FOCUS ON: Earnings Season and UK Inflation Data

- Increased appetite for stocks, euro, and sterling triggered by low US inflation numbers

- Earnings season continues with big US banks and Tesla preparing to update investors

- UK CPI inflation report due Wednesday

The extended summer break, which often results in quieter markets, still looks some way off. Last week’s US inflation report has triggered a shift into risk-on assets, a trend which could continue as US corporations enter the earnings season.

Forex

GBPUSD

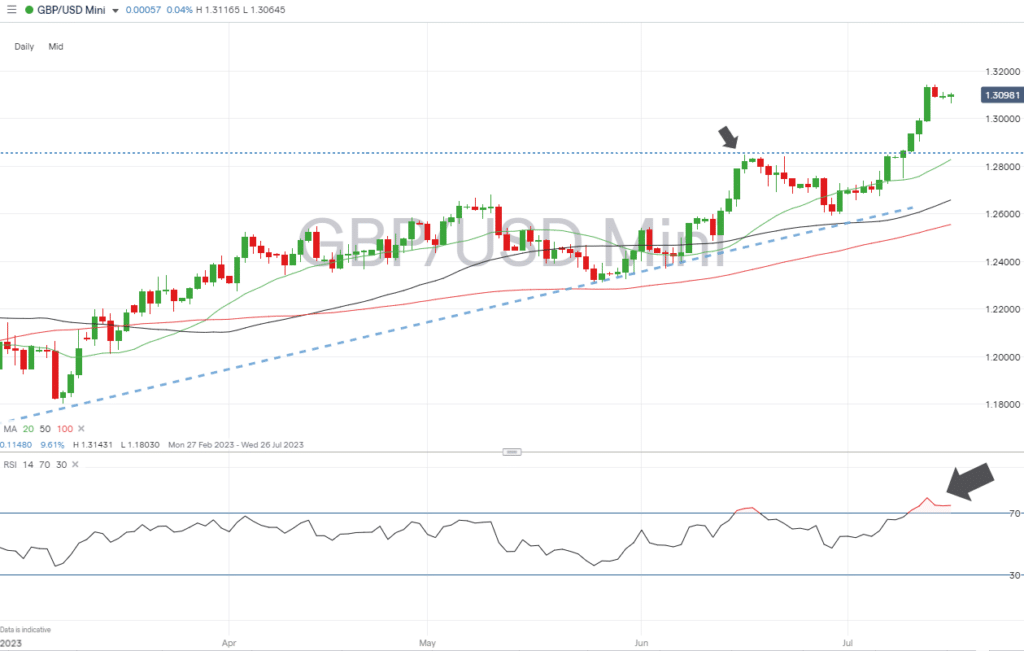

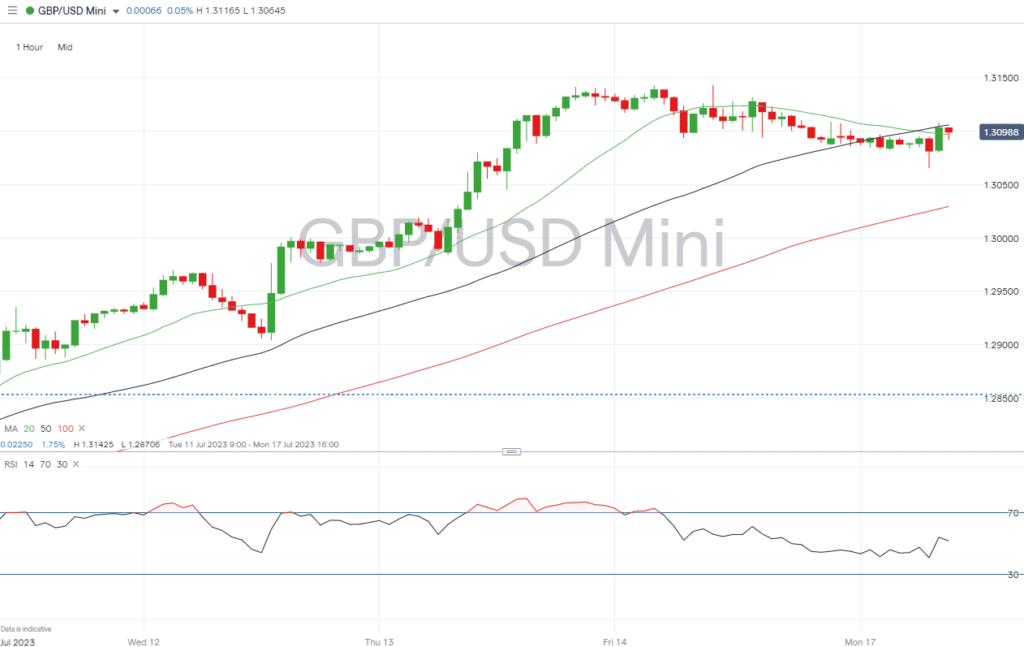

The UK CPI inflation report due on Wednesday will be a crucial guide to the future performance of sterling currency pairs. Strength in GBPUSD could continue if the UK economy is seen to be continuing to overheat at the same time as US inflation levels are cooling.

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Wednesday 19th July – 7.00am BST – UK CPI (June). Analysts forecast year-on-year price growth to slow to 8.3% from 8.7% and the month-on-month figure to drop to 0.4% from 0.7%. The crucial core CPI is expected to rise 7% year-on-year from 7.1%.

- Friday 21st July – 7.00am BST – UK retail sales (June). Retail sales are forecast to fall 0.2% month-on-month and 1.7% year-on-year.

EURUSD

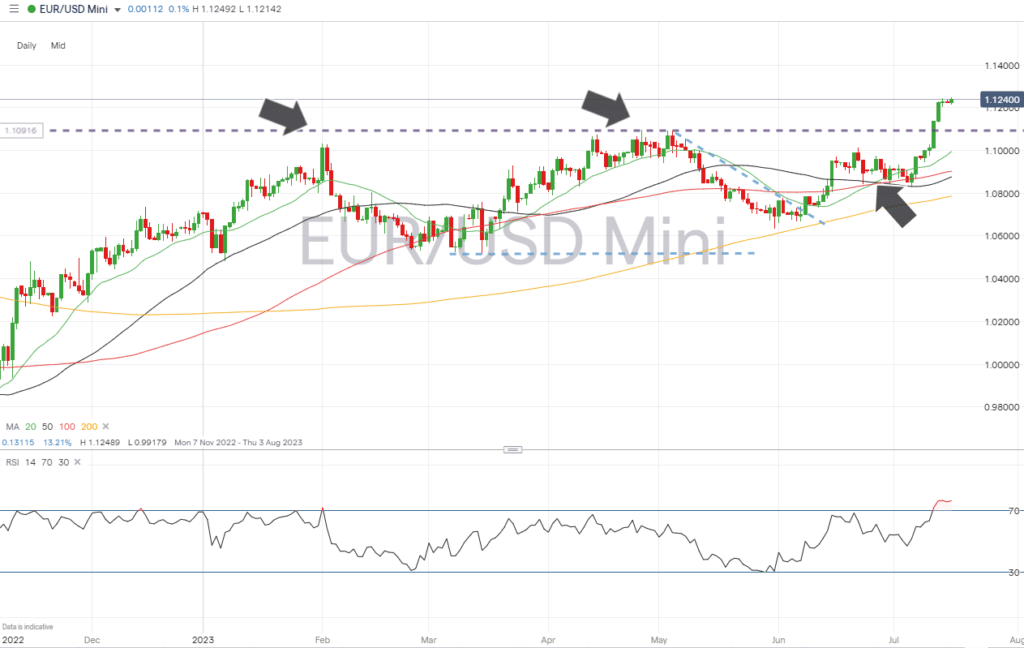

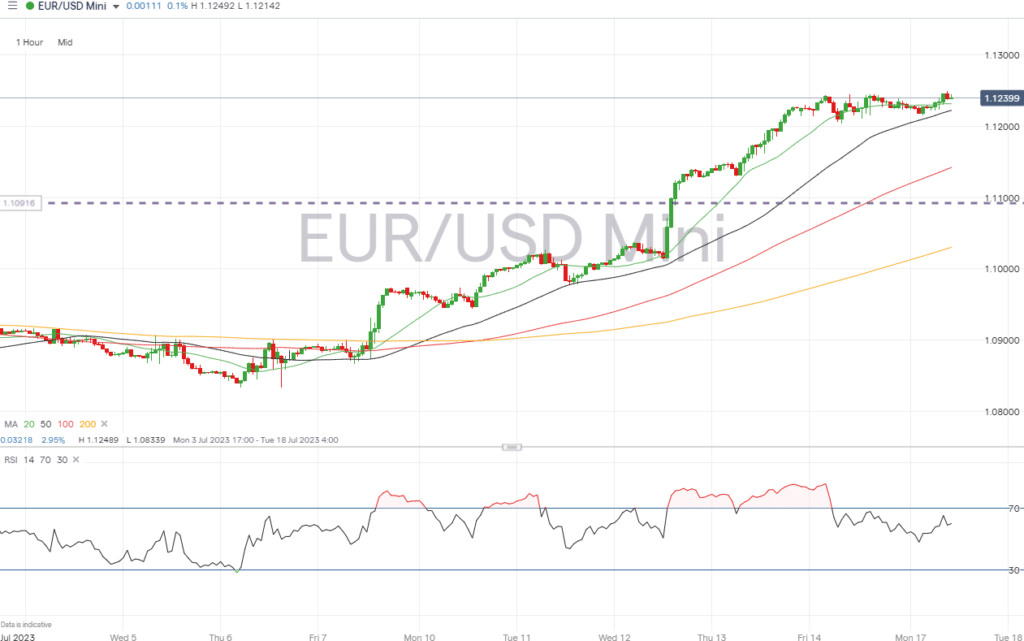

The coming week is a quiet one in terms of Eurozone-specific news reports, but events in the US can be expected to influence the value of the EURUSD currency pair.

EURUSD Chart – Daily Price Chart

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Tuesday 18th July – 1.30pm BST – US retail sales (June). Analysts forecast a rise of 0.5% month-on-month, up from 0.3%.

- Thursday 20th July – 3.00pm BST – US existing home sales (June). Sales are expected to rise 0.7% month-on-month.

Indices

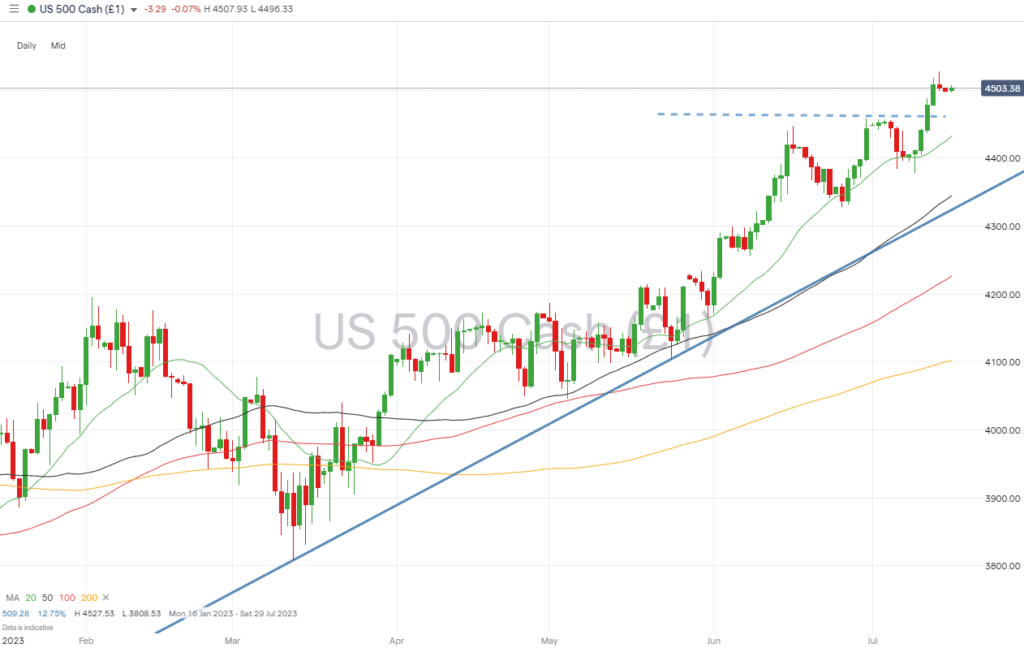

S&P 500

Earnings season gets into gear this week with big banks and bellwether companies such as Tesla ready to update investors. This comes on the back of an impressive upward surge triggered by last week’s lower-than-expected US inflation data.

S&P 500 Chart – Daily Price Chart

Source: IG

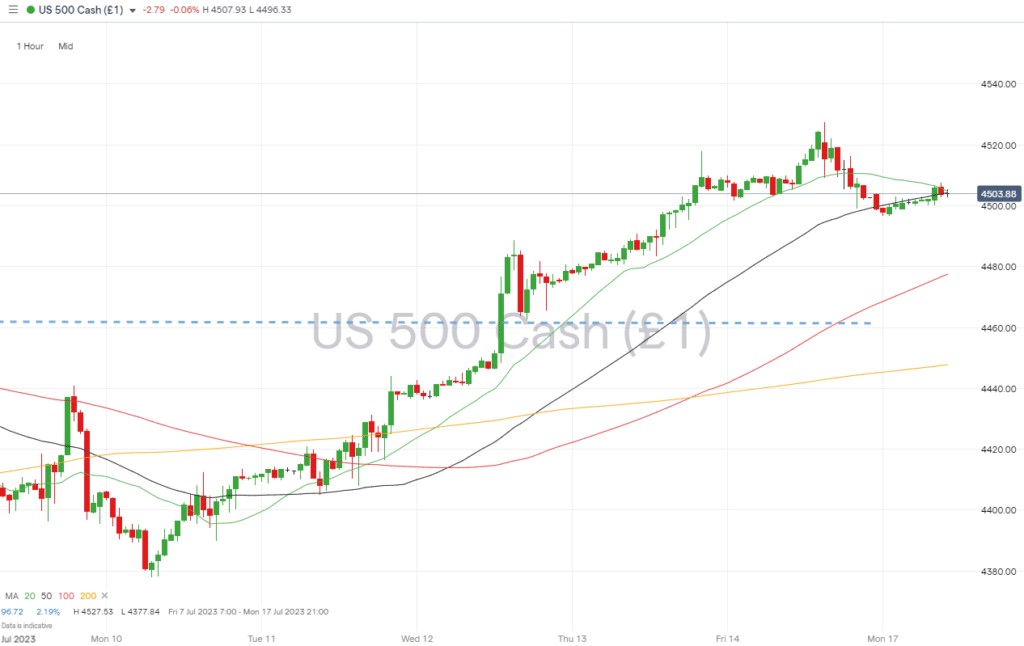

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 18th July – 1.30pm BST – US retail sales (June). Analysts forecast a rise of 0.5% month-on-month, up from 0.3%.

- Thursday 20th July – 3.00pm BST – US existing home sales (June). Sales are expected to rise 0.7% month-on-month.

Companies releasing earnings reports this week:

- Tuesday 18th July – Goldman Sachs, Bank of America, Merrill Lynch.

- Wednesday 19th July – Tesla, Alcoa, Netflix.

- Thursday 20th July – American Airlines, Johnson & Johnson.

- Friday 21st July – Schlumberger, American Express.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.07.17

- The Best and Worst Performing Currency Pairs in June 2023

- Forex Market Forecast for July 2023

- The Week Ahead – 10th July 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk