FOCUS ON: Reports Due on Underlying Economic Situation

- Inflation, unemployment, and sentiment reports due out in the UK, Eurozone, and Japan

- Minutes of the US Federal Reserve’s last meeting also due to be released

- Key technical support/resistance levels coming into play

The coming week sees the release of reports on the underlying health of the global economy. Inflation, GDP, sentiment, and unemployment data updates are due from countries around the globe.

Forex

GBPUSD

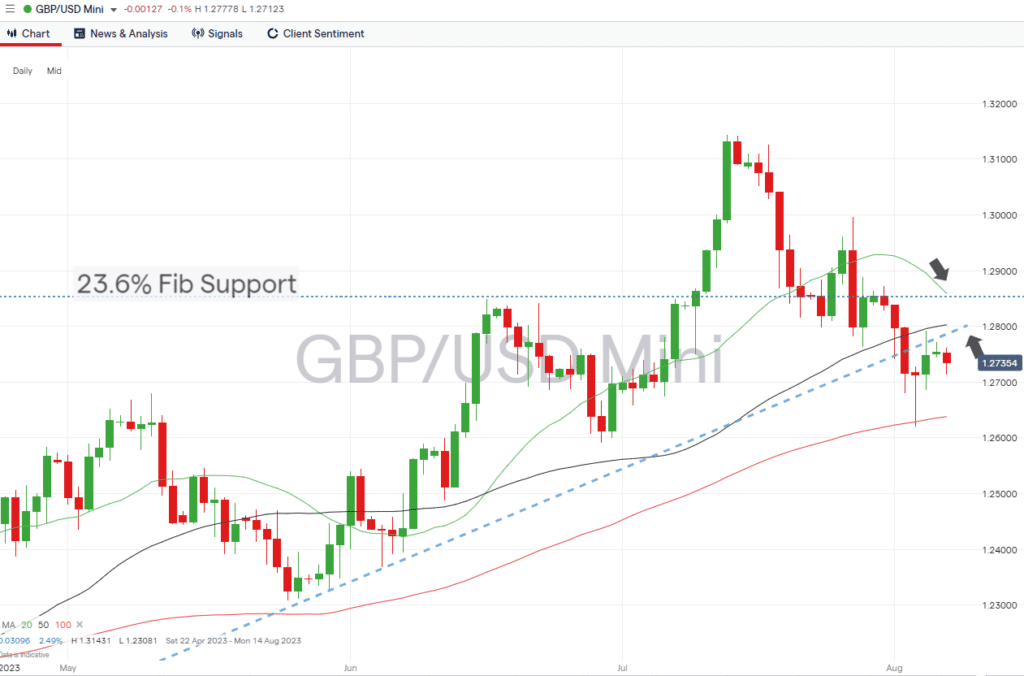

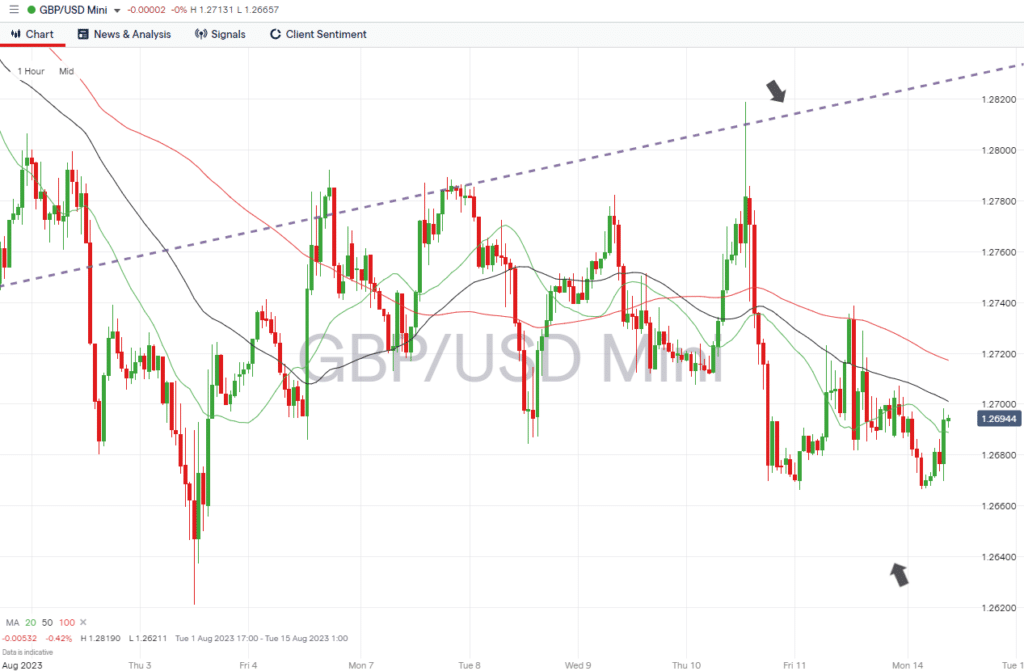

The price of GBPUSD softened last week thanks to a better-than-expected inflation report. That has led some to think the hawkish policy of the Bank of England might not be as long-lasting as previously expected. Updates on unemployment, inflation, and retail sales are due this week and will offer further insight into what form future BOE interest policy might take.

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Wedge Pattern

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Tuesday 15th August – 7:00am BST – UK employment data. June unemployment rate expected to hold at 4%. Average earnings, including bonuses, are forecast to rise 6.8%.

- Wednesday 16th August – 7:00am BST – UK CPI (July). Prices in the UK are expected to rise 7.4% year-on-year, from 7.9% in June, and 0.1% month-on-month, in line with the previous month.

- Wednesday 16th August – 7:00pm BST – FOMC minutes. Further insight into the July meeting when the Fed decided to raise rates by 25bps.

- Friday 18th August – 7:00am BST– UK retail sales (July). Analysts expect sales to rise 0.7% month-on-month.

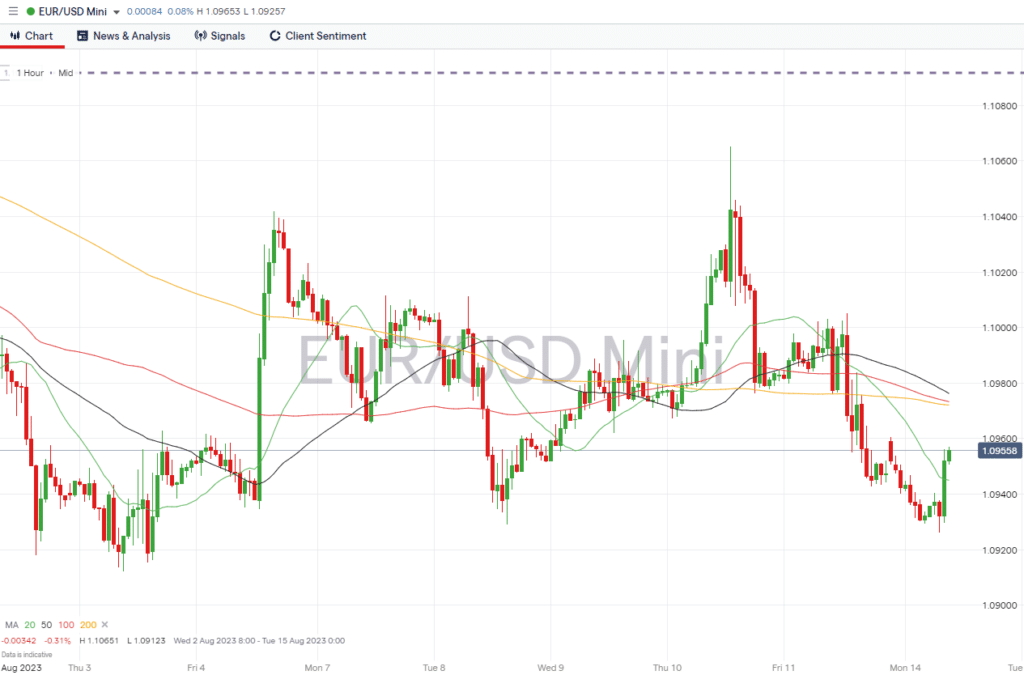

EURUSD

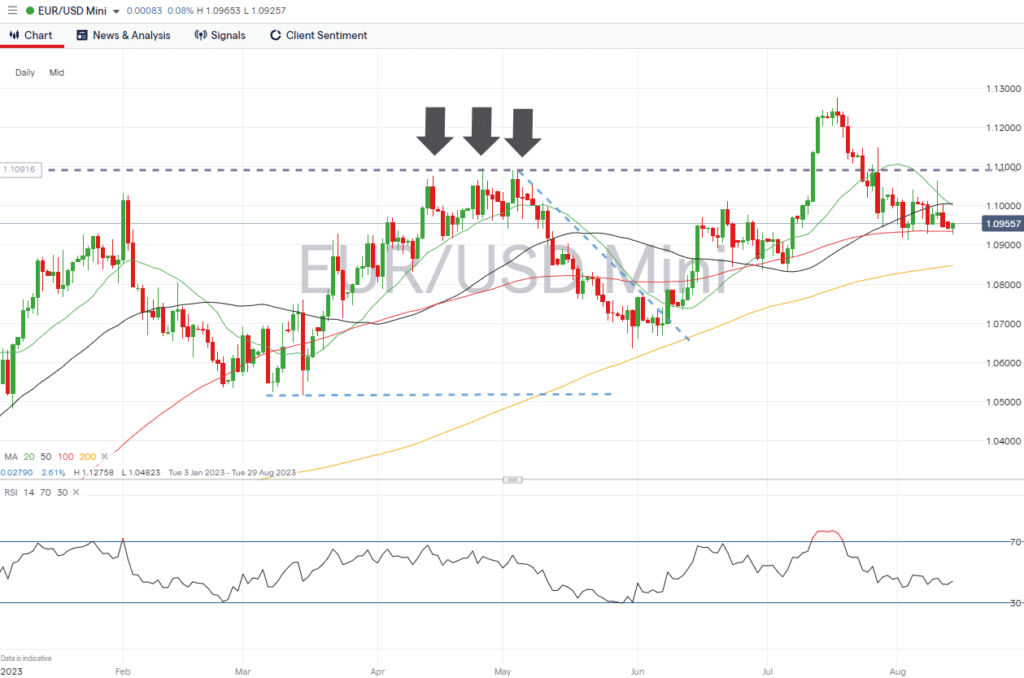

In a week with little euro-specific news, analysts will continue digesting the EU GDP figure and German unemployment numbers released last week. The dollar leg of the EURUSD currency pair can be expected to fluctuate in price when key US inflation data is released at the end of the week.

EURUSD Chart – Daily Price Chart

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Tuesday 15th August – 10:00am BST – German ZEW index (August). Sentiment index expected to fall to -16.

- Wednesday 16th August – 7:00am BST – UK CPI (July). Prices in the UK are expected to rise 7.4% year-on-year, from 7.9% in June, and 0.1% month-on-month, in line with the previous month. Currency pair to watch EURGBP.

- Wednesday 16th August – 7:00pm BST – FOMC minutes. Further insight into the July meeting when the Fed took the decision to raise rates by 25bps.

Indices

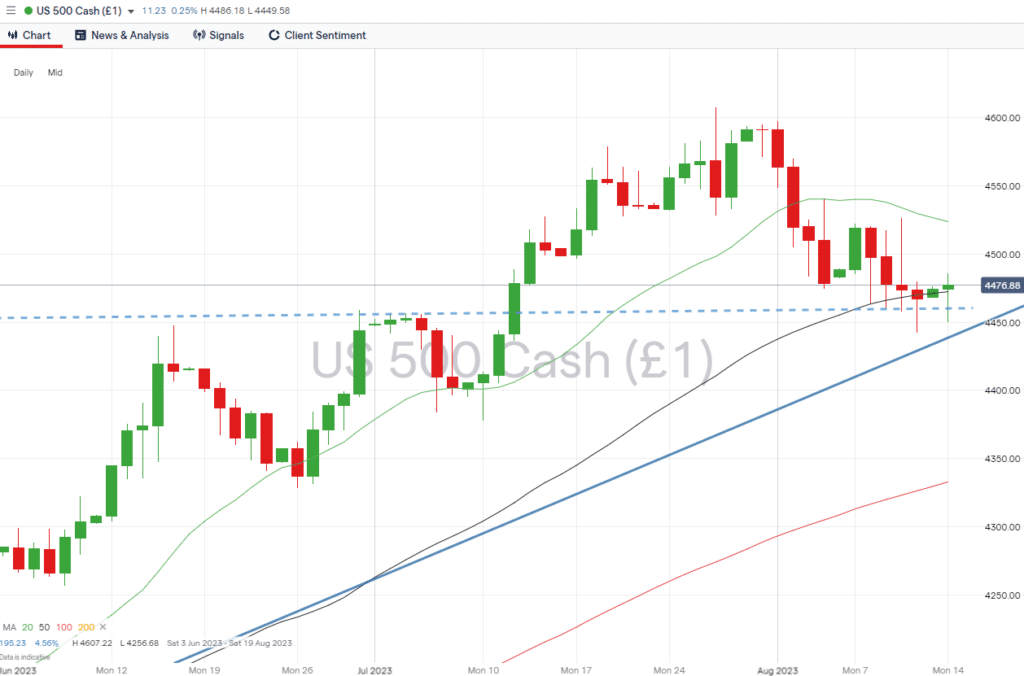

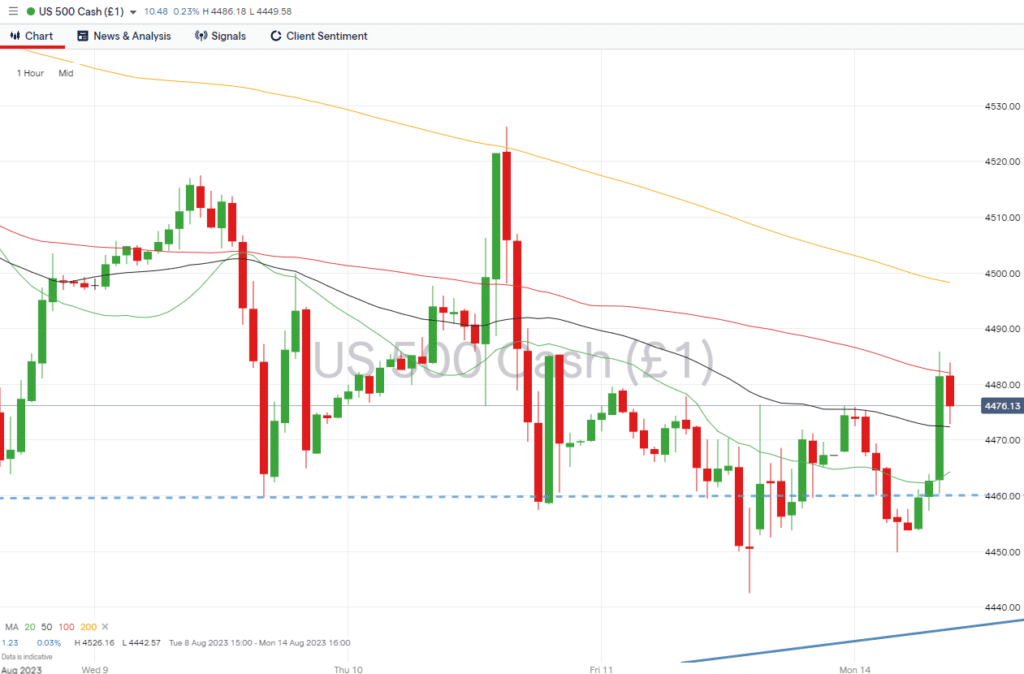

S&P 500

The earnings season is drawing to a close, with the big-name grocers, Target and Walmart, announcing their figures later this week. Stock sentiment has cooled since the early earnings announcement triggered a run into risk-on assets, and the Fed’s release of meeting minutes on Wednesday will allow traders and analysts a chance to consider long-term macro factors.

S&P 500 Chart – Daily Price Chart – Key Support Levels

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Tuesday 15th August – 7:00am BST – UK employment data. June unemployment rate expected to hold at 4%. Average earnings, including bonuses forecast to rise 6.8%. Currency pair to watch GBPUSD.

- Tuesday 15th August – 1:30pm BST – US retail sales (July). Sales expected to rise 0.3% month-on-month.

- Wednesday 16th August – 7:00pm BST – FOMC minutes. Further insight into the July meeting when the Fed took the decision to raise rates by 25bps.

Companies releasing earnings reports this week:

- Tuesday 15th August – Home Depot.

- Wednesday 16th August – Target, Cisco.

- Thursday 17th August – Walmart.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.08.14

- The Best and Worst Performing Currency Pairs in July 2023

- Forex Market Forecast for August 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk