This is a guest post by Rania Gule, Market Analyst at XS.com

Crude oil is being traded at around $73.00 during Tuesday’s sessions following disappointing results from the OPEC+ meeting. The internal division among oil-producing nations was significant, and the outcome did not align with market expectations for boosting oil prices. Meanwhile, the United States is working to enhance its oil supplies and increase its strategic reserves. This implies that once the reserves are filled, supply will be available in the markets, leading to a potential price decline.

Simultaneously, the U.S. dollar index has strengthened for the second consecutive day after China received negative outlooks from Moody’s rating agency. Additionally, Isabelle Schnabel, a member of the European Central Bank’s board, mentioned that inflation is nearing the target, signaling the end of the central bank’s tightening cycle. This development suggests that markets are stepping back from the idea that the U.S. Federal Reserve will be the first to cut interest rates, supporting U.S. yields and bolstering the value of the U.S. dollar against the euro and other currencies.

Last week, OPEC+ nations, led by Saudi Arabia, collectively decided to significantly cut their oil production by about 2.2 million barrels per day early next year. However, the market reaction was a decline in oil prices, as markets were disappointed with the size of the cuts and the inclusion of new countries in the decision, leaving uncertainty about further reductions in the future.

I believe global uncertainty about the oil demand supports a negative price trend. Major global economies are beginning to witness the effects of their contractionary monetary policies on their economies. In line with this, the United States will announce key labor market figures this week, culminating in the Non-Farm Payrolls report next Friday, likely shaping future decisions from the Federal Reserve.

Therefore, if these numbers and data support further monetary tightening, the U.S. economy, being the largest consumer of oil, may face additional challenges that could negatively impact demand in the markets. This is particularly noteworthy after observing some unusual movements in South Korea, where two companies reportedly bought 4 million barrels of American oil so far, according to reliable sources.

The American Petroleum Institute (API) is scheduled to announce its weekly changes in oil inventories later today, Tuesday. After registering a slight decrease of 0.817 million barrels last week, with no specific expectations for this week’s numbers, markets are left in further confusion, contributing to the support for lower prices.

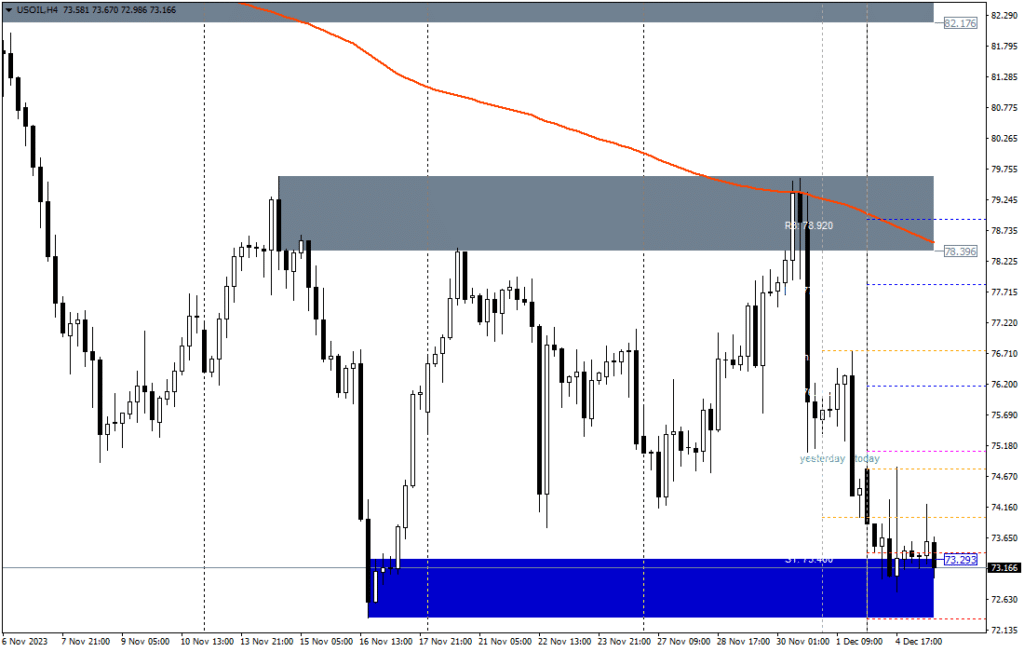

Technical Analysis of the OIL (WTI) Prices

Oil prices remained completely stable in the days following the official announcement by OPEC+. Member countries began to realize the missed opportunity and are trying to salvage the situation through side comments, such as those made by the Saudi Energy Minister. In my view, these elements may be good for short-term volatility, but they are unlikely to lead to significant increases in oil prices in the long and medium term.

According to the daily chart, expectations have shifted towards a bearish trend for oil prices. This is primarily because the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are deep in the negative zone, and the price is below the 100 and 200-day Simple Moving Averages (SMA). From a technical perspective, this suggests that sellers are in control of the trend in oil prices.

Source: XS.com

In a less likely optimistic scenario, the $80.00 level represents a resistance level that needs to be surpassed and maintained. If crude oil manages to hold above this level, the next target is $84.00 as a resistance level, expecting some selling pressure or profit-taking. If oil prices consolidate above this level, the subsequent upside target is near $93.00.

However, the more probable negative scenario suggests that the current support near $73.00 is under strong pressure, making a breach imminent. This level serves as the last line of defense for the bullish rebound before targeting a price level of $70.00 or lower. Therefore, caution should be exercised when making buying decisions before the $67.00 level, near the triple bottom from June, as the next support level for trading. A modest price rebound at this level could lead to a breakdown in prices on the other side.

Related Articles

Trade Commodities with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||