FOCUS ON: Inflation Report and ECB

- US CPI and PPI inflation reports are due this week

- Will offer an insight into what kind of policy the US Fed will need to adopt

- Euro currency pairs await Thursday’s interest rate announcement from the ECB

Key US inflation reports due on Tuesday and Wednesday will offer traders a chance to take a view on whether the interest rate policy of the Fed will remain as hawkish as it has been. Events at Silicon Valley Bank have highlighted how a high-interest rate policy can impact the ‘real’ economy and inflation levels.

Forex

GBPUSD

Chancellor Jeremy Hunt’s budget, due to be presented on Wednesday, has the potential to set the tone regarding short- and medium-term objectives for the UK economy. It follows unemployment data being released on Tuesday, which will act as a barometer of the health of ‘UK Plc’.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

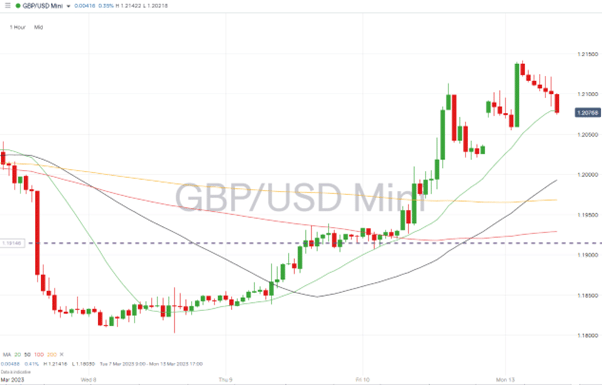

GBPUSD Chart – Hourly Price Chart

Source: IG

UK economic data:

- Tuesday 14th March (7 am GMT): UK unemployment data: analysts forecast the January unemployment rate to rise to 3.8% and average earnings to have risen 6.6% over the previous three months.

- Wednesday 15th March 12.30 pm GMT): UK Budget.

EURUSD

The big event of the week for euro traders is the announcement on interest rate levels due for release at 1.15 pm (GMT) on Thursday 16th March. The US CPI and PPI inflation numbers can also be expected to influence the price of EURUSD, with those reports due on Tuesday 14th and Wednesday 15th.

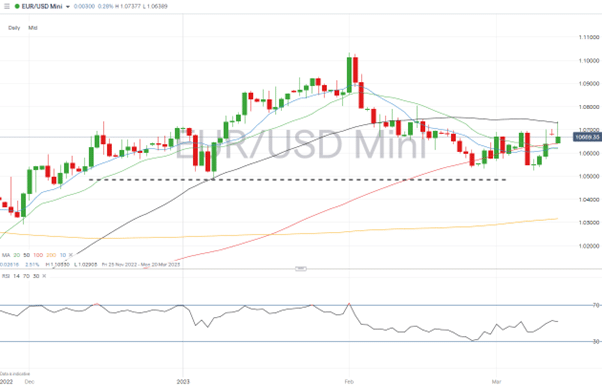

EURUSD Chart – Daily Price Chart

Source: IG

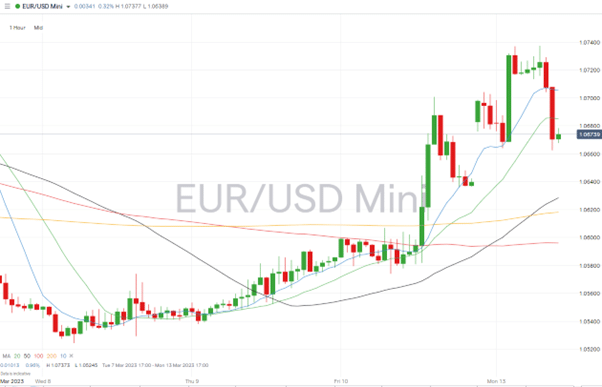

EURUSD Chart – Hourly Price Chart

Source: IG

Indices

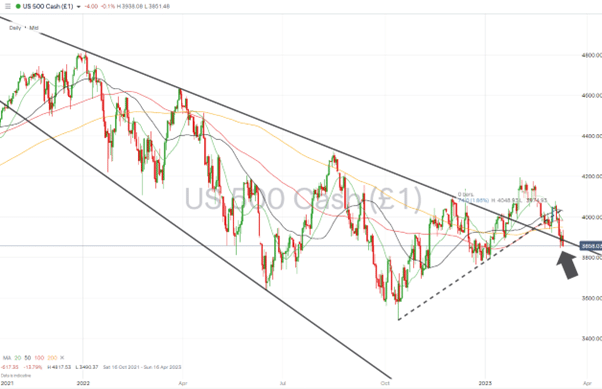

S&P 500

After a busy week of announcements from the Fed and the release of the Non-Farm Payrolls job numbers, the focus will this week turn to inflation. Inflationary pressures have been the primary driver of US interest rate policy for more than 12 months making the CPI and PPI reports due on Tuesday and Wednesday essential reading.

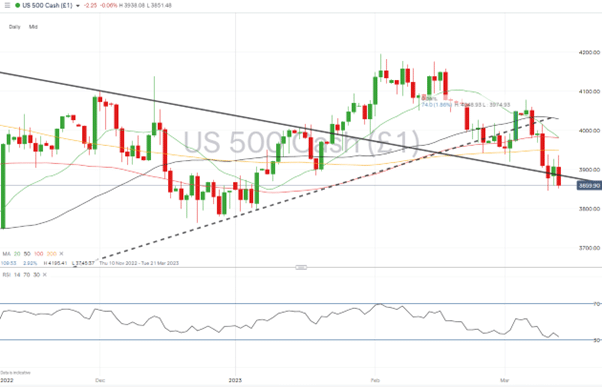

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Daily Price Chart – Trendline

Source: IG

US economic data:

- Tuesday 14th March (12.30 pm GMT): US CPI (February), analysts forecast prices to rise 6.2% year-on-year from 6.4% and 0.4% month-on-month from 0.5%.

- Wednesday 15th March (12.30 pm GMT): US PPI, retail sales (February), analysts forecast prices to rise 0.2% month-on-month from 0.3%.

People Also read:

- WEEKLY FOREX TRADING TIPS – 2023.03.13

- US Dollar Weakens as Nonfarm Payrolls Data Comes in at +311K

- Euro Hangs in the Balance as Markets Prepare for US Jobs Report

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk