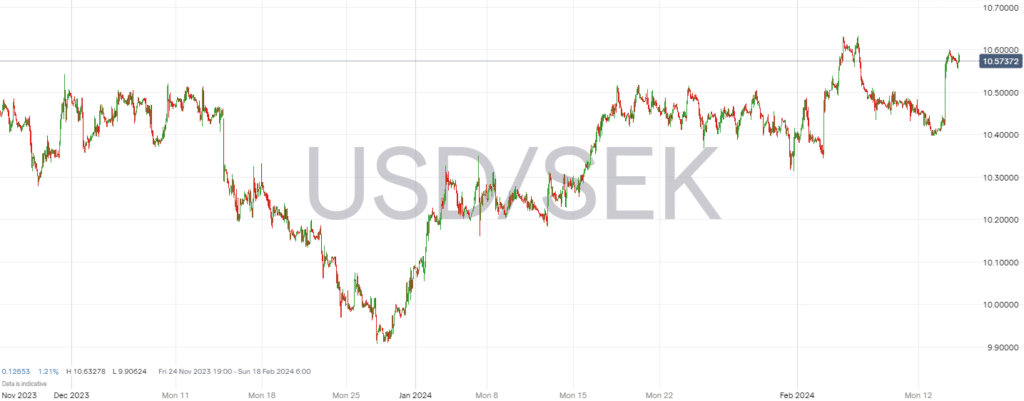

The USDSEK currency pair has experienced a notable ascent, marking a 3.86% increase from January 1 to February 9, 2024. This movement is attributed to a confluence of fundamental factors, technical analysis insights, and future forecasts that suggest a continued upward trajectory.

Starting the year slowly, the USDSEK pair reached a low of 10.0672 SEK per USD on the 1st January. However, this trend reversed dramatically as the pair climbed to its highest point of 10.6071 SEK on February 5, 2024, indicating a significant appreciation of the US Dollar over the Swedish Krona within the first few weeks of the year.

This volatility can be attributed to a variety of global economic factors. These include shifts in monetary policy expectations, geopolitical tensions, and macroeconomic data releases from both the United States and Sweden. Such movements are typical for the currency markets, where investor sentiment can quickly shift in response to new information and broader economic trends.

Throughout January and into February, the USDSEK rate demonstrated a steady increase in volatility. Daily exchange rates reflecting both the market’s reaction to immediate economic indicators and speculative positioning by traders. For instance, detailed trading data from Yahoo Finance highlighted specific days where notable shifts occurred, underlining the responsiveness of the USDSEK pair to market dynamics and economic news

The upward trend in early February, culminating in the year’s highest exchange rate so far, suggests that investors might be favoring the US Dollar amidst a backdrop of economic uncertainty or perceived strength in the US economy relative to Sweden’s. However, currency markets are inherently unpredictable, and numerous factors can influence future movements of the USDSEK exchange rate.

Fundamental Factors Affecting USDSEK

The underlying strength of the USD against the SEK can be traced back to a series of economic indicators that have shaped market sentiment. Key among these are tech earnings and job data, anticipation around the Federal Reserve‘s monetary policy, and global oil demand dynamics. These elements collectively signal robust economic performance and policy shifts that potentially favor the USD over the SEK.

USDSEK Technical Analysis

Technical analysis reveals that the USDSEK pair has shown significant momentum. Pivot points, serving as key indicators of potential resistance and support levels, suggest that the currency pair may encounter resistance at higher levels but also finds ample support, indicating a strong bullish undercurrent.

Forecast and Projections

Looking ahead, forecasts suggest a continued positive outlook for the USDSEK pair. Projections for the remainder of 2024 anticipate further gains. Target levels could reach as high as 11.2022 in August and peaking at 11.3464 in September. These predictions underscore the possibility of sustained strength in the USD relative to the SEK.

In conclusion, the USDSEK exchange rate’s rise in early 2024 is underpinned by strong fundamental factors and technical indicators. Forecasts project further appreciation, albeit with the understanding that currency markets are subject to rapid changes influenced by global economic shifts. Investors and analysts alike should remain vigilant. Keep an eye on both macroeconomic indicators and geopolitical developments that could influence future movements.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk