- The US Non-Farm Payroll jobs report due on Friday 7th April will be the week’s main event.

- Before that, other key data points will be updated, including interest rate announcements from central banks.

- The Easter holiday means the trading week will be shortened.

An abundance of economic data reports is due to hit the market in a week shortened by the Easter holiday, with many exchanges closed on Friday. Price volatility can be expected to pick up around the time of the announcements, and pressure from longer-term investors can also be expected to play a part. The rally in stocks, which started in October 2022, is beginning to look more like a new bull market rather than a bear market reversal – and that could lead to FOMO kicking in.

Forex

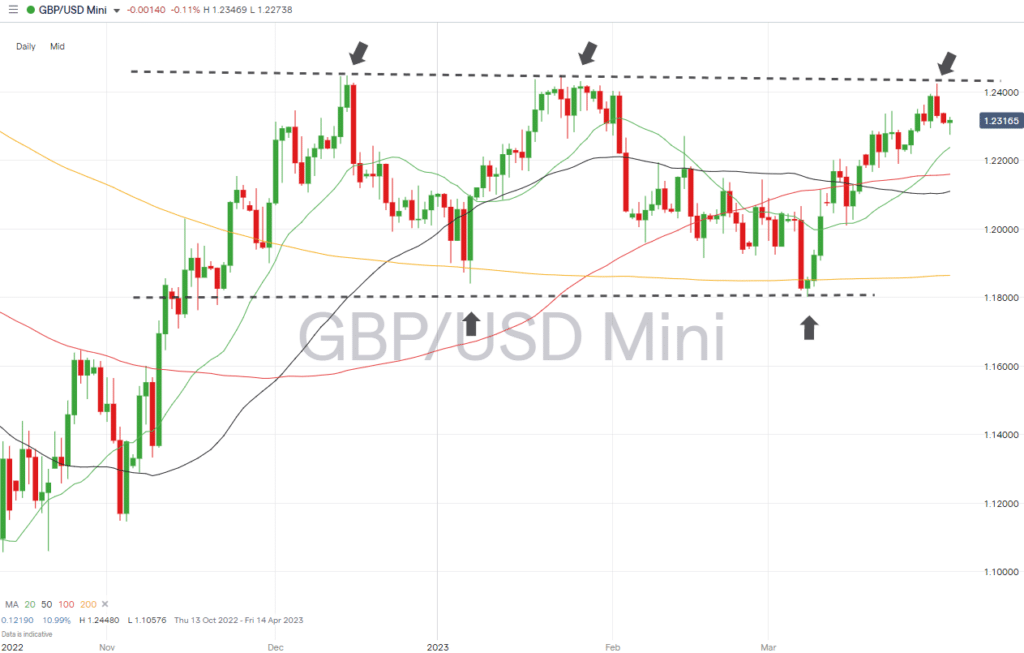

GBPUSD

The lack of UK-specific data releases shouldn’t lull traders in sterling into a false sense of security. The RBA will announce its latest interest rate news on Tuesday, and the RBNZ will follow suit on Wednesday. Both banks are seen as barometers of global interest rate policy, and the US NFP report due on Friday can be expected to impact all markets.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

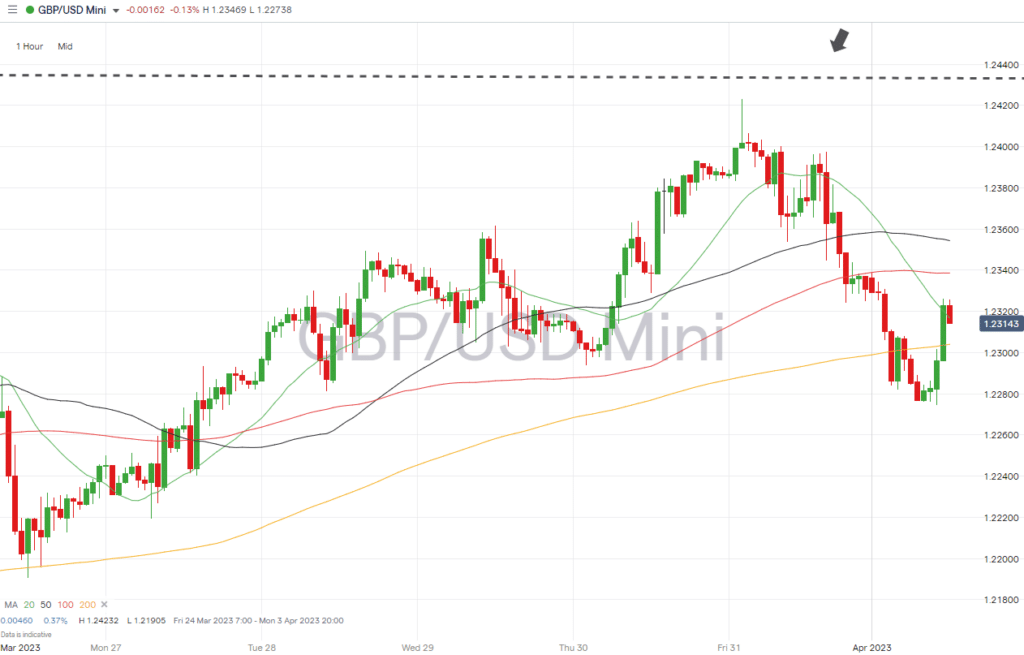

GBPUSD Chart – Hourly Price Chart

Source: IG

UK company reports:

- Tuesday 4th April – Saga full-year earnings.

- Wednesday 5th April – Lookers, Hilton Food, full-year earnings. Imperial Brands, Topps Tiles, trading update.

UK asset influencing economic reports:

- Friday 7th March 1.30 pm GMT – US non-farm payrolls (March): 240,000 jobs expected to have been created, down from 311,000 in February. The unemployment rate is forecast to hold at 3.6%. Average hourly earnings are expected to rise 0.3% month-on-month and 4.5% year-on-year.

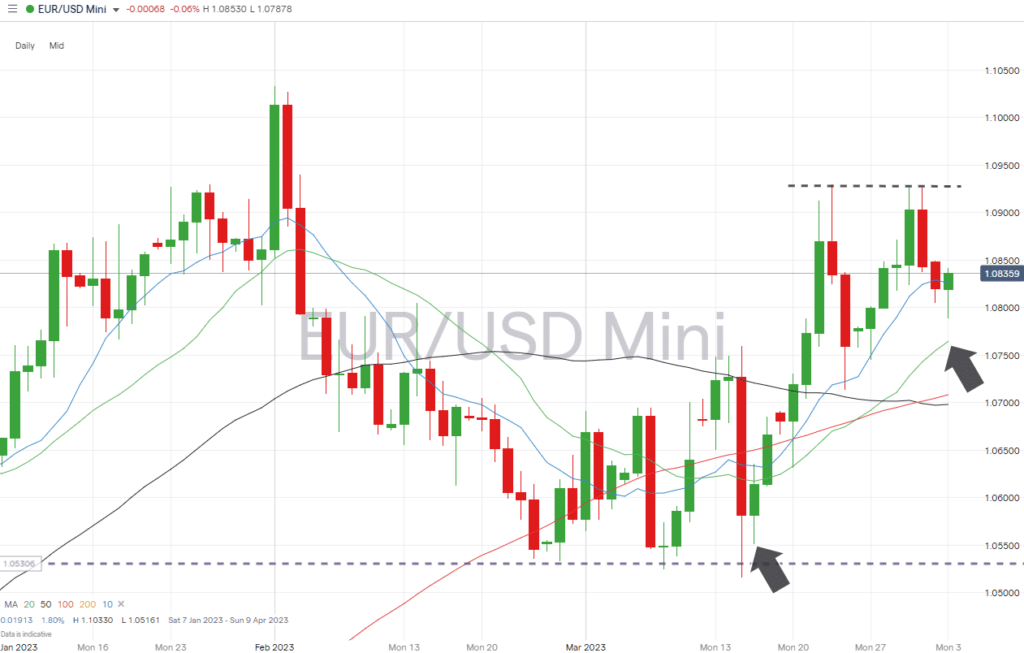

EURUSD

Eurodollar traders will focus this week on the potential impact of the US jobs numbers, which will hit the markets on Friday. Central bank rate decisions from Australia and New Zealand can also be expected to trigger price moves.

EURUSD Chart – Daily Price Chart

Source: IG

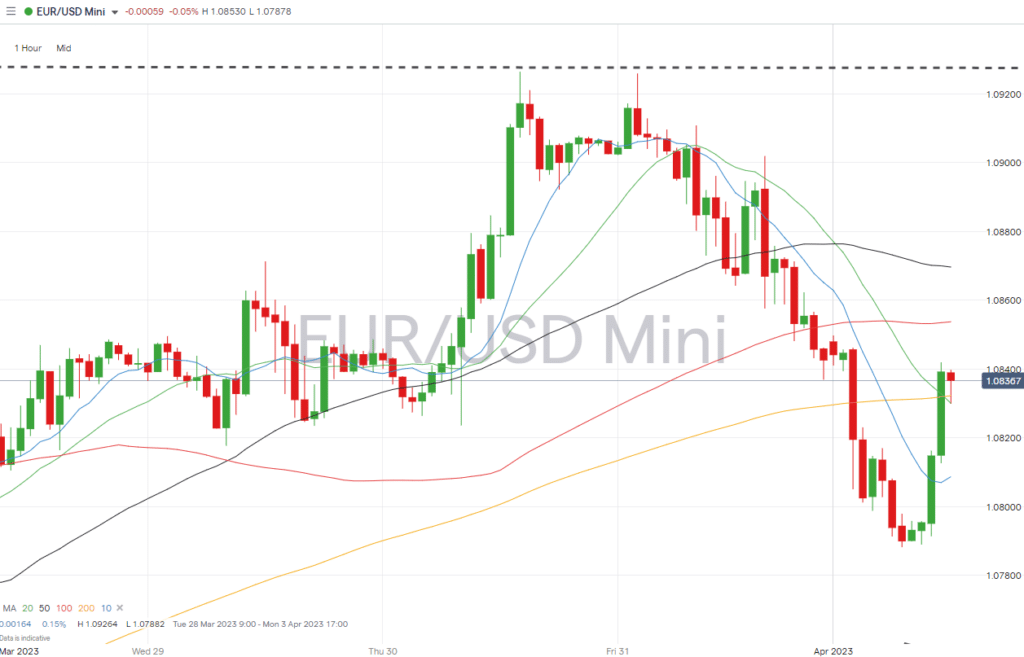

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset influencing economic data:

- Tuesday 4th April – 5.30 am (GMT) – RBA interest rate decision, analysts expect rates to hold at 3.6%.

- Friday 7th March 1.30 pm GMT – US non-farm payrolls (March): 240,000 jobs expected to have been created, down from 311,000 in February. The unemployment rate is forecast to hold at 3.6%. Average hourly earnings are expected to rise 0.3% month-on-month and 4.5% year-on-year.

Indices

S&P 500

Manufacturing and Service PMIs reports are released earlier in the week. However, the data point stock traders will most eagerly anticipate is the Non-Farm Payroll jobs number due out on Friday.

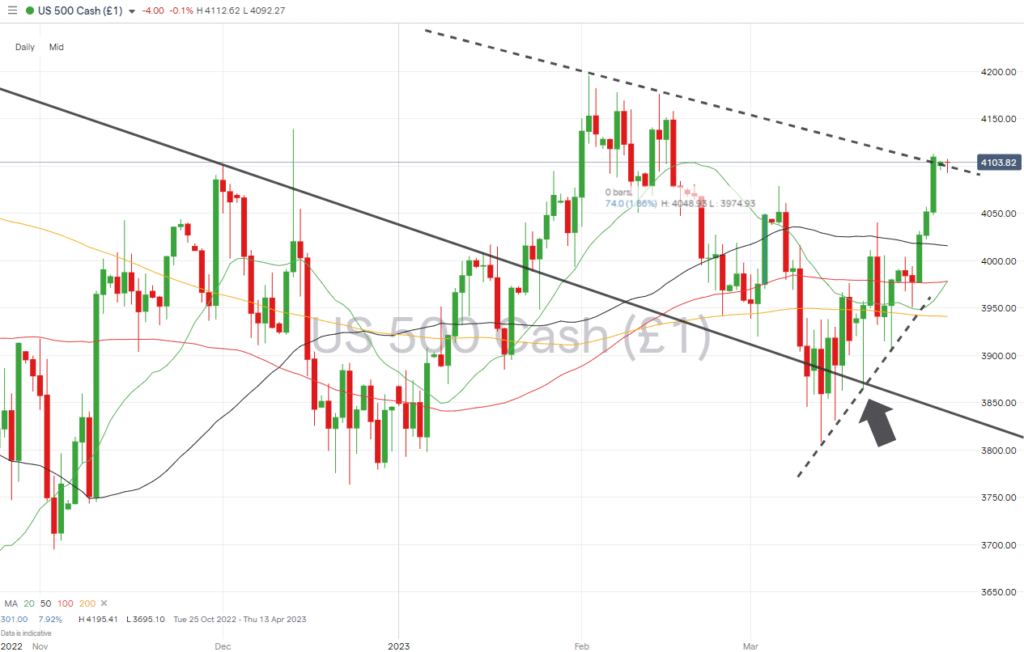

S&P 500 Chart – Daily Price Chart – Trendline Support

Source: IG

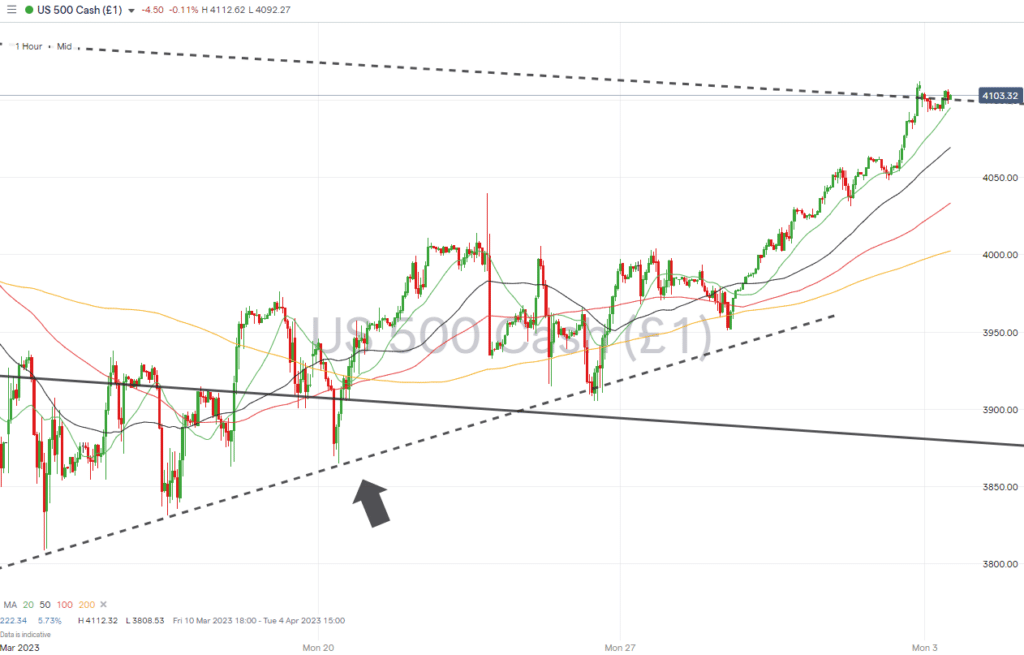

S&P 500 – Hourly Price Chart – Trendline Support

Source: IG

US economic data:

- Monday 3rd April – 3 pm GMT – US ISM Manufacturing PMI (March): Analysts expect the index to fall to 47.7.

- Wednesday 5th April – 3 pm GMT – US ISM Non-Manufacturing PMI (March): Analysts expect the index to fall to 54.6.

- Friday 7th March 1.30 pm GMT – US non-farm payrolls (March): 240,000 jobs expected to have been created, down from 311,000 in February. The unemployment rate is forecast to hold at 3.6%. Average hourly earnings are expected to rise 0.3% month-on-month and 4.5% year-on-year.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.04.03

- Forex Market Forecast for April 2023

- How to trade EURUSD bullish momentum triggered by banking ‘reforms’

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk