FOCUS ON: Central Banks, Interest Rates, Earnings, and Job Numbers.

- US earnings season continues.

- ECB and US Fed set to announce interest rates.

- US employment data to be released Friday.

Market prices have formed consolidation patterns in the run-up to a huge week regarding economic news reports. Central banks will update on interest rate levels, US Non-Farm Payroll employment data will be released on Friday, and blue-chip corporations will update investors on quarterly earnings. All of the data points have the potential to trigger significant price moves in a variety of asset groups.

Forex

GBPUSD

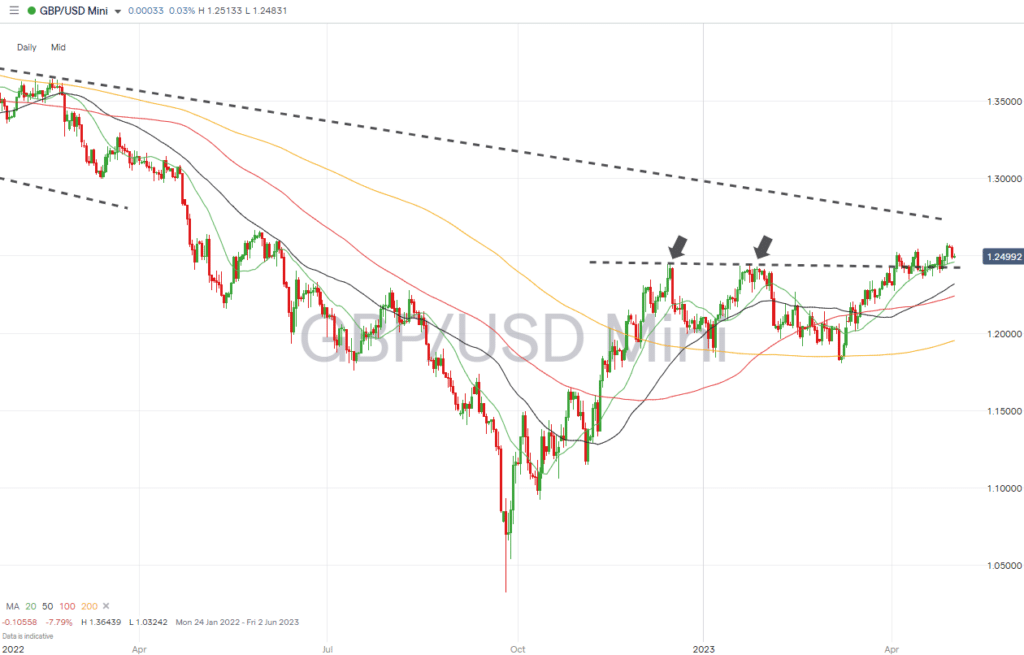

The absence of UK-specific economic data releases and the national holiday on 1st May could lull some sterling investors into mistakenly expecting a quiet week. The Reserve Bank of Australia, US Federal Reserve and ECB provide updates on interest rate policy on Tuesday, Wednesday, and Thursday. Each announcement could impact the value of GBP-based currency pairs.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

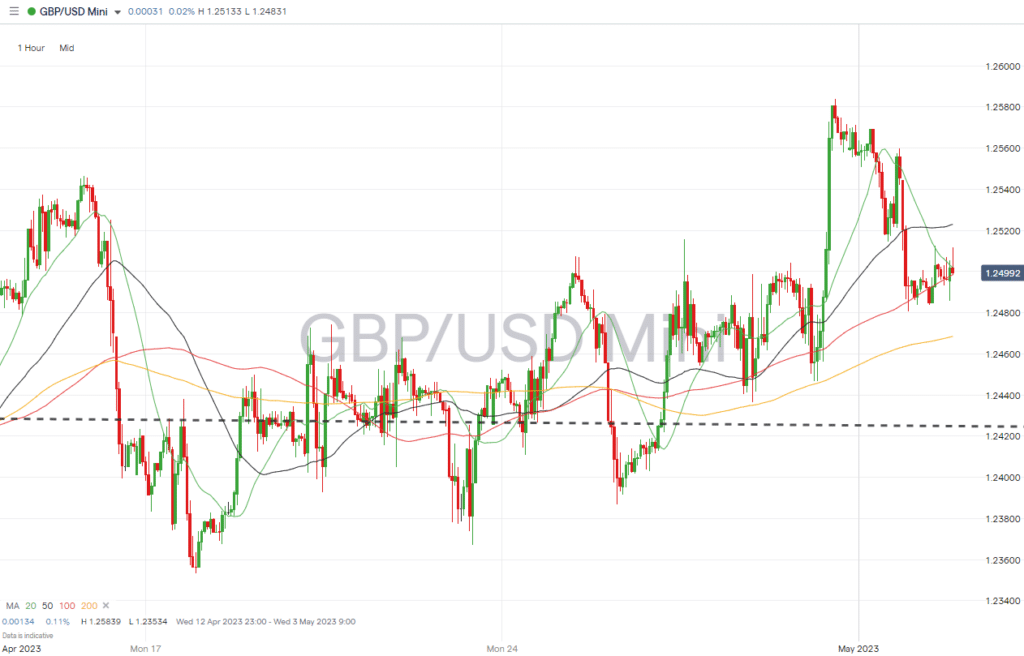

GBPUSD Chart – Hourly Price Chart

Source: IG

UK company reports:

- Tuesday 2nd May – BP, HSBC earnings report.

- Wednesday 3rd May – Metro Bank, Lloyds, Barratt Developments, Airbus earnings.

- Thursday 4th May – Shell quarterly earnings. Next, BAE Systems trading update.

- Friday 5th May – IAG earnings.

EURUSD

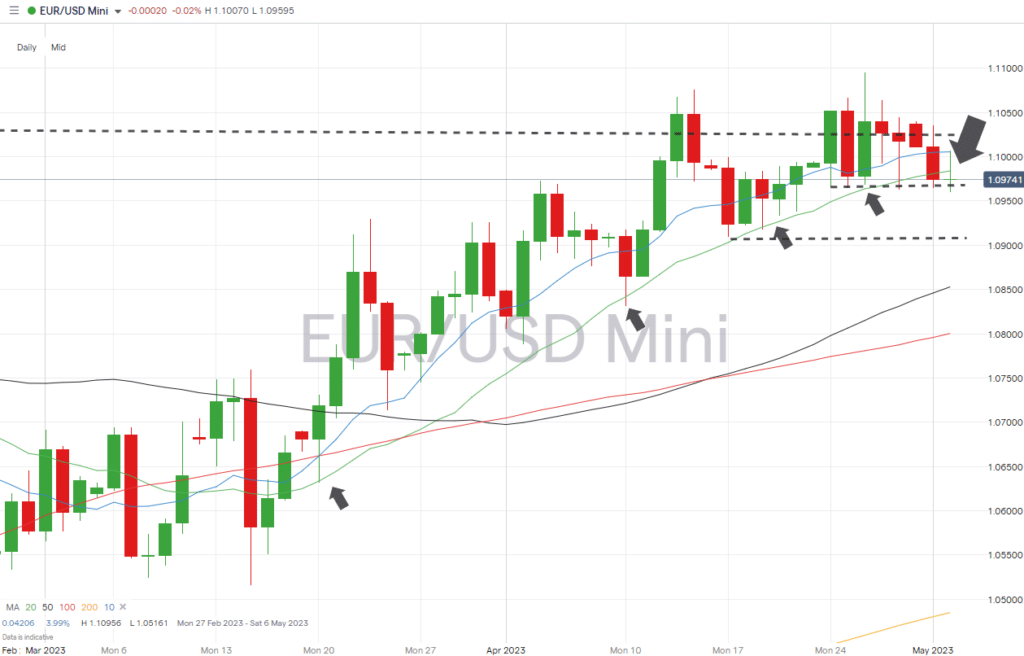

Analyst forecasts on the next interest rate rise by the ECB are split between the hike being 25 or 50 basis points. The degree of uncertainty running into the decision can be expected to result in significant price moves after the event.

EURUSD Chart – Daily Price Chart – Break of 20 SMA

Source: IG

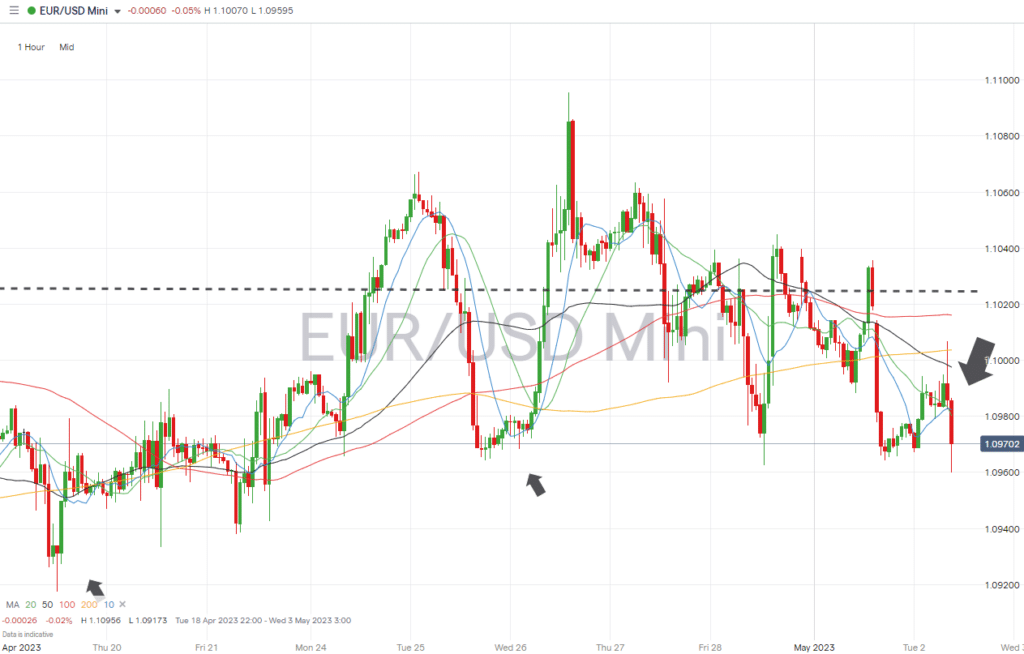

EURUSD Chart – Hourly Price Chart

Source: IG

Eurozone asset-influencing economic data:

- Tuesday 2nd May – 10 am GMT – Eurozone inflation, analysts forecast year-on-year inflation to fall to 6.6%.

- Wednesday 3rd May – 7 pm GMT – US Federal Reserve FOMC interest rate decision. An increase in base rates to 5.25% is widely expected, and guidance from the Fed’s officers will provide clues regarding medium-term policy.

- Thursday 4th May – 1.15 pm GMT – European Central Bank interest rate decision. Markets are pricing in a 25-basis point increase to 3.75%, but a 50-basis point increase can’t be ruled out.

Indices

S&P 500

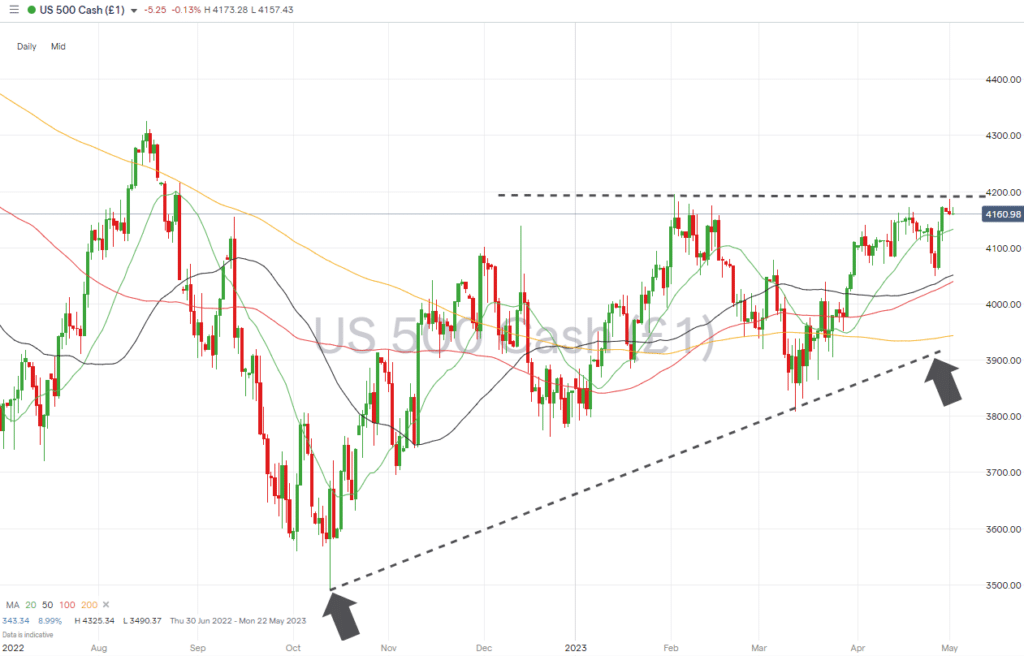

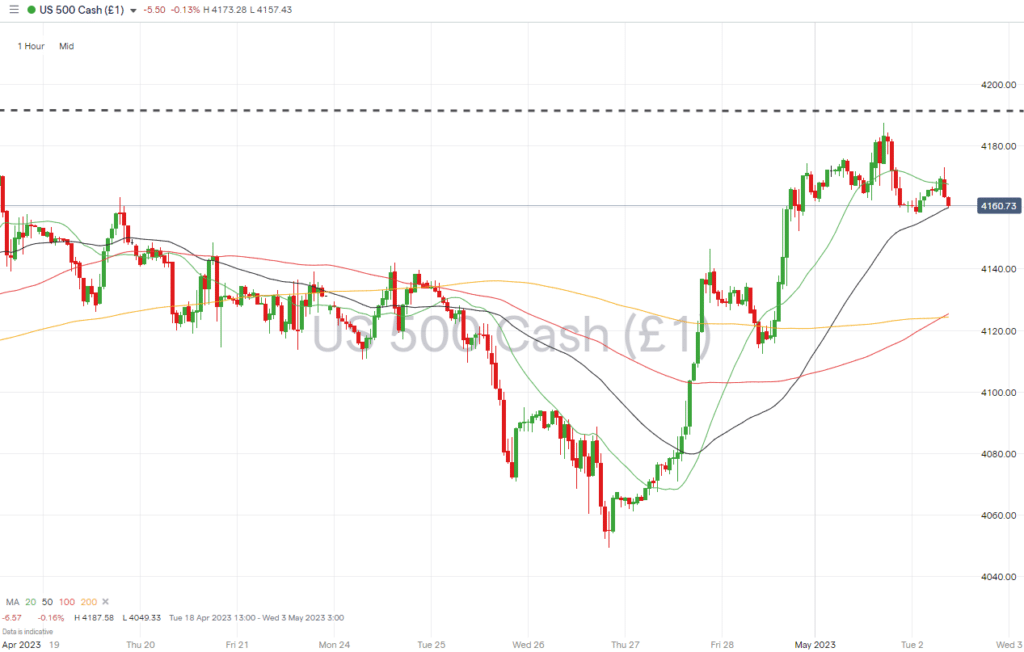

The bull run in stocks has paused while investors prepare for a busy week regarding earnings announcements. The Fed will set interest rate levels on Wednesday, and the US NFP jobs report due on Friday is a significant data milestone of every month. The backdrop to these announcements is another round of earnings reports, including those from Apple and Ford.

S&P 500 Chart – Daily Price Chart – Moving Average Support

Source: IG

S&P 500 – Hourly Price Chart

Source: IG

US economic data:

- Wednesday 3rd May – 7 pm GMT – US Federal Reserve FOMC interest rate decision. An increase in base rates to 5.25% is widely expected, and guidance from the Fed’s officers will provide clues regarding medium-term policy.

- Thursday 4th May – 1.15 pm GMT – European Central Bank interest rate decision. Markets are pricing in a 25-basis point increase to 3.75%, but a 50-basis point increase can’t be ruled out.

- Friday 5th May – 1.30 pm GMT – US Non-Farm Payroll employment report. The unemployment rate is expected to rise to 3.6%, and payrolls by 181,000, up from 236,000 last month.

US company reports:

- Tuesday 2nd May – Ford, Uber, AMD, earnings report.

- Thursday 4th May – Apple quarterly earnings.

People Also Read:

- WEEKLY FOREX TRADING TIPS – 2023.05.01

- Forex Market Forecast for May 2023

- Strong Euro Price Action Heading into Key Data Releases

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk