FOCUS ON: Investors Scour Data Releases for Hints on Future Interest Rate Moves.

- Eurozone economies to release a batch of economic reports.

- Investors review jobs and consumer data for clues on the next interest rate move.

- Price consolidation could continue to be the dominant theme.

The minutes of the last meeting of the US Federal Reserve FOMC were released at 7pm GMT on Wednesday 22nd February. They point to US interest rate policy remaining ‘hawkish’, and without major updates from central banks investors will be studying this week’s economic data reports for clues on how long inflation will remain the priority.

Forex

GBPUSD

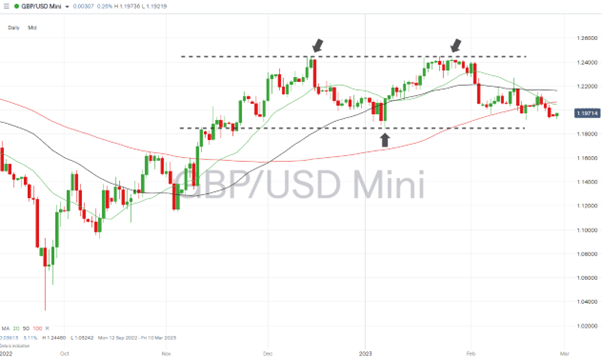

There are few data reports relating to the UK economy due to be released this week. With the Bank of England’s next update on interest rates not due until 23rd March that opens the door to continued sideways movement in GBP forex pairs.

After testing the psychologically important 8,000 price level the FTSE 100 has fallen back to 7,944. With UK companies such as Ocado releasing earnings updates this week there is potential for further volatility in UK stocks.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

UK earnings updates:

- Tuesday 28th February: Ocado, abrdn, St James’s Place, Travis Perkins.

- Wednesday 1st March: Weir, Persimmon, Reckitt Benckiser.

- Thursday 2nd March: Metro Bank, LSE, Taylor Wimpey.

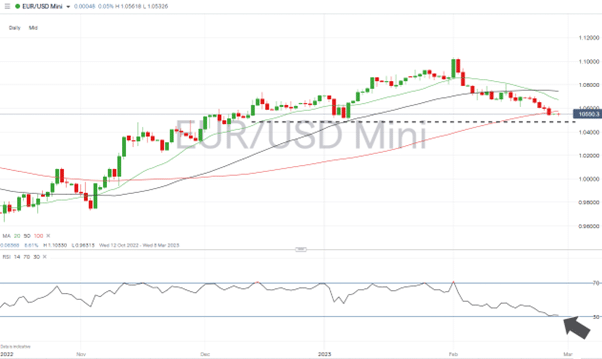

EURUSD

Traders of euro currency pairs should prepare for a busy week. Inflation, jobs, and consumer sentiment reports are due out from the major economies of the eurozone which could result in a test of key price resistance/support levels.

Tuesday 28th February, all times GMT:

- 7.45am – France PMIs (February, flash): Analysts forecast prices to rise 5.7% year-on-year, down from 6% in January.

Wednesday 1st March:

- 8.55am – German unemployment data (February): unemployment rate forecast to rise to 5.6%.

- 1pm – German inflation (February, preliminary): Analyst forecast prices to rise 8.4% from 8.7% year-on-year.

Thursday 2nd March:

- 10am – eurozone CPI (February): prices to rise 8.1% YoY and 0.5% MoM.

EURUSD Chart – Daily Price Chart –SMA Break

Source: IG

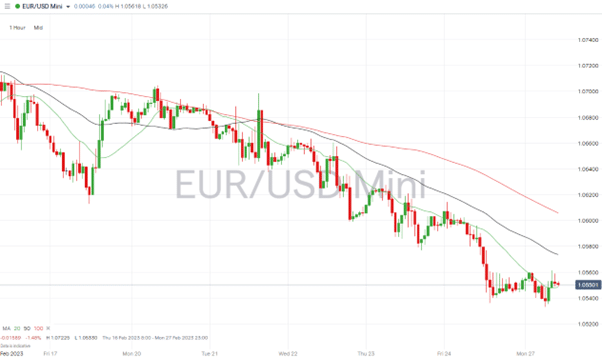

EURUSD Chart – Hourly Price Chart

Source: IG

Indices

S&P 500

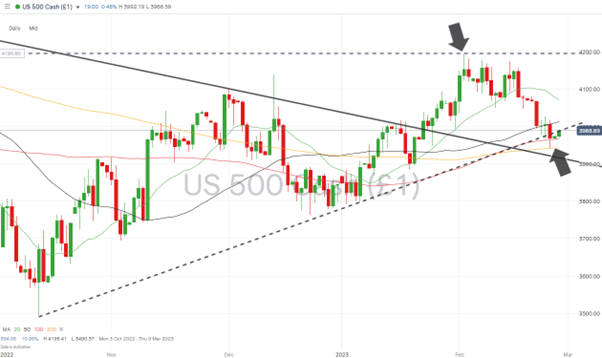

The Fed minutes dominated the news channels after being released last Wednesday, but this week’s data releases will allow investors to appraise how higher interest rates are impacting the broader economy.

S&P 500 Chart – Daily Price Chart –SMA Support

Source: IG

S&P 500 – Hourly Price Chart – Long-term Trendline Support

Source: IG

Monday 27th February, all times GMT:

- 1.30pm – US durable goods orders (January): Analysts forecast orders to fall 2.1% month-on-month.

- 3pm – US pending home sales (January): Analysts forecast sales to fall 1.3% month-on-month.

Tuesday 1st March:

- 2.45pm – US Chicago PMI (February): Analysts forecast index to rise to 46.

- 3pm – US consumer confidence (February): Analysts forecast index to rise to 109.5 from 107.1.

Wednesday 2nd March:

3pm – US ISM Manufacturing PMI (February): Analysts forecast index to rise to 47.8.

People Also Read:

- EURUSD Approaches Key Support Level as Fed Minutes Match Market Expectations

- WEEKLY FOREX TRADING TIPS – 2023.02.27

- Disconnect Between Forex and Stock Markets Points Towards Increased Volatility

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk