FOCUS ON: Traders Prepare for Collection of Big News Announcements

- Investors and traders prepare for batch of important news announcements

- Key US Non-Farm Payroll jobs data due on Friday

- Inflation, GDP, and sentiment reports are released throughout the week

Investors and traders face a busy week in terms of news announcements. The US Non-Farm Payroll report due on Friday can potentially influence all asset groups. Crucial inflation and sentiment reports will also be released throughout the week.

Forex

GBPUSD

GBPUSD currency traders will see little in the way of UK-focussed data, but reports from the US and Eurozone can be expected to influence the price of sterling-based currency pairs.

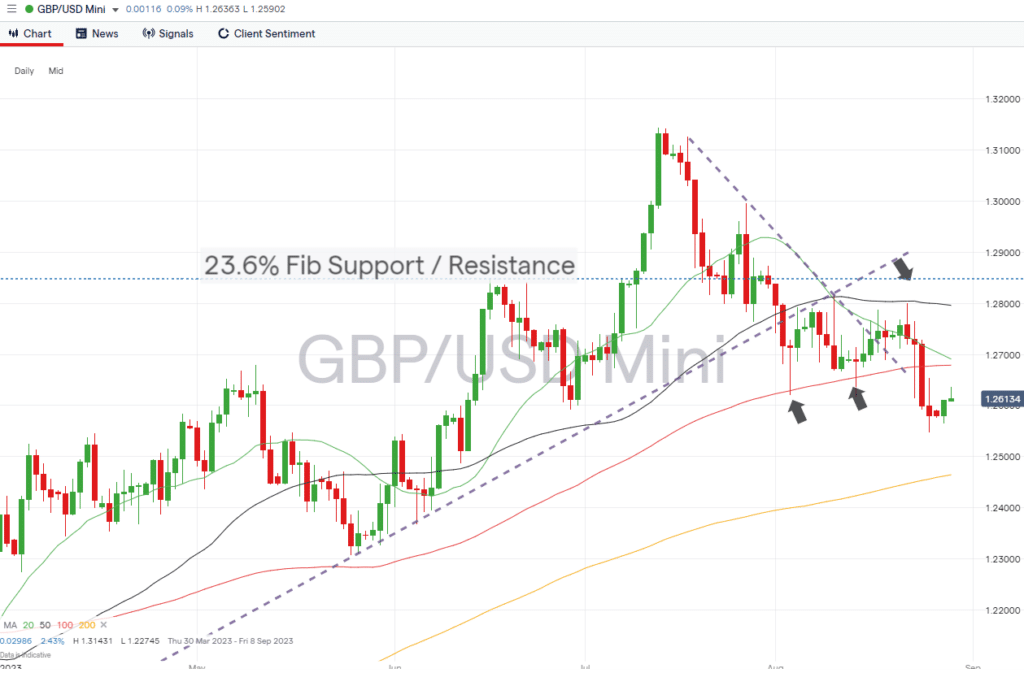

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

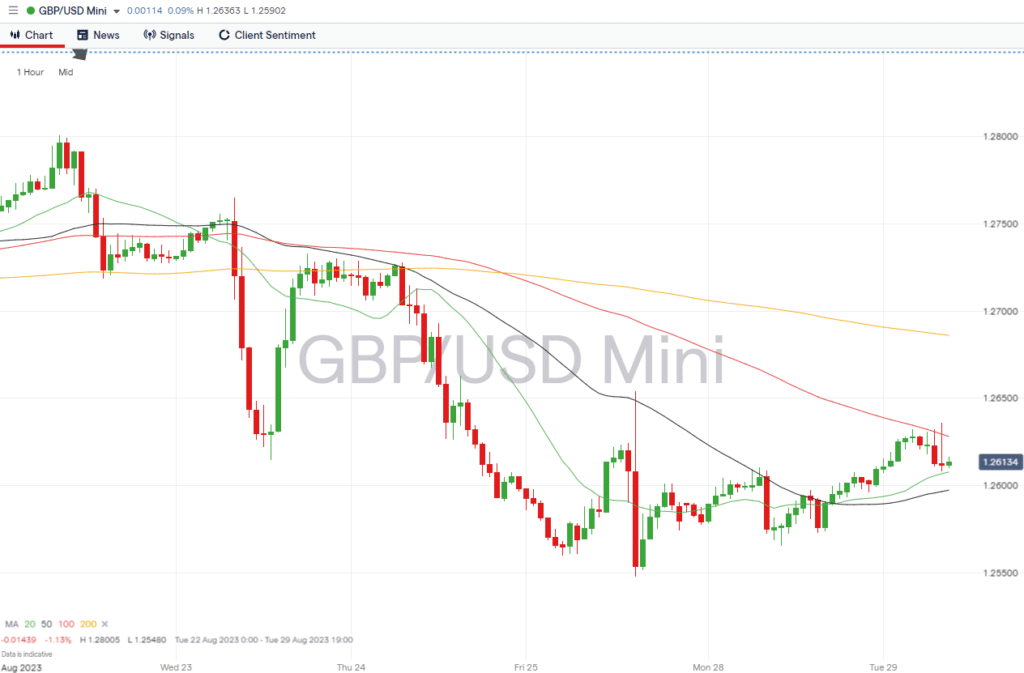

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs, all times BST:

Tuesday 29th August

- 7:00am – German GfK consumer confidence (September). Index expected to rise to -22 month-on-month from -24.4.

- 3:00pm – US consumer confidence (August). Forecast to fall to 115 from 117 on a month-on-month basis.

Wednesday 30th August

- 1:00pm – German consumer price index (CPI) (August, preliminary). Prices are expected to rise 6% year-on-year and 0.2% month-on-month.

- 1:30pm – US GDP (Quarter 2 (Q2), 2nd estimate). US growth is expected to be an annualised 2.4% increase on a quarter-on-quarter basis, upgraded from 2% in the preliminary estimate.

Thursday 31st August

- 8:55am – German unemployment rate (August). Analysts expect the German annual unemployment rate to rise to 5.7% from 5.6% last month.

- 10:00am – Eurozone inflation (August, flash). Prices forecast to have risen 4.9% year-on-year and 0.2% month-on-month.

- 1:30pm – US PCE price index (July). Analysts predict US price inflation to rise to 3.2% year-on-year and to remain unchanged at 0.2% month-on-month.

Friday 1st September

- 1:30pm – US non-farm payrolls (August). US payrolls predicted to fall to 180,000 from 187,000 last month; unemployment rate to stay unchanged at 3.5%.

- 3:00pm – US ISM manufacturing PMI (August). Manufacturing PMI index forecast to rise to 46.6 from 46.4.

EURUSD

The coming week is a busy one in terms of Eurozone and German economic data, with the Eurozone inflation report due on Thursday being just one example of the factors that could influence the value of euro currency pairs. Important news out of the US can also be expected to influence the price of EURUSD.

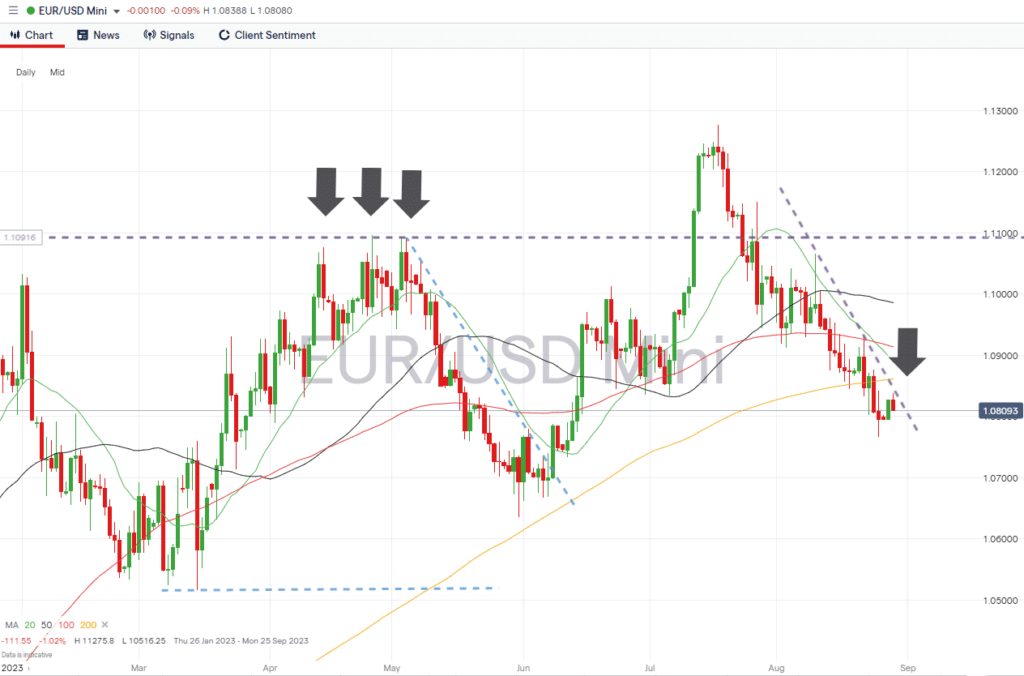

EURUSD Chart – Daily Price Chart

Source: IG

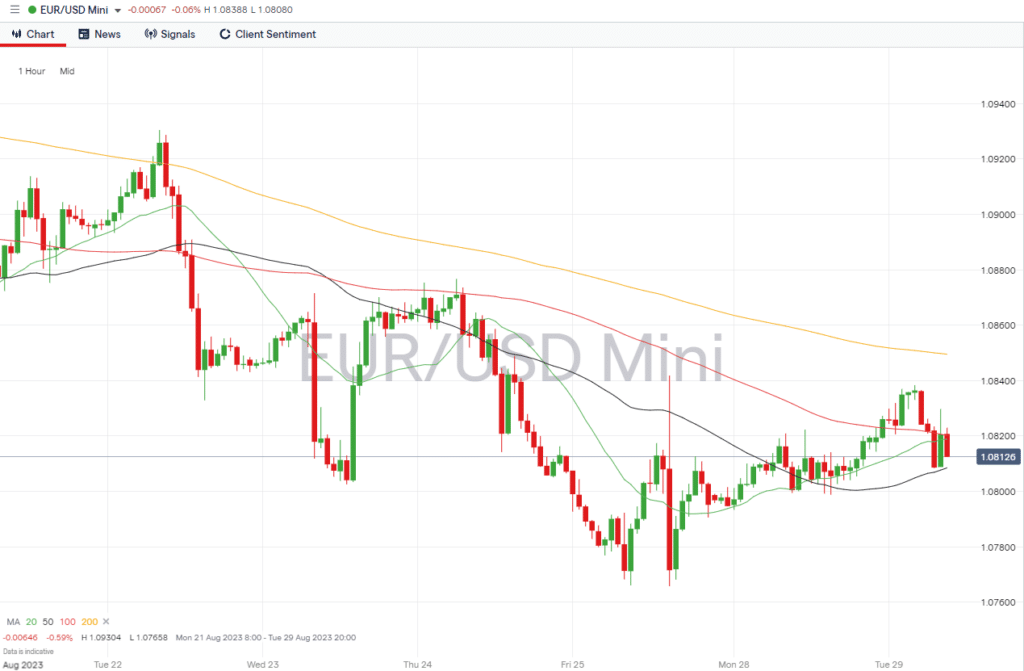

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

Tuesday 29th August

- 7:00am – German GfK consumer confidence (September). Index expected to rise to -22 month-on-month from -24.4.

- 3:00pm – US consumer confidence (August). Forecast to fall to 115 from 117 on a month-on-month basis.

Wednesday 30th August

- 1:00pm – German consumer price index (CPI) (August, preliminary). Prices expected to rise 6% year-on-year and 0.2% month-on-month.

- 1:30 pm – US GDP (Quarter 2 (Q2), 2nd estimate). US growth expected to be an annualised 2.4% increase on a quarter-on-quarter basis, upgraded from 2% in the preliminary estimate.

Thursday 31st August

- 7:00am – German retail sales (July). Forecast to rise to -0.3% from -0.8% on a month-on-month basis.

- 8:55am – German unemployment rate (August). Analysts expect the German annual unemployment rate to rise to 5.7% from 5.6% last month.

- 10:00am – Eurozone inflation (August, flash). Prices forecast to have risen 4.9% year-on-year and 0.2% month-on-month.

- 1:30pm – US PCE price index (July). Analysts predict US price inflation to rise to 3.2% year-on-year and to remain unchanged at 0.2% month-on-month.

Friday 1st September

- 1:30pm – US non-farm payrolls (August). US payrolls predicted to fall to 180,000 from 187,000 last month; unemployment rate to stay unchanged at 3.5%.

- 3:00pm – US ISM manufacturing PMI (August). Manufacturing PMI index forecast to rise to 46.6 from 46.4.

Indices

S&P 500

Earnings season may be almost over, but core economic data reports due out of the US can be expected to trigger price moves in stocks. The keynote report is the US Non-Farm Payrolls jobs number on Friday, but other reports are also likely to give an insight into the health of the US economy.

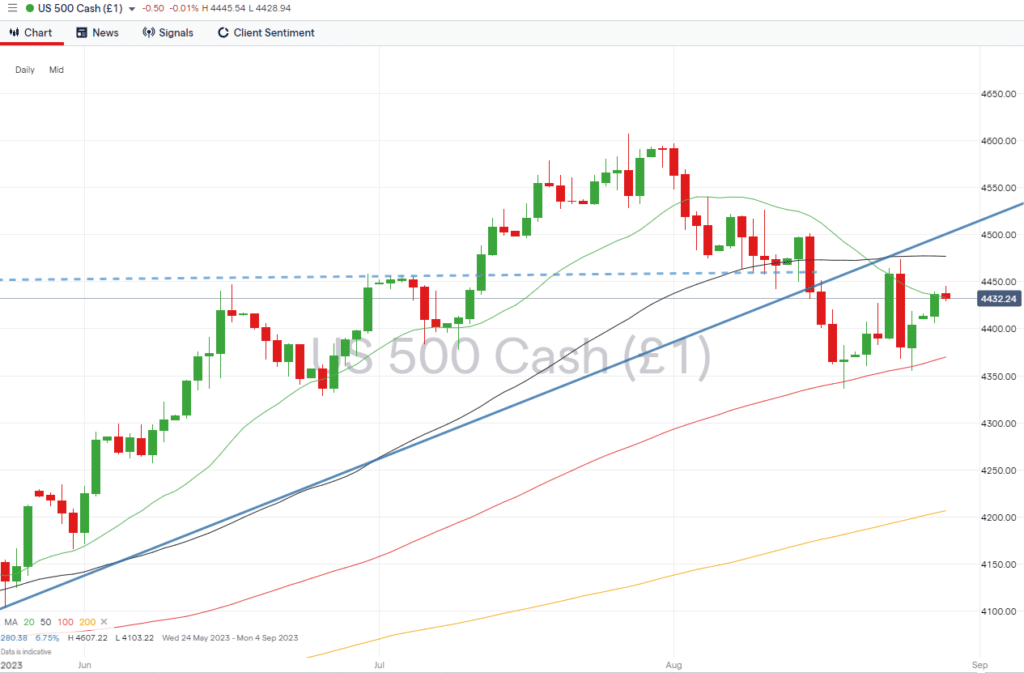

S&P 500 Chart – Daily Price Chart – 100 SMA

Source: IG

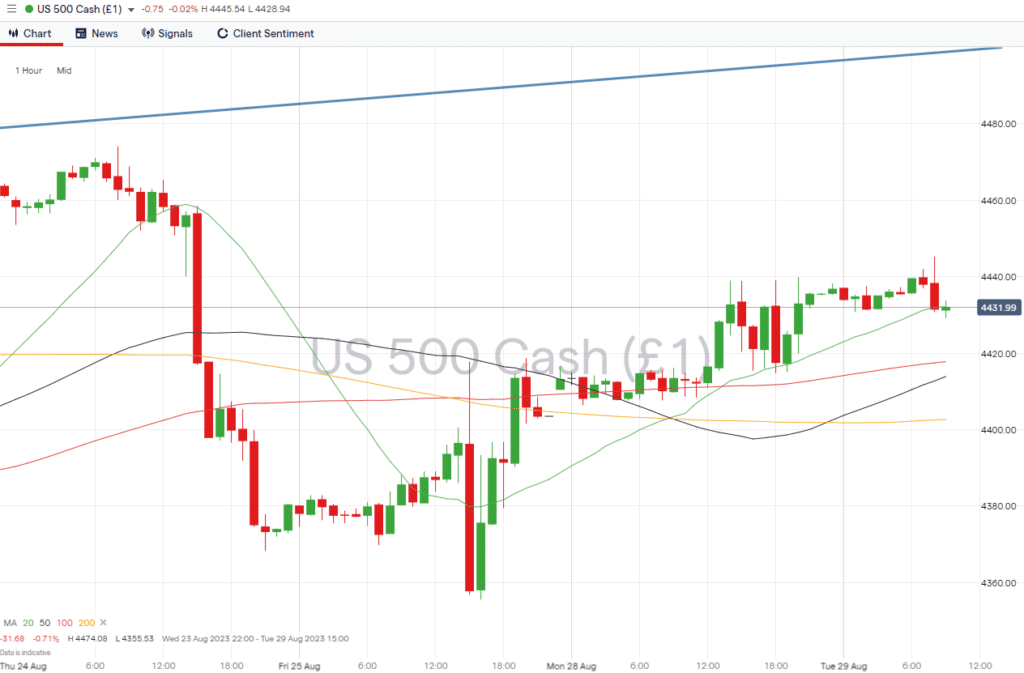

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

Tuesday 29th August

- 3:00pm – US consumer confidence (August). Forecast to fall to 115 from 117 on a month-on-month basis.

Wednesday 30th August

- 1:30pm – US GDP (Quarter 2 (Q2), 2nd estimate). US growth expected to be an annualised 2.4% increase on a quarter-on-quarter basis, upgraded from 2% in the preliminary estimate.

Thursday 31st August

- 8:55am – German unemployment rate (August). Analysts expect the German annual unemployment rate to rise to 5.7% from 5.6% last month.

- 10:00am – Eurozone inflation (August, flash). Prices forecast to have risen 4.9% year-on-year and 0.2% month-on-month.

- 1:30pm – US PCE price index (July). Analysts predict US price inflation to rise to 3.2% year-on-year and to remain unchanged at 0.2% month-on-month.

Friday 1st September

- 1:30pm – US non-farm payrolls (August). US payrolls predicted to fall to 180,000 from 187,000 last month; unemployment rate to stay unchanged at 3.5%.

- 3:00pm – US ISM manufacturing PMI (August). Manufacturing PMI index forecast to rise to 46.6 from 46.4.

Companies releasing earnings reports this week:

- Tuesday 29th August – HP

- Wednesday 30th August – Salesforce

- Thursday 31st August – Broadcom, Dell, Campbell Soup

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.08.29

- The Week Ahead – 21st August 2023

- The Best and Worst Performing Currency Pairs in July 2023

- Forex Market Forecast for August 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk