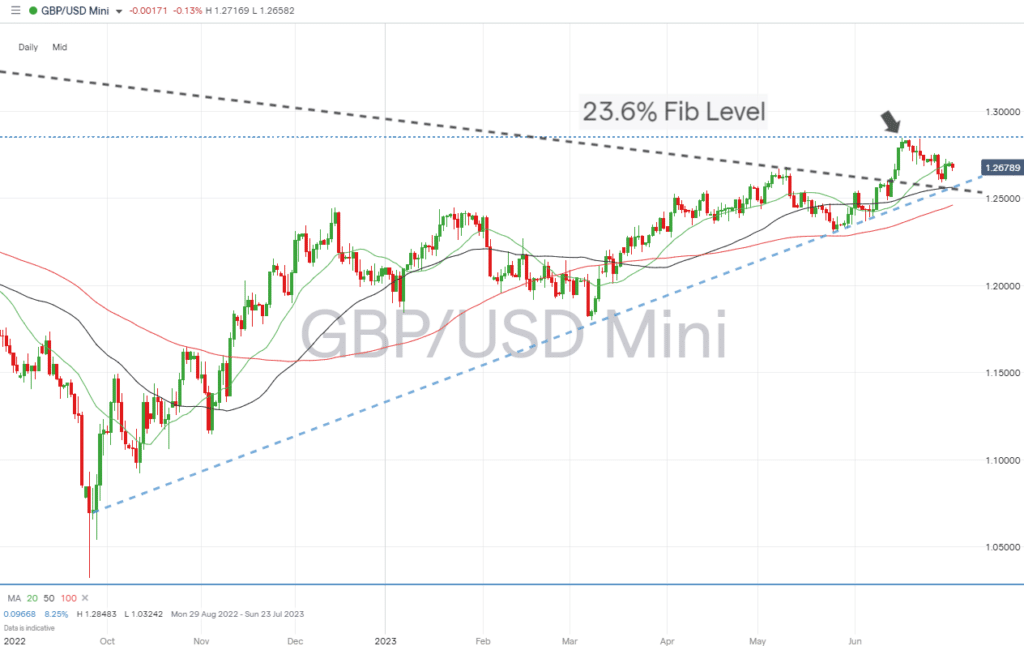

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance

Source: IG

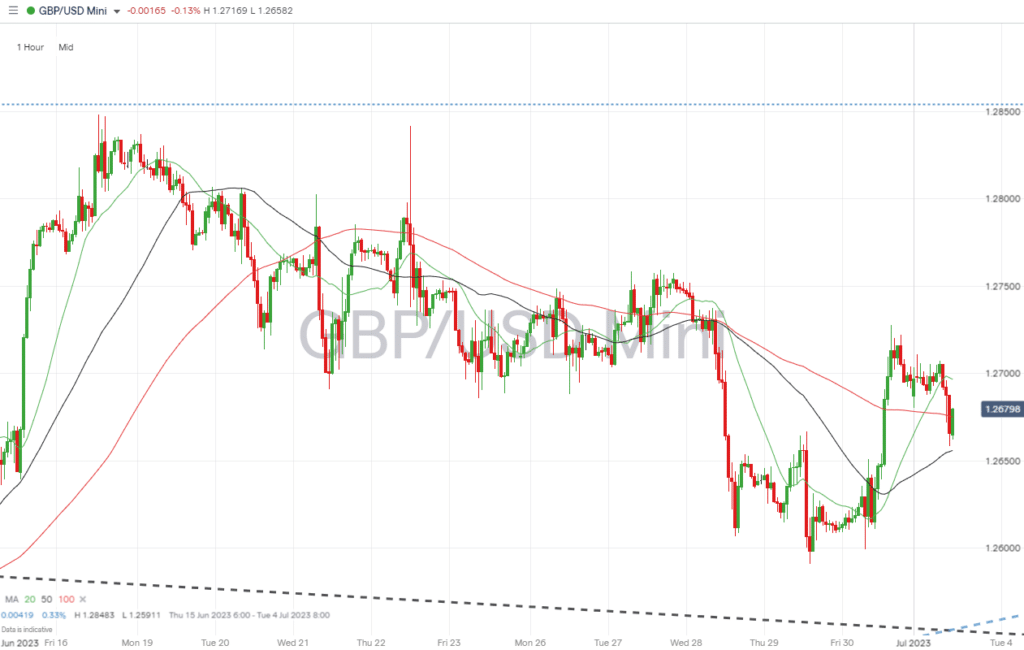

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Tuesday 4th July – US holiday. Exchanges closed.

- Wednesday 5th July – 7.00pm BST – Fed FOMC minutes released. The most recent meeting saw the Fed hold off on a rate hike, but subsequent guidance has suggested that two more hikes would be needed in 2023. These minutes will provide further insight into the factors the Fed is considering when making that decision.

- Friday 7th July – 1.30pm BST – US non-farm payrolls (June). Analysts forecast [-payrolls to rise by 200,000 from 339,000 in May. Unemployment rate forecast to be unchanged at 3.7% and average hourly earnings to rise 0.3% and 4.1%.

EURUSD

Reports released last week relating to Germany and Eurozone sentiment, inflation, and unemployment, failed to prompt a move by EURUSD out of a relatively tight trading range. The end of the coming week sees the US jobs numbers be released which could act as a catalyst for a new trend to form.

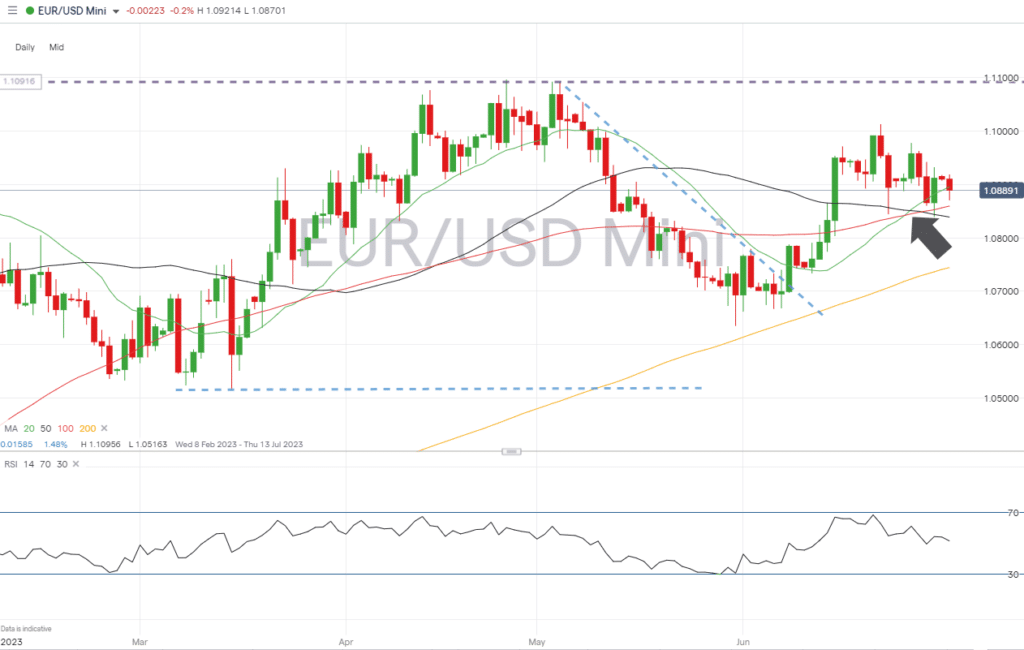

EURUSD Chart – Daily Price Chart

Source: IG

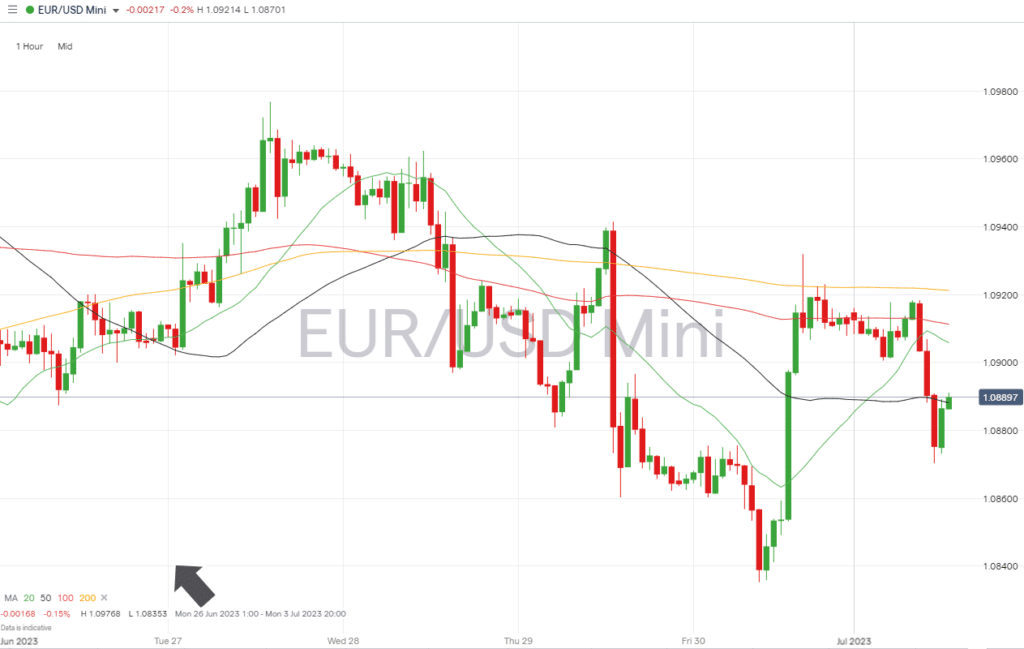

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Tuesday 4th July – US holiday. Exchanges closed.

- Wednesday 5th July – 7.00pm BST – Fed FOMC minutes released. The most recent meeting saw the Fed hold off on a rate hike, but subsequent guidance has suggested that two more hikes would be needed in 2023. These minutes will provide further insight into the factors the Fed is considering when making that decision.

- Friday 7th July – 1.30pm BST – US non-farm payrolls (June). Analysts forecast [-payrolls to rise by 200,000 from 339,000 in May. Unemployment rate forecast to be unchanged at 3.7% and average hourly earnings to rise 0.3% and 4.1%.

Indices

S&P 500

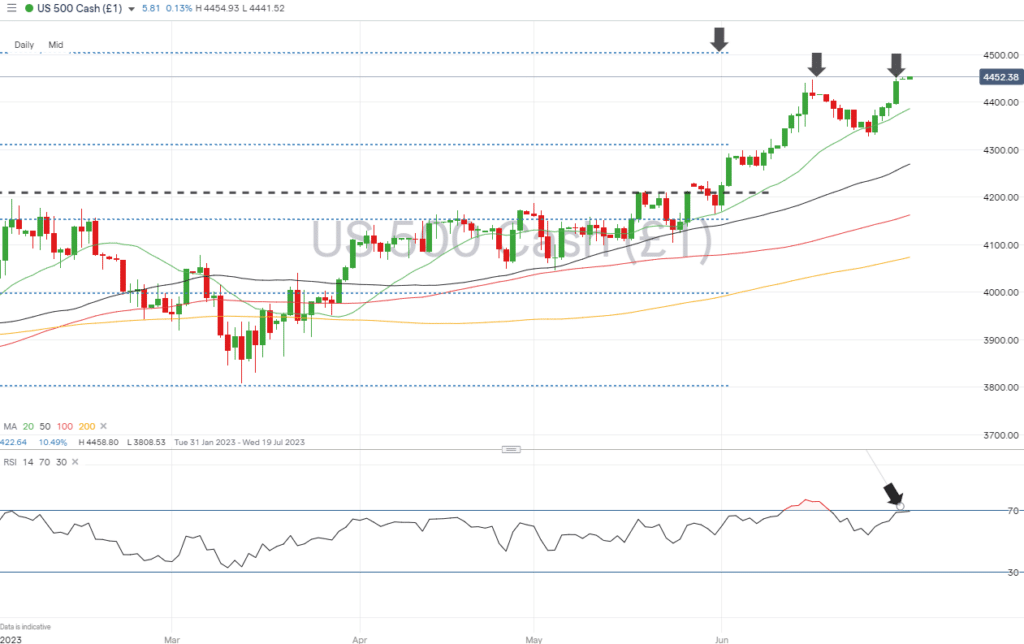

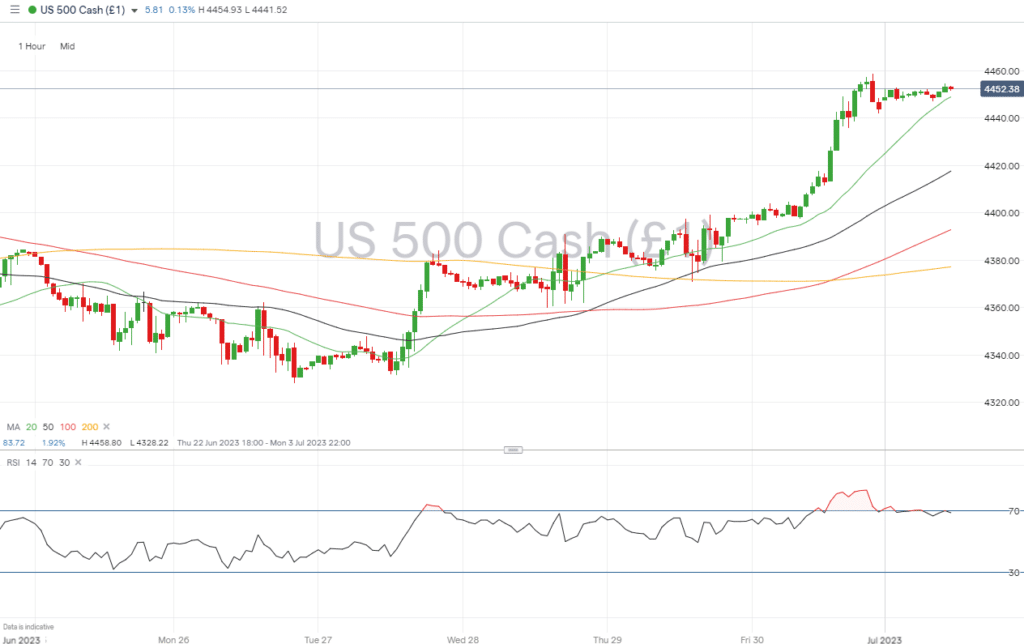

The air is getting thin for US stocks which have found considerable strength since mid-March. A period of price consolidation can’t be ruled out, especially with the US national holiday on Tuesday meaning exchanges there will be closed. But the NFP jobs report on Friday is a much anticipated data point in any month, but possibly more so this time around thanks to comments made by Jerome Powell that if the underlying economy is holding up, then his intention is to raise US interest rates two more times before the end of the year.

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 4th July – US holiday. Exchanges closed.

- Wednesday 5th July – 7.00pm BST – Fed FOMC minutes released. The most recent meeting saw the Fed hold off on a rate hike, but subsequent guidance has suggested that two more hikes would be needed in 2023. These minutes will provide further insight into the factors the Fed is considering when making that decision.

- Thursday 8th July – 3pm BST – US ISM services PMI (June). Analysts forecast the index to fall to 50.

- Friday 7th July – 1.30pm BST – US non-farm payrolls (June). Analysts forecast [-payrolls to rise by 200,000 from 339,000 in May. Unemployment rate forecast to be unchanged at 3.7% and average hourly earnings to rise 0.3% and 4.1%.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.07.03

- Powell Sets Out the Variables Which Will Influence Forex Rates Over the Summer

- BoE Interest Rates: Short-term and Long-term Prospects for GBPUSD

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk