FOCUS ON: Variety of Data Reports are Due to be Released but Price Consolidation Could Continue.

- US Presidents’ Day holiday on Monday, 20th February means the trading week will be shortened.

- During the rest of the week, a wide range of mid-level economic data will be released.

- Price consolidation patterns could continue to be the dominant theme for most markets.

The coming week is busy regarding news announcements; however, most of the reports are less critical to traders than the major milestones, such as US inflation and jobs data which hit the markets in the preceding two weeks.

The report most eagerly awaited is the release of the minutes of the last meeting of the US Federal Reserve – they are due to be released at 7 pm GMT on Wednesday, 22nd February.

Forex

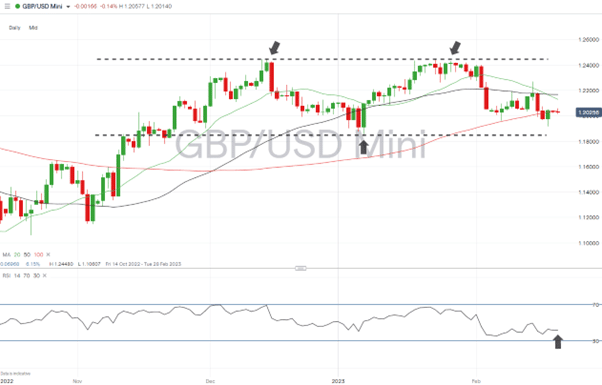

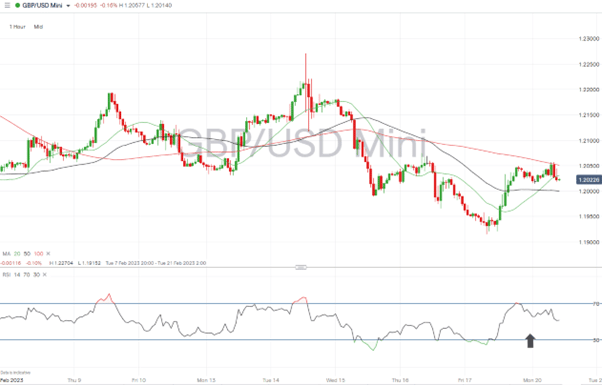

GBPUSD

The recent release of UK GDP, inflation, and job numbers has been followed by a period of sideways trading in GBPUSD. With the coming week quieter regarding news announcements, that consolidation pattern can be expected to continue.

UK stocks are a market to watch, with the FTSE100 index posting new highs.

Tuesday 21st February:

9.30 am – UK PMIs (February, flash): Analyst forecasts point to services rising to 49.3 and manufacturing rising to 47.5.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

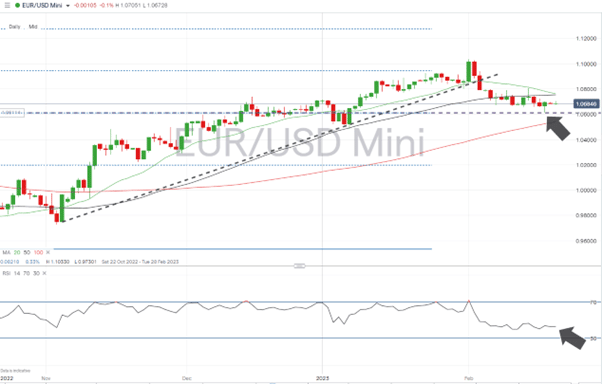

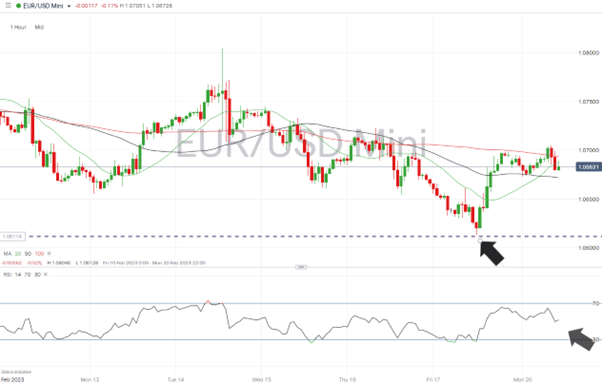

EURUSD

Traders of euro currency pairs could be in for a busier week. Inflation and sentiment reports are due from the eurozone’s major economies, which could result in a test of key price resistance/support levels.

Tuesday 21st February:

- 8.30 am – German PMIs (February, flash): Analysts forecast manufacturing to rise to 48.2 and services to rise to 51.5.

- 9 am – eurozone PMIs (February, flash): Analysts forecast manufacturing to rise to 49.5 and services to rise to 51.5.

Wednesday 22nd February:

- 9 am – German IFO index (February): Analysts forecast the index to rise to 91.2.

Friday 24th February:

- 7 am – German GfK consumer confidence (March): Analysts forecast the index to fall to -34.

EURUSD Chart – Daily Price Chart – Consolidation Pattern

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Indices

S&P 500

The Presidents’ Day holiday in the US on Monday 20th February means stock traders will get off to a slow start this week. Home sales and weekly jobs reports are released on Thursday and Friday, but the significant number to watch out for is the release of the minutes of the last meeting of the FOMC on Wednesday.

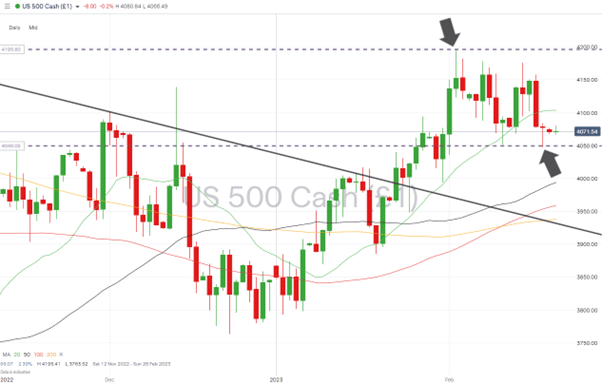

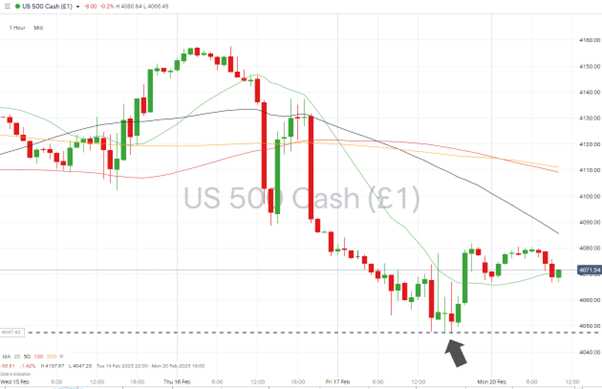

S&P 500 Chart – Daily Price Chart –Trendline Break Followed by Sideways Trading

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

People Also Read:

- Disconnect Between Forex and Stock Markets Points Towards Increased Volatility

- The Week Ahead – 13th February 2023

- Dollar Tests Key Inflection Point – Stick or Twist for the Greenback

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk