FOCUS ON: US-China, Inflation, Dovish Guidance

- Last week’s Non-Farm Payroll jobs increased the levels of uncertainty in financial markets.

- This week’s US-China talks will add to macroeconomic tensions.

- US inflation data due on Wednesday will give more of a clue as to the next move by the Fed.

Macroeconomic and geopolitical trends look set to play a crucial role in guiding asset prices this week. US Treasury Secretary Janet Yellen is meeting with China’s powerbrokers to smooth US-China relations, but she faces a challenging task. At the same time, analysts are digesting last week’s US jobs report, which, for only the second time in the previous 13 months, generated an employment number below what analysts had forecast.

Forex

GBPUSD

UK authorities will release two crucial pieces of data this week. The unemployment report due on Tuesday will give an insight into how the UK labour market is coping with rapidly rising interest rates, and the GDP report due on Thursday will provide a high-level view of the state of the economy.

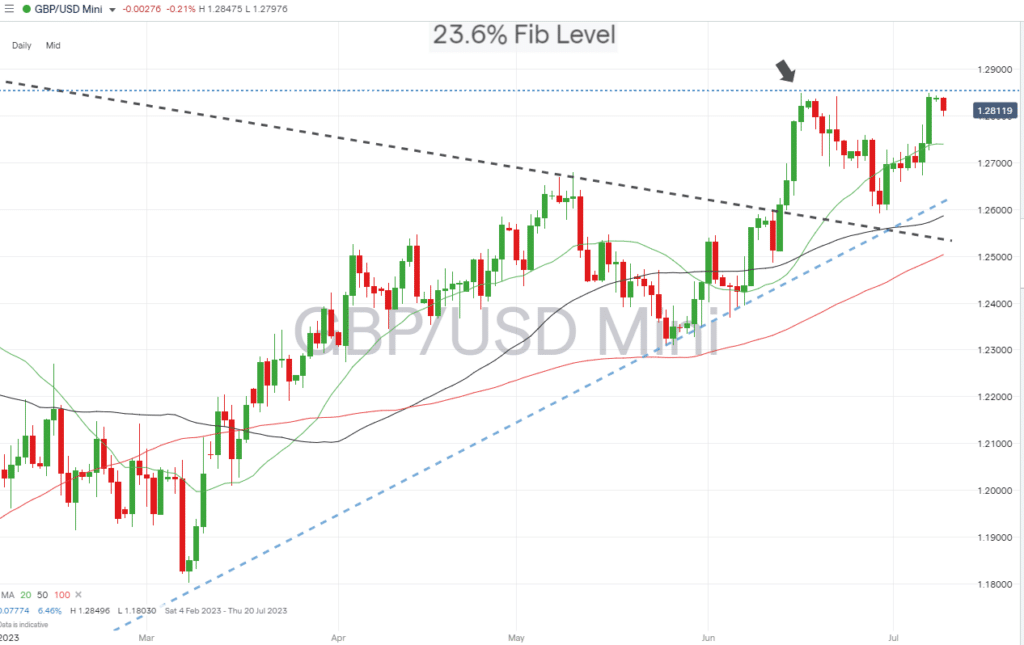

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Fib Level Resistance

Source: IG

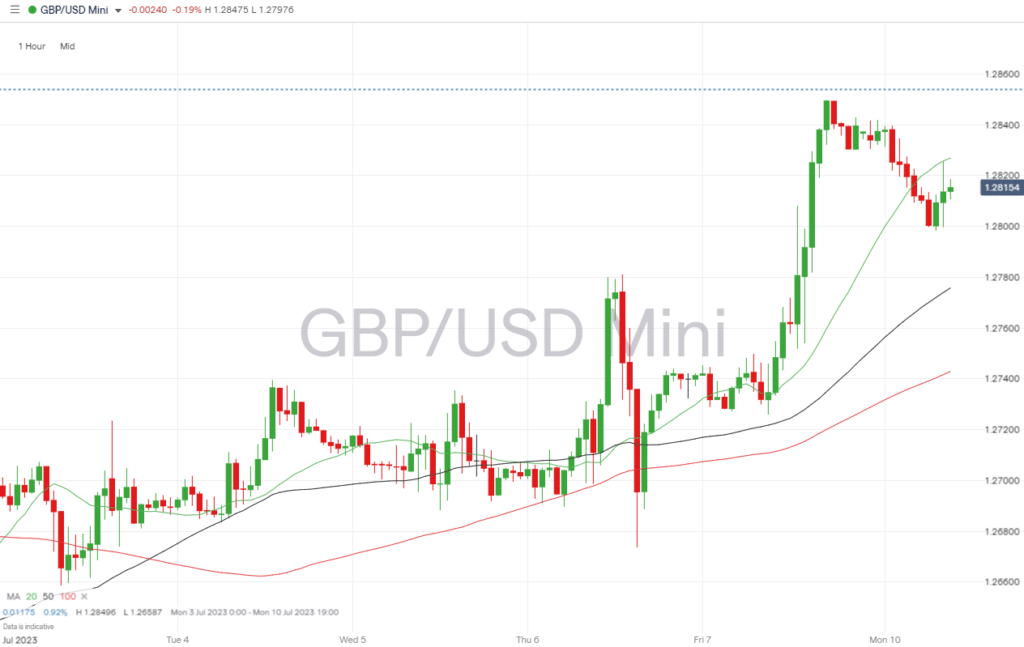

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Tuesday 11th July – 7.00am BST – UK unemployment data (May). The unemployment rate is predicted to hold at 3.9% in May, and the claimant count to fall by 22K in June. Average earnings are expected to rise 6.7%.

- Wednesday 12th July – 1.30pm BST – US CPI (June). Analysts predict US prices to rise 3.6% year-on-year and 0.2% month-on-month, from 4% and 0.1%, respectively. The crucial Core CPI number is expected to rise to 5% and 0.3%, respectively, from 5.3% and 0.4% last month.

- Thursday 13th July – 7.00am BST – UK GDP (May). Analysts forecast growth to be flat month-on-month, down from 0.2%

- Thursday 13th July – 1.30pm BST – US PPI (June). Factory gate prices as represented by the PPI number are forecast to be -0.1% month-on-month, from -0.3% in May.

EURUSD

German ZEW index data due on Tuesday can be expected to influence the price of all EUR currency pairs, and big announcements in the US on Thursday look set to impact the price of EURUSD.

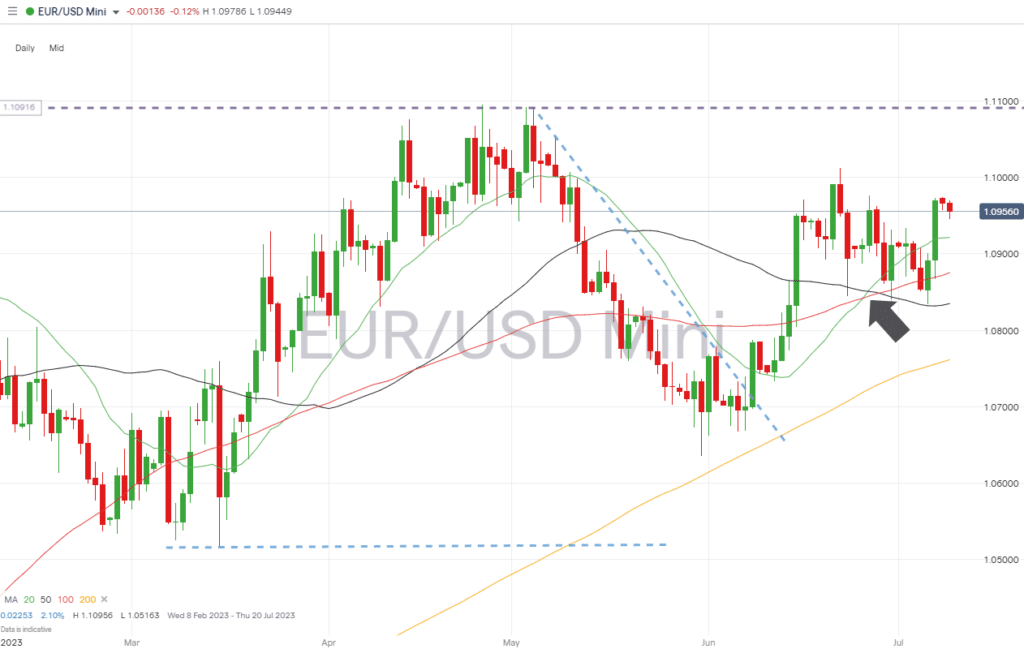

EURUSD Chart – Daily Price Chart

Source: IG

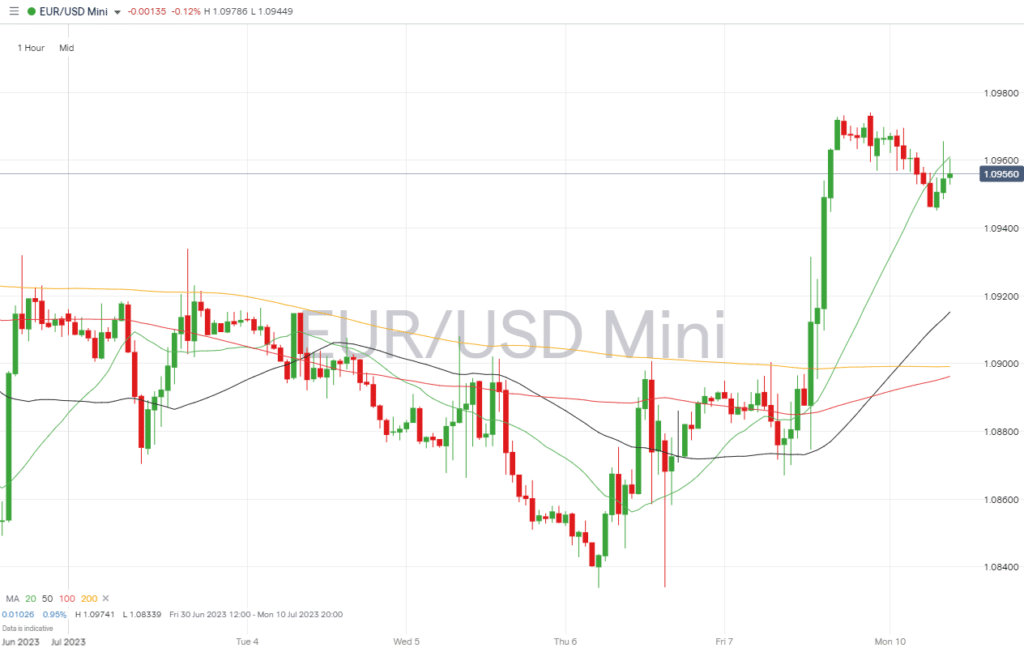

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Tuesday 11th July – 10.00am BST – German ZEW index (July). Analysts predict the index to fall to -13.

- Wednesday 12th July – 1.30pm BST – US CPI (June). Analysts predict US prices to rise 3.6% year-on-year and 0.2% month-on-month, from 4% and 0.1%, respectively. The crucial Core CPI number is expected to rise to 5% and 0.3%, respectively, from 5.3% and 0.4% last month.

- Thursday 13th July – 1.30pm BST – US PPI (June). Factory gate prices as represented by the PPI number are forecast to be -0.1% month-on-month, from -0.3% in May.

Indices

S&P 500

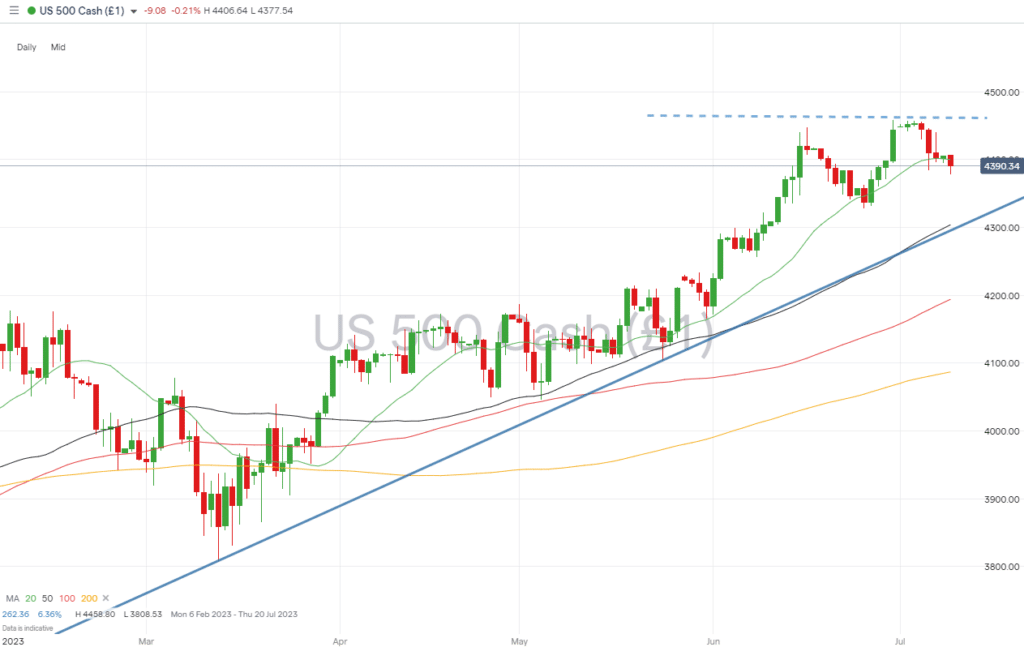

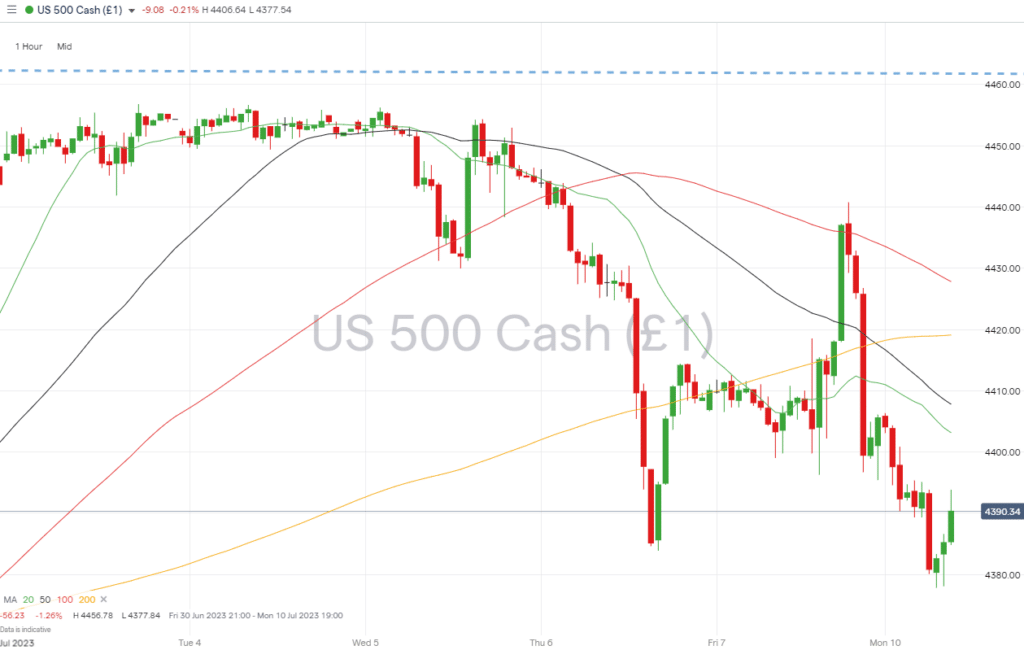

Stock traders are still digesting the surprisingly downbeat US jobs data released on Friday. Signs that the US economy is slowing down could leave the Fed room to not raise interest rates at the rate it has been doing. However, the absence of an immediate bounce in the S&P 500 reflects investor concerns about the possibility of the economy entering a period of stagflation.

S&P 500 Chart – Daily Price Chart

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Wednesday 12th July – 1.30pm BST – US CPI (June). Analysts predict US prices to rise 3.6% year-on-year and 0.2% month-on-month, from 4% and 0.1%, respectively. The crucial Core CPI number is expected to rise to 5% and 0.3%, respectively, from 5.3% and 0.4% last month.

- Thursday 13th July – 1.30pm BST – US PPI (June). Factory gate prices as represented by the PPI number are forecast to be -0.1% month-on-month, from -0.3% in May.

- Friday 14th July – 3pm BST – US Michigan consumer sentiment (July, preliminary). Analysts expect the sentiment index to rise to 64.5 from 64.4.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.07.10

- The Best and Worst Performing Currency Pairs in June 2023

- Forex Market Forecast for July 2023

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk