FOCUS ON: US Fed, Bank of England, and Bank of Japan to make Interest Rate Announcements

- Busy week for Central Banks after inflation news out of the US last week came in hotter than expected

- Prices in many markets now at key support/resistance levels

- Potential for upcoming comments from Central Bank leaders to trigger new trends

Three leading central banks will take a view on interest rate policy this week. Their decision-making is likely to be influenced by the hotter-than-expected US inflation report, which jolted the markets last week. First up is the US Federal Reserve, which sets rates on Wednesday, followed by the Bank of England on Thursday and the Bank of Japan on Friday.

Forex

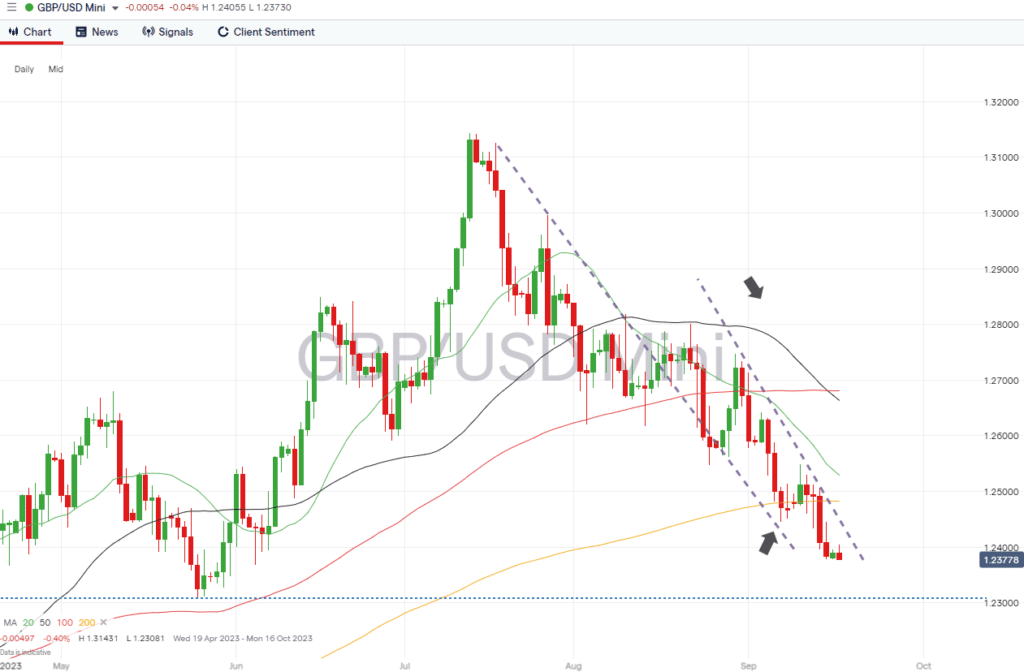

GBPUSD

The Bank of England’s appetite for adopting a more dovish approach continues to be hindered by stubbornly high inflation levels. With GDP figures recently upgraded, the resilience of the underlying economy points to another rate hike being likely on Thursday.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

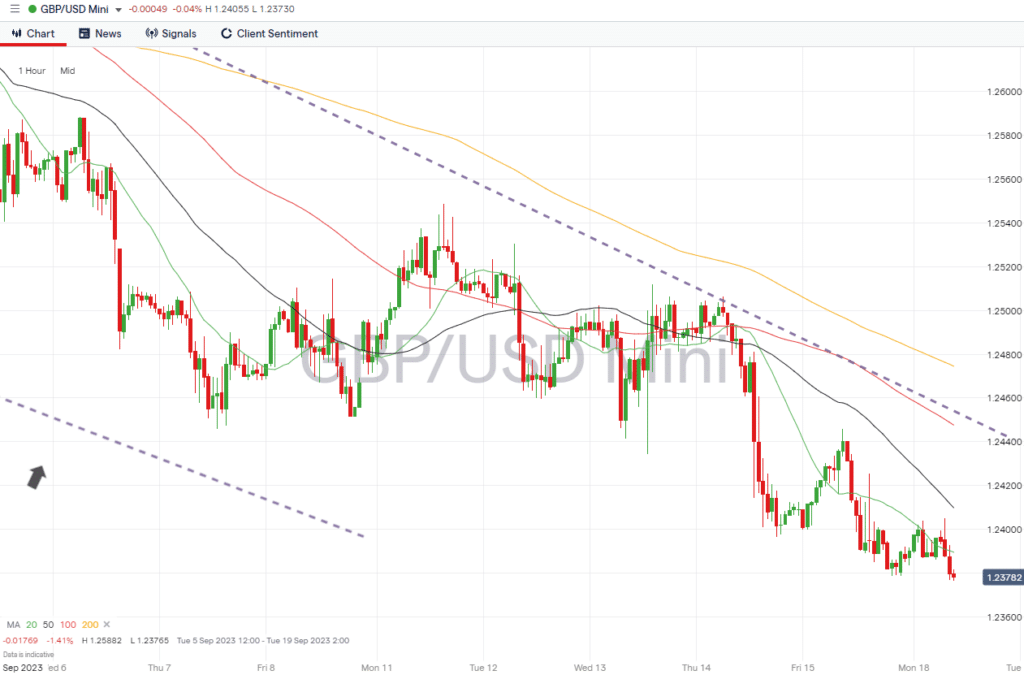

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs, all times BST:

Tuesday 19th September

- 1:30 pm: Canada CPI inflation report (August). Analysts forecast prices rose 3.3% year-on-year and 0.6% month-on-month.

Wednesday 20th September

- 7:00 am – UK CPI (August). Analysts forecast prices to rise 6.7% year-on-year and fall 0.2% month-on-month.

- 7:00 pm – US Federal Reserve interest rate decision. US interest rates forecast to remain unchanged at 5.5%, with an unexpected rate hike likely to trigger a selloff in risk-on assets. Press conference to follow at 7.30 pm.

Thursday 21st September

- 12:00 pm – Bank of England interest rate decision. Rates expected to rise by 25 basis points to 5.5%

Friday 22nd September

- 4:00 am – Bank of Japan interest rate decision. Rates forecast to remain unchanged at -0.1%.

- 9:00 am – Eurozone PMI index report. Manufacturing index expected to rise to 44.9, and Services to rise to 49.1.

- 2:45 pm – US PMI index report. Manufacturing index expected to rise to 48.8 and Services to fall to 49.0.

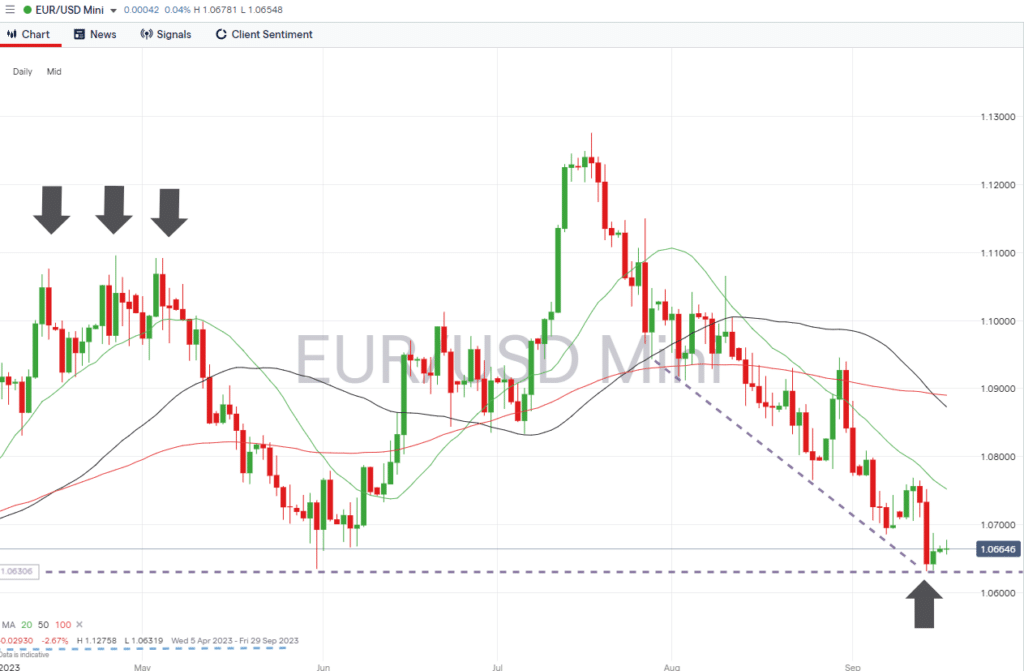

EURUSD

Last week’s decision by the ECB to raise Eurozone interest rates by 25 basis points surprised some but highlights how controlling inflation remains the focus for central bankers. The upcoming week is a quiet one in terms of euro-specific news, but announcements by the Fed, BoE, and BoJ can be expected to influence the value of EUR currency pairs.

EURUSD Chart – Daily Price Chart

Source: IG

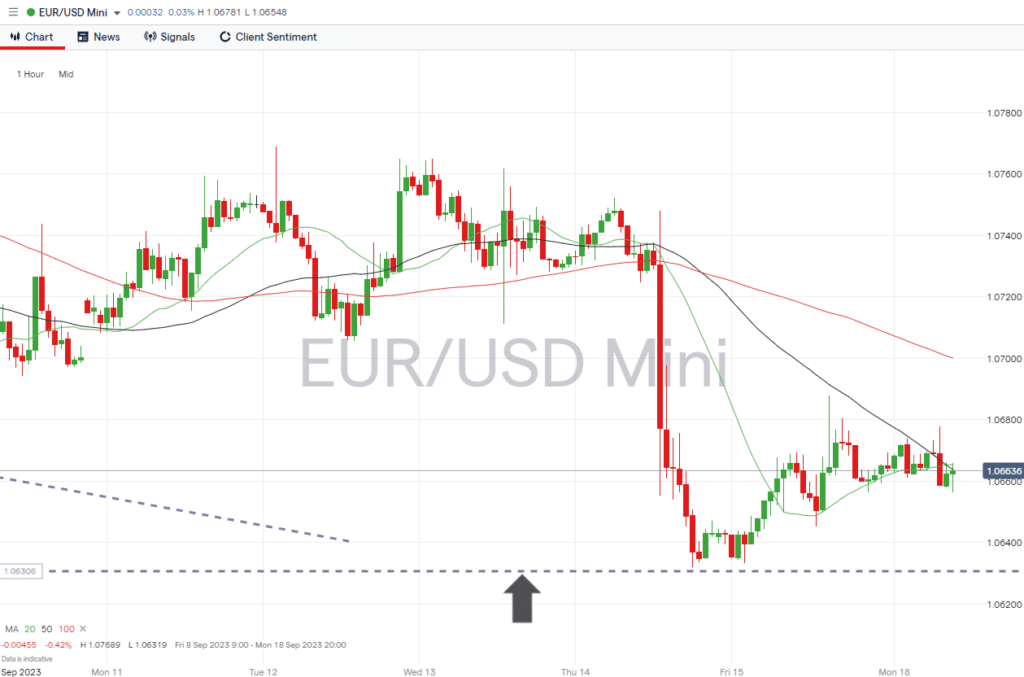

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

Tuesday 19th September

- 1:30 pm – Canada CPI inflation report (August). Analysts forecast prices rose 3.3% year-on-year and 0.6% month-on-month.

Wednesday 20th September

- 7:00 am – UK CPI (August). Analysts forecast prices to rise 6.7% year-on-year and fall 0.2% month-on-month.

- 7:00 pm – US Federal Reserve interest rate decision. US interest rates forecast to remain unchanged at 5.5%, with an unexpected rate hike likely to trigger a selloff in risk-on assets. Press conference to follow at 7.30 pm.

Thursday 21st September

- 12:00 pm – Bank of England interest rate decision. Rates expected to rise by 25 basis points to 5.5%

Friday 22nd September

- 4:00 am – Bank of Japan interest rate decision. Rates forecast to remain unchanged at -0.1%.

- 9:00 am – Eurozone PMI index report. Manufacturing index expected to rise to 44.9, and Services to rise to 49.1.

- 2:45 pm – US PMI index report. Manufacturing index expected to rise to 48.8 and Services to fall to 49.0.

Indices

S&P 500

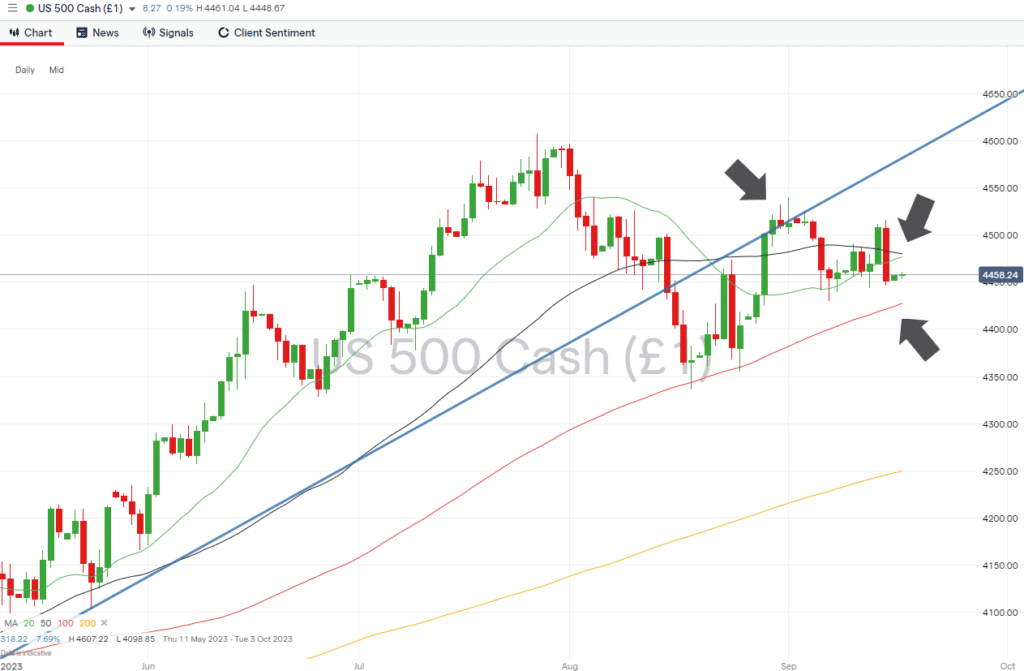

The break of the upward trendline, which dates back to September 2022, has been followed by a period of price consolidation. The interest rate decision due from the Fed on Wednesday will offer a steer on which way stock prices might next head, and the post-announcement press conference will allow Jerome Powell and his team to expand on the reasoning behind their decision.

S&P 500 Chart – Daily Price Chart

Source: IG

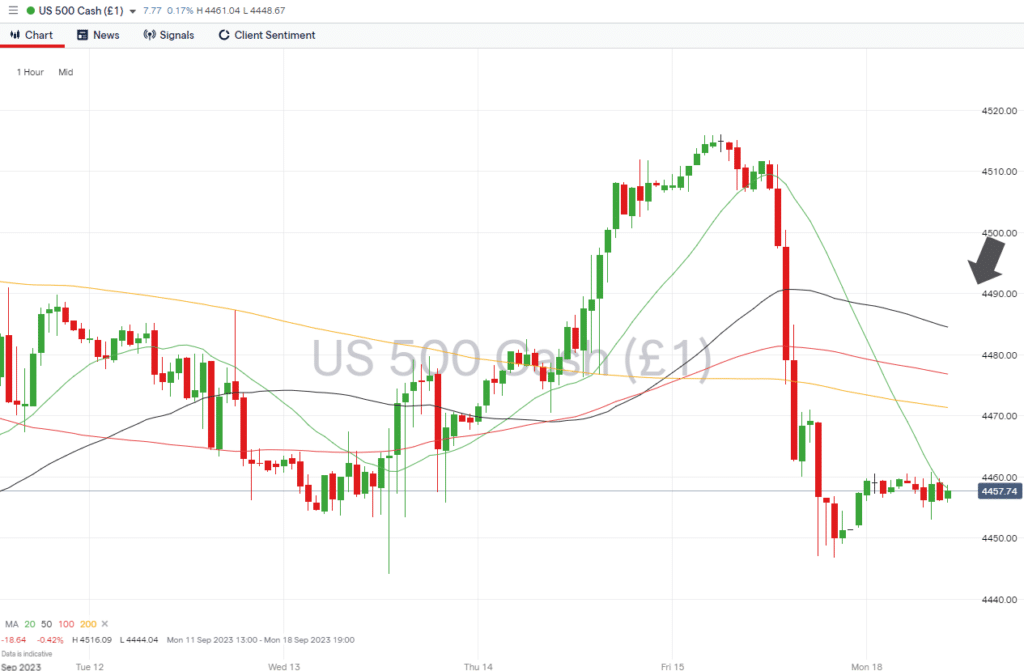

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

Tuesday 19th September

- 1:30 pm – Canada CPI inflation report (August). Analysts forecast prices rose 3.3% year-on-year and 0.6% month-on-month.

Wednesday 20th September

- 7:00 am – UK CPI (August). Analysts forecast prices to rise 6.7% year-on-year and fall 0.2% month-on-month.

- 7:00 pm – US Federal Reserve interest rate decision. US interest rates forecast to remain unchanged at 5.5%, with an unexpected rate hike likely to trigger a selloff in risk-on assets. Press conference to follow at 7.30 pm.

Thursday 21st September

- 12:00 pm – Bank of England interest rate decision. Rates expected to rise by 25 basis points to 5.5%

Friday 22nd September

- 4:00 am – Bank of Japan interest rate decision. Rates forecast to remain unchanged at -0.1%.

- 9:00 am – Eurozone PMI index report. Manufacturing index expected to rise to 44.9, and Services to rise to 49.1.

- 2:45 pm – US PMI index report. Manufacturing index expected to rise to 48.8 and Services to fall to 49.0.

People Also Read

- WEEKLY FOREX TRADING TIPS – 2023.09.18

- The Best and Worst Performing Currency Pairs in August 2023

- The Week Ahead – 11th September 2023

- WEEKLY FOREX TRADING TIPS – 2023.09.11

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk