FOCUS ON: Eurozone inflation report prepares to offer a signal to the markets.

- Reports this week focus on the underlying condition of the global economy

- A variety of data releases could trigger moves in euro currency pairs

- Stock traders will keenly watch US PCE inflation report due on Friday

After the excitement of last week’s interest rate announcements, data releases this week offer an insight into the health of the underlying economy. Attention will be directed at consumer sentiment reports and the Eurozone CPI inflation number due out on Friday.

Forex

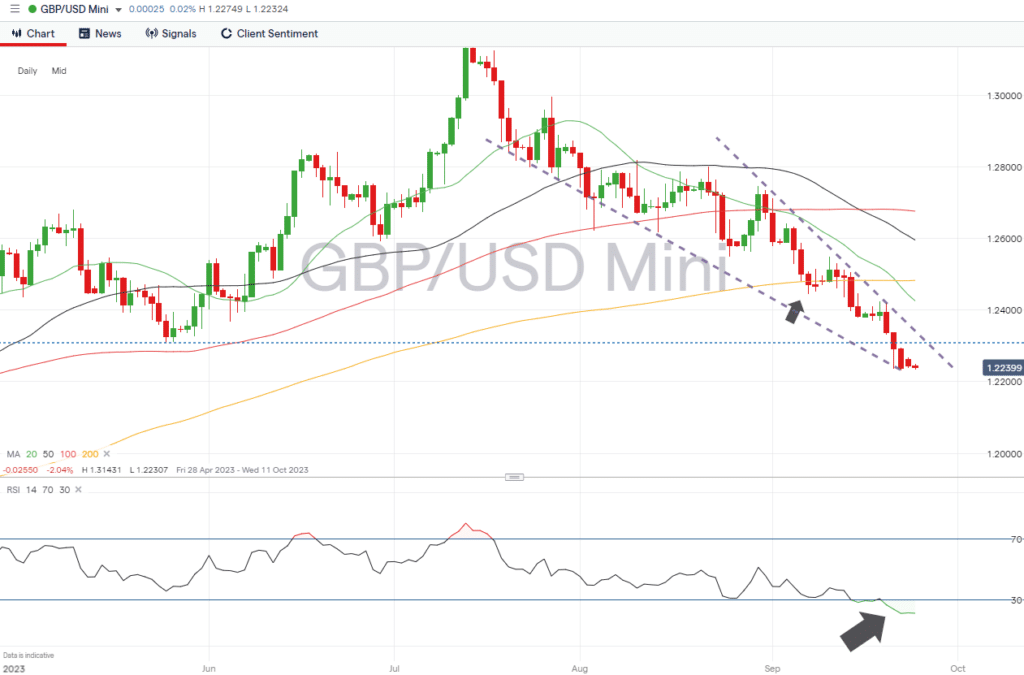

GBPUSD

The Bank of England’s decision to hold rather than increase interest rates did little to support GBPUSD. With little UK-specific news due to be released, traders of GBP-based currency pairs will study reports from the Eurozone and the US.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs, all times BST:

Monday 25th September

- 9:00 am – German IFO index (September). Analysts forecast index to all to 84.3.

Wednesday 27th September

- 7:00 am – German Gfk Consumer confidence (October). Analysts forecast index to rise to -24.8.

Thursday 28th September

- 1:00 pm – German CPI inflation report (September). Price rises expected to be 5.9% year-on-year and 0.6% month-on-month.

Friday 29th September

- 7:45 am – French CPI inflation report (September). Price rises expected to be 4.8% year-on-year and 0.7% month-on-month.

- 8:55 am – German unemployment data (September). Unemployment rate forecast to be unchanged at 5.7%.

- 10:00 am – Eurozone inflation data (September). Analysts forecast price rises of 5.5% year-on-year and 0.5% month-on-month.

- 1:30 pm – US PCE price index (August). Analysts forecast that the Fed’s preferred measure of inflation will show price rises of 3.5% year-on-year and 0.4% month-on-month.

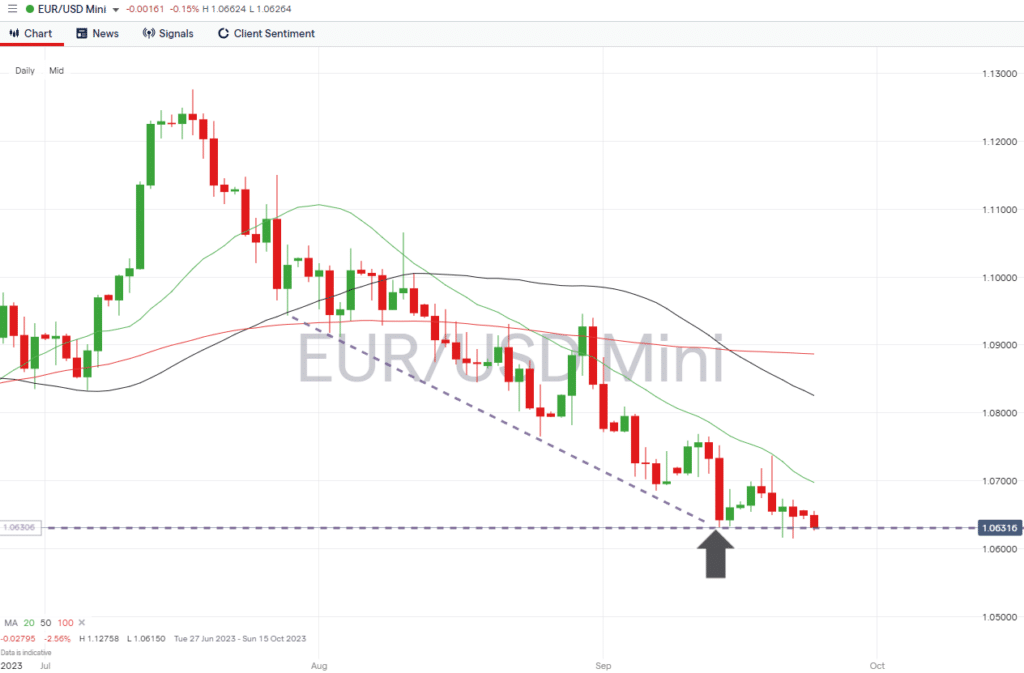

EURUSD

Traders of euro-denominated currency pairs have a wide variety of data points to monitor this week. Most attention will be focused on Friday when the Eurozone and French inflation reports are released, but German consumer confidence (Wednesday) and inflation (Thursday) reports could also trigger price moves.

EURUSD Chart – Daily Price Chart

Source: IG

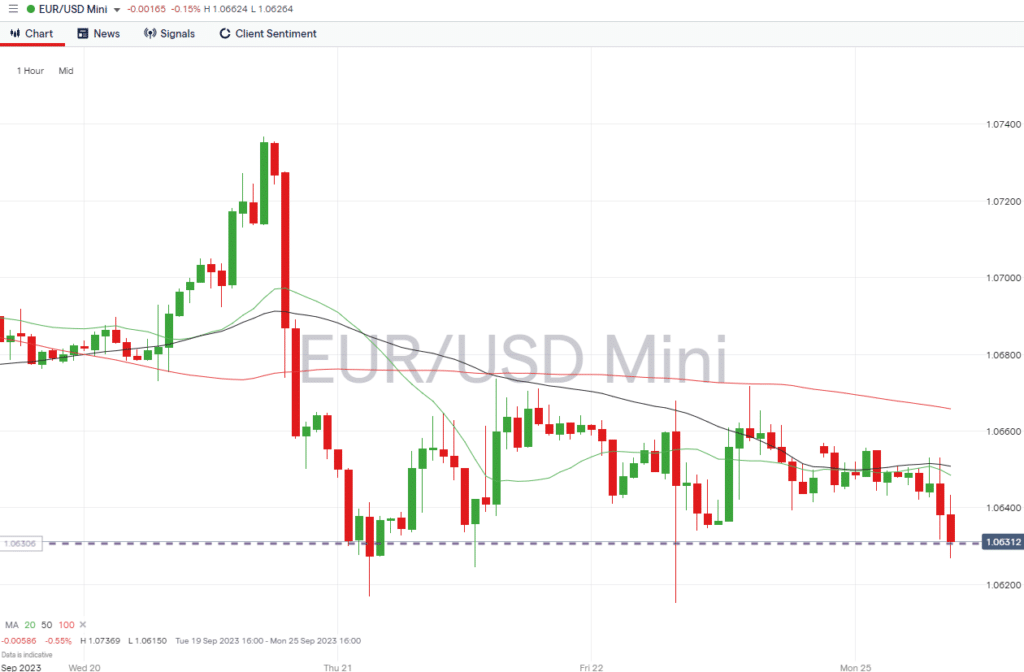

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

Wednesday 27th September

- 7:00 am – German Gfk Consumer confidence (October). Analysts forecast index to rise to -24.8.

Thursday 28th September

- 1:00 pm – German CPI inflation report (September). Price rises expected to be 5.9% year-on-year and 0.6% month-on-month.

Friday 29th September

- 7:45 am – French CPI inflation report (September). Price rises expected to be 4.8% year-on-year and 0.7% month-on-month.

- 8:55 am – German unemployment data (September). Unemployment rate forecast to be unchanged at 5.7%.

- 10:00 am – Eurozone inflation data (September). Analysts forecast price rises of 5.5% year-on-year and 0.5% month-on-month.

- 1:30 pm – US PCE price index (August). Analysts forecast that the Fed’s preferred measure of inflation will show price rises of 3.5% year-on-year and 0.4% month-on-month.

- 2:45 pm – US PMI index report. Manufacturing index expected to rise to 48.8 and Services to fall to 49.0.

Indices

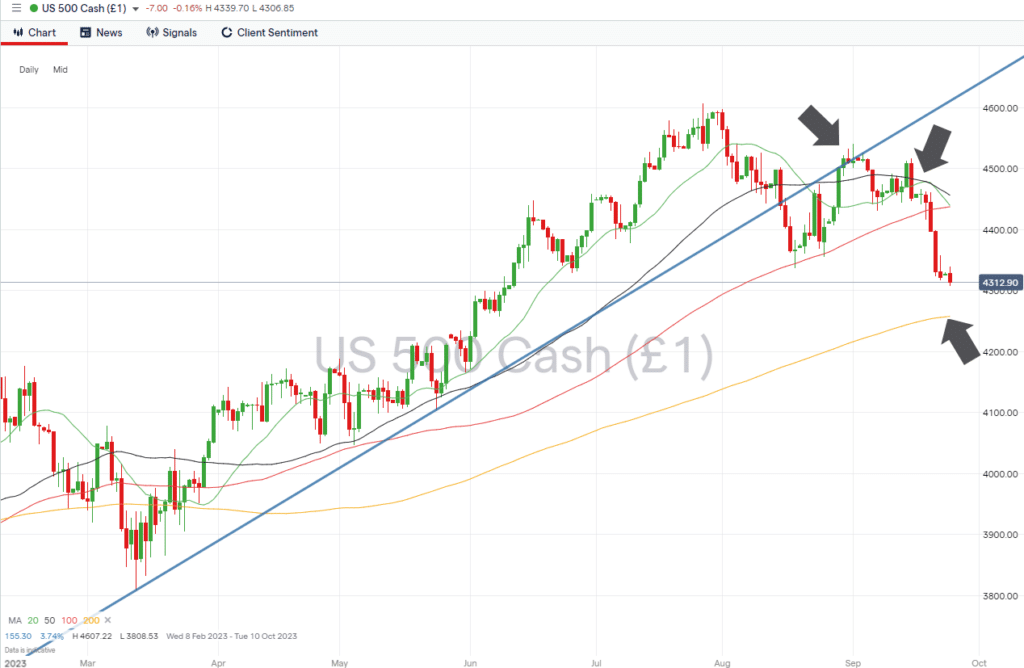

S&P 500

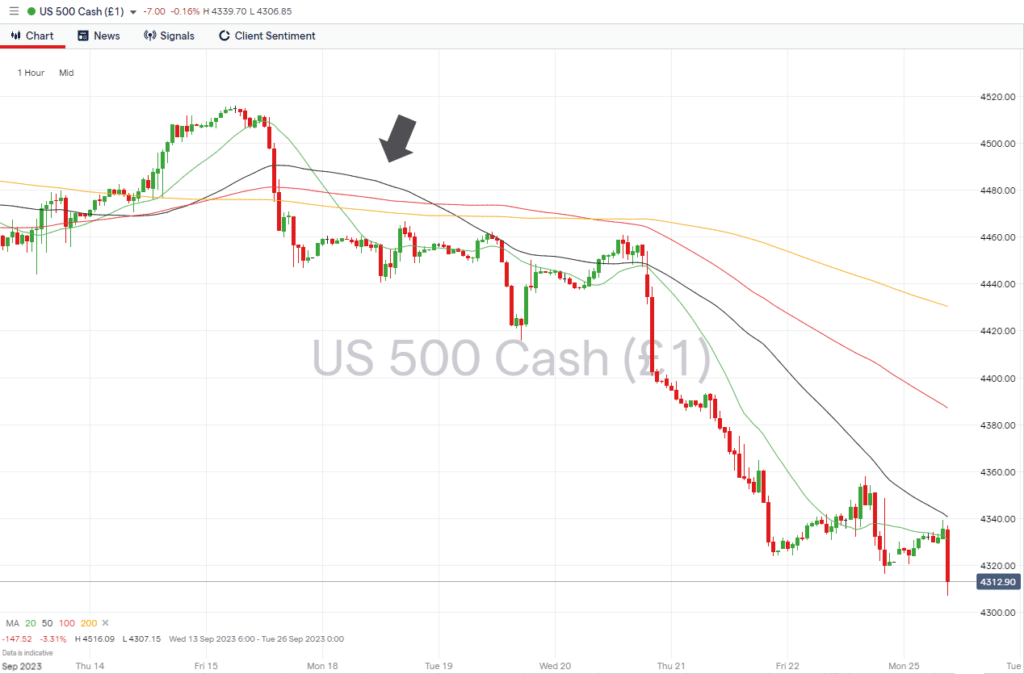

For stock traders and investors, it’s a case of quality, not quantity, in terms of data reports being released this week. With Jerome Powell’s statement causing a selloff in equity markets last week, all eyes now turn to the PCE price index report, the Fed’s inflation report of choice, due out on Friday.

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

Monday 25th September

- 9:00 am – German IFO index (September). Analysts forecast index to all to 84.3.

Wednesday 27th September

- 7:00 am – German Gfk Consumer confidence (October). Analysts forecast index to rise to -24.8.

Thursday 28th September

- 1:00 pm – German CPI inflation report (September). Price rises expected to be 5.9% year-on-year and 0.6% month-on-month.

Friday 29th September

- 7:45 am – French CPI inflation report (September). Price rises expected to be 4.8% year-on-year and 0.7% month-on-month.

- 8:55 am – German unemployment data (September). Unemployment rate forecast to be unchanged at 5.7%.

- 10:00 am – Eurozone inflation data (September). Analysts forecast price rises of 5.5% year-on-year and 0.5% month-on-month.

- 1:30 pm – US PCE price index (August). Analysts forecast that the Fed’s preferred measure of inflation will show price rises of 3.5% year-on-year and 0.4% month-on-month.

- 2:45 pm – US PMI index report. Manufacturing index expected to rise to 48.8 and Services to fall to 49.0.

People Also Read

- WEEKLY FOREX TRADING TIPS – 2023.09.25

- The Best and Worst Performing Currency Pairs in August 2023

- The Week Ahead – 18th September 2023

- WEEKLY FOREX TRADING TIPS – 2023.09.18

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk