FOCUS ON: Wide-ranging set of data releases could influence the next market move.

- Inflation is the key metric influencing the markets, and UK CPI due on Wednesday could point to inflation there still being in double-digits.

- Employment, GDP, and sentiment reports are also due to be released.

- US earnings season gets into full swing.

The coming week is full of mid-range data reports covering a wide selection of topics. GDP, inflation, retail sales, and producer confidence will all be updated at a time when markets are shifting towards adopting a ‘risk-on’ approach.

Forex

GBPUSD

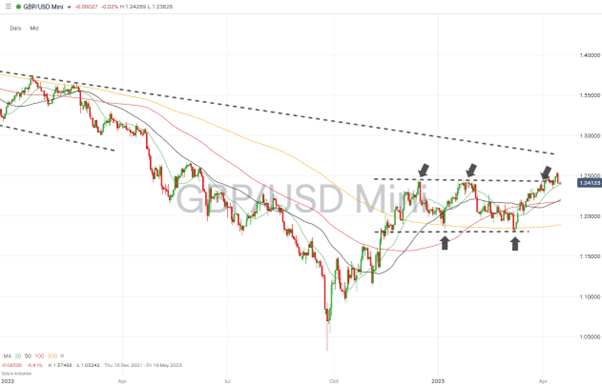

Traders of sterling-based currency pairs can expect volatility levels to increase on Tuesday when the UK unemployment rate is announced. Wednesday’s release of UK CPI data will be the key metric to look out for; that data point still drives the Bank of England’s interest rate policy.

The Bank’s stated priority is getting inflation under control, and with the last reading being 10.4%, there is still some way to go.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

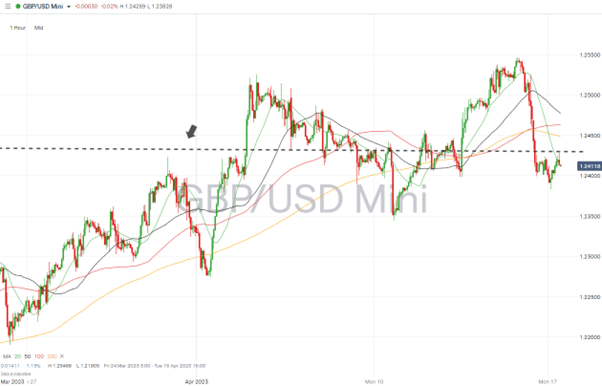

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic reports:

- Tuesday 18th April – 7 am GMT – UK employment data: Analysts expect the February unemployment rate to rise to 3.8% from 3.7% and the claimant count to drop by 9500 in March. Average earnings are forecast to rise 5.1% for the three months to February, a slowdown from the 5.7% in January.

- Wednesday 19th April – 7 am GMT – UK CPI (March): Analysts forecast prices to rise 10.2% year-on-year and 0.3% month-on-month, down from 10.4% and 1.1% in February. Core CPI is expected to rise 6%, down from 6.2%.

- Friday 21st April – 7 am GMT – UK retail sales (March): Analysts forecast sales to fall 0.5% month-on-month.

UK company reports:

- Tuesday 18th April – Moneysupermarket.com, easyJet, and Deliveroo provide trading updates.

- Wednesday 19th April – Just Eat Takeaway.com trading update.

- Thursday 20th April – WHSmith releases quarterly earnings.

EURUSD

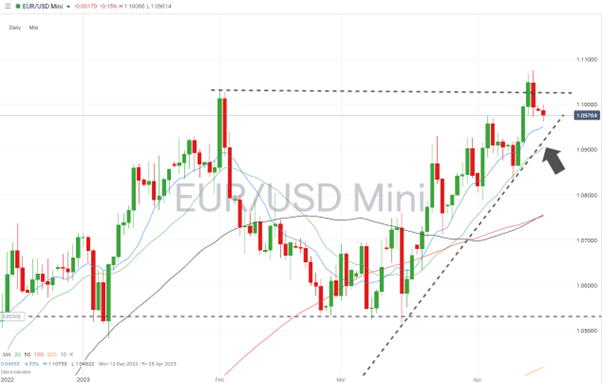

This week sees a deep dive into Eurozone sentiment. Reports are due to be released on the health of consumers, manufacturers, and the service sector. All can be expected to influence the price of euro currency pairs and provide trading opportunities.

EURUSD Chart – Daily Price Chart

Source: IG

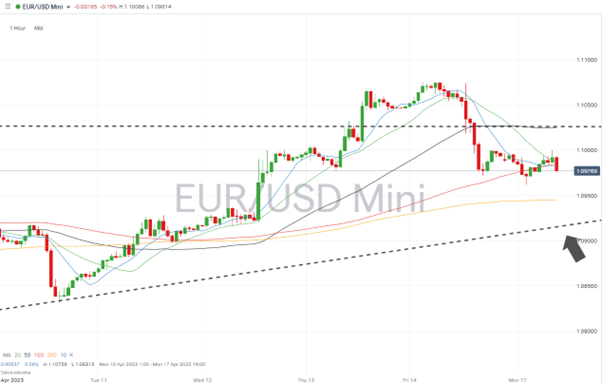

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Tuesday 18th April – 10 am GMT – German ZEW index (April): Analysts forecast economic sentiment index to rise to 15.

- Thursday 18th April – 3.00 pm GMT – eurozone consumer confidence (April, flash): Analysts forecast a rise to -19.

- Friday 19th April – 9.00 am German PMIs (April, flash): Analysts forecast manufacturing PMI to fall to 44 and services PMI to fall to 44.7.

- Friday 19th April – 9.00 am eurozone PMIs (April, flash): Analysts forecast manufacturing PMI to fall to 47 and services PMI to fall to 54.

Indices

S&P 500

A strong opening to the earnings season was led by the big banks, with JP Morgan leading the way. Firms from other sectors will update investors this week, offering a chance to check the health of US consumers and big corporations.

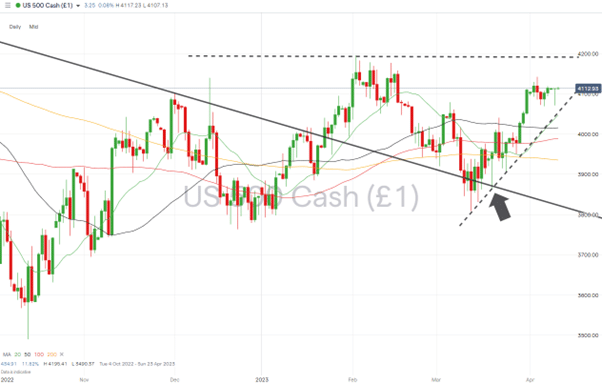

S&P 500 Chart – Daily Price Chart – Trendline Support

Source: IG

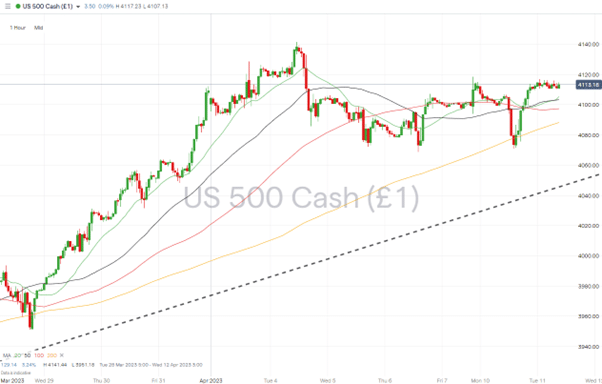

S&P 500 – Hourly Price Chart – Trendline Support

Source: IG

US economic data:

- Friday 19th April – 2.45 pm eurozone PMIs (April, flash): Analysts forecast manufacturing PMI to fall to 51.4 and services PMI to fall to 51.8.

US company reports:

- Tuesday 18th April – Goldman Sachs, Netflix, Johnson & Johnson, and Bank of America release Q1 earnings reports.

- Wednesday 19th April – Tesla and IBM Q1 earnings released.

- Thursday 20th April – American Airlines Q1 earnings.

- Friday 21st April – Procter & Gamble Q1 earnings.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.04.17

- US Reports Hint at GBPUSD Breaking Through Triple-Top Resistance

- EURUSD and GBPUSD go into Crucial NFP Announcement Hovering at Key Price Levels

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk