FOCUS ON: US Interest Rate Decision

- Markets brace for interest rate announcement from US Federal Reserve due on Wednesday

- Bank of England sets rates this week

- Analyst opinion on interest rate policy diverging as stress felt by the underlying economy begins to show

The big event of the week, and possibly the month, is the announcement by the US Federal Reserve on Wednesday when interest rate levels will be announced. Jerome Powell and his team must consider how rising rates have impacted the finance sector. High-profile banks, including Silicon Valley Bank (SVB) and Credit Suisse, have signalled the alarm, leaving analyst forecasts of the next US rate rise swinging between ‘unchanged’ and 50 basis points.

Forex

GBPUSD

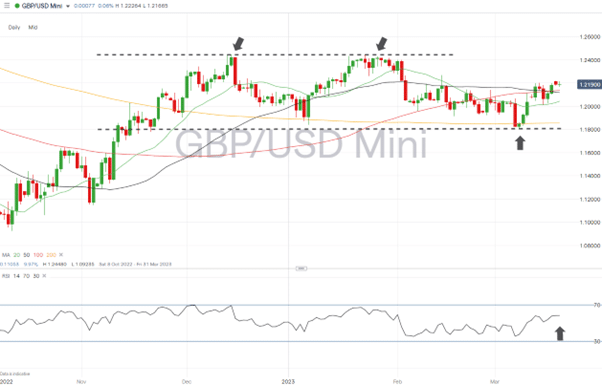

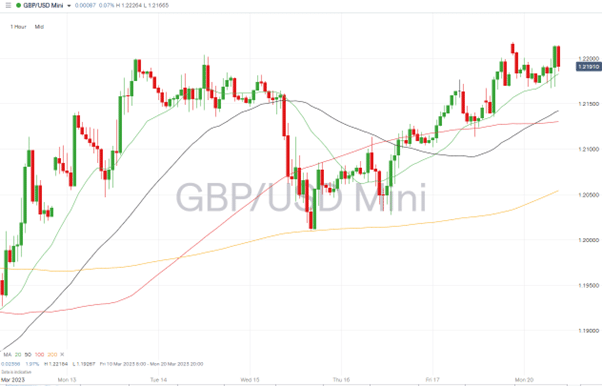

Traders of sterling-based forex pairs face a busy week in terms of news announcements. The Bank of England will decide on UK interest rates on Thursday, one day after the Fed sets US levels. This follows the budget delivered last week by Chancellor Jeremy Hunt, and high levels of price volatility can be expected.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Wednesday 22nd March – 7 am (GMT) – UK CPI (February): Analysts predict prices to rise 9.6% YoY and 0.5% MoM from last month’s 10.1% and -0.6%

- Thursday 23rd March – 12 pm (GMT) – Bank of England interest rate decision: Analysts predict rates to rise to 4.25% from 4%

EURUSD

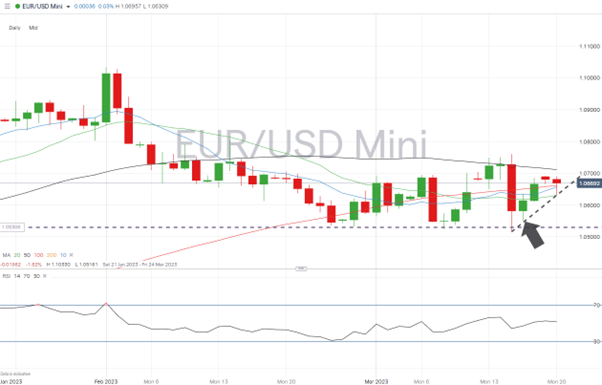

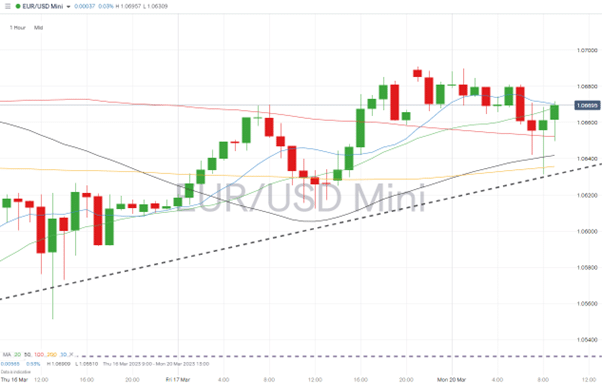

While no major announcements are due out of the ECB this week, euro currency pairs can be expected to fluctuate in price on the back of interest rate decisions set by other central banks.

EURUSD Chart – Daily Price Chart

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone economic data:

- Tuesday 21st March – 10 am (GMT) – German ZEW index (March): Analysts predict the index to fall to 28 from 28.1.

- Wednesday 22nd March – 6 pm (GMT) – FOMC rate decision: after a see-saw couple of weeks, analysts forecast US rates to rise by 25bps to 5%.

- Friday 24th March – 9 am (GMT) – Eurozone PMIs (March, flash): Analysts forecast the manufacturing index to rise to 49 and services to fall to 52.5.

Indices

S&P 500

Stock traders already have the Wednesday interest rate decision in their diaries, but the bank sector crisis could throw up ‘curveballs’ at any time. Price volatility levels can be expected to be higher throughout the week.

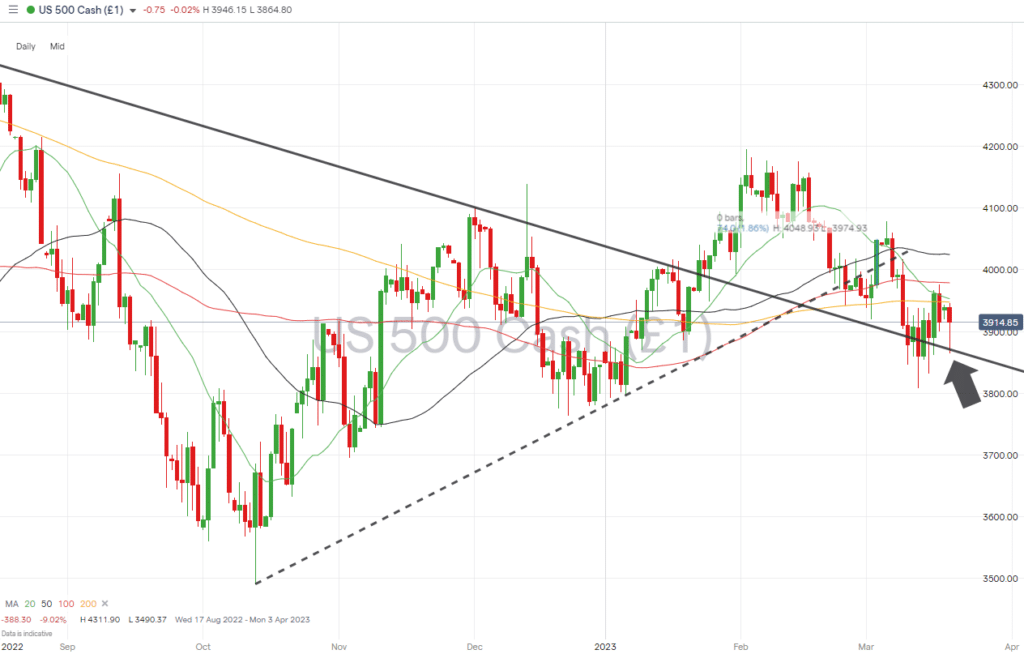

S&P 500 Chart – Daily Price Chart – Trendline Support

Source: IG

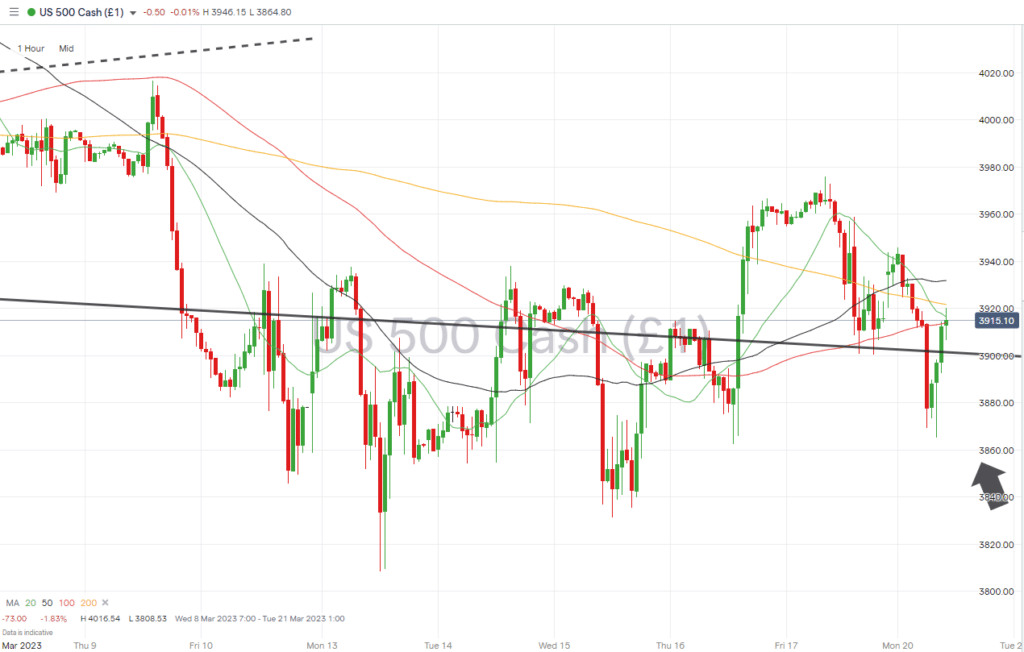

S&P 500 – Hourly Price Chart – Trendline Support

Source: IG

US economic data:

- Wednesday 22nd March – 6 pm (GMT) – FOMC rate decision: after a see-saw couple of weeks, analysts forecast US rates to rise by 25bps to 5%.

- Friday 24th March – 1.45 pm (GMT) – 1.45 pm – US PMIs (March, flash): Analysts expect manufacturing to fall to 47 and services to fall to 50.1.

People Also read:

- WEEKLY FOREX TRADING TIPS – 2023.03.20

- Markets Braced for Euro Interest Rate Announcement – Something’s Got to Give

- US Dollar Weakens as Nonfarm Payrolls Data Comes in at +311K

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk