The time for hand wrangling is over, as it is for speculation from financial pundits and insights drawn from the futures market. The Fed has finally spoken, and financial markets did not hear exactly what they were expecting. Chairman Powell and his banking buddies equivocated. The market half expected a 50 basis point rate cut, but it only received 25, and what was worse was that Powell did not commit to a series of cuts, but hedged a bit and claimed there could always be another one. Analysts and especially markets were confused, but life goes on.

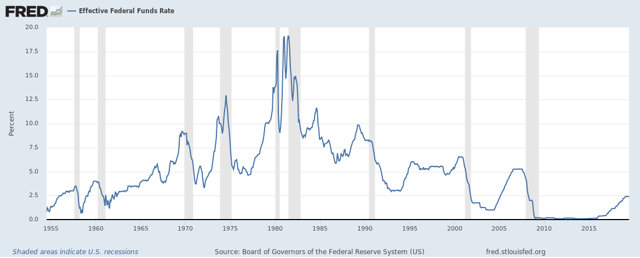

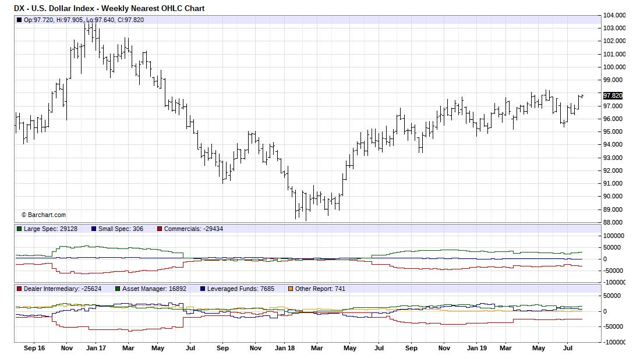

The 25 basis point interest rate reduction brought the Fed’s benchmark rate back down to 2.25%. Amazingly enough, it was also the first rate cut since 2008 and was a move away from attaining “neutral” ground, as Powell has phrased it in the past. The U.S. Dollar actually rose on the news, a peculiar reaction that it has also displayed in the past when other cuts have been made. It nearly hit 98.7, a new record for 2019, but it has since pulled back slightly to 98.3, still a high watermark. Equities immediately dipped after Powell refused to commit to a series of cuts, but they have also recovered slightly.

President Trump was not pleased. He had demanded 50 basis points, and he soon expressed his dissatisfaction in his normal fashion by tweeting his negative sentiments. He is struggling to boost the economy in any manner that he can, fearing an economic slowdown in 2020, even possibly a recession, which could spell doom for his re-election aspirations. The simple truth is that he painted Powell into a corner, since the current chaos in trade negotiations makes it impossible for Powell to commit to anything going forward. As the old adage goes, Trump has been hoisted upon his own petard.

As one analyst described it, we will remain stuck with “The Three Stooges: LIRP, ZIRP and NIRP”: “Whether it is low interest rate policy, zero interest rate policy or negative interest rate policy, none of these were ever meant to be forever policies. Unless of course, you ask Ben Bernanke, who said he didn’t expect to see normal rates again in his lifetime. For the record, Bernanke was only 60 when he said this at quarter million dollar lunches (quarter million being the fee he got) he held for big shots a few years ago.” As icing on the cake, yields on 10-Tear Treasuries fell below 2% this morning.

But will the rate cut help the economy? This question is being asked, even after economists and talking heads on financial news channels had been demanding for months a reversal of the Fed’s “Normalization” program. Political and market pressure were threatening to end the supposed independence of the Fed, something Jerome Powell was indeed sensitive to and part of the reason his press statements were so noncommittal. As many analysts predicted, he chose to take the “insurance” option by explaining that the only reason to cut was to ensure that Fed did not wait too late.

Rate cuts are intended to spur economic development, but many analysts claim that the world is so awash in debt and so many asset bubbles have formed that any new liquidity added to the system will be like pushing upon a wet noodle. The effectiveness of monetary policy has suddenly been brought to the forefront of an ongoing debate of how can central bankers extricate the global economy from this so-called “temporary” set of conditions that were imposed to curtail market forces a decade ago.

Temporary experiments may have become permanent fixtures after a dacade of use, but, for the present, economists and analysts point to several reasons for the new accepted norm of slow and gradual economic growth:

- Aging demographics create headwinds due to unfunded liabilities related to benefit programs for the elderly. Politicians are well aware of the problem, but they refuse to deal with it;

- Technology has been a friend in the past, but it is now destroying jobs more rapidly than it is creating them. Futurists are postulating that, “We are likely to see 20% to 40% of jobs displaced by the middle of the century. If we allow it to happen, that could cause a massive depression”;

- For decades, wealth has continued to be concentrated in the “Top 1%”. Wealth inequality only exacerbates existing problems;

- Massive debt and its eventual high servicing costs, when real interest rates do rise, will stifle economic growth both now and in the future. Economists tell us that more borrowing is only taking away future growth prospects from generations to come, yet politicians are now fixated on causing run-away deficits and the debt that must fund them;

- Residential and commercial real estate prices are through the roof again and are quickly becoming a privilege that only the top quartile can afford, if at all. Rising debt delinquencies on consumer and business liabilities are an escalating problem that can only get worse;

- We are late in the economic cycle, a time when businesses tend to pull in their belts in preparation for the impending storms to come. By April of this year, U.S. retail businesses have already announced the closure of some 6,000 outlets. An additional $50 billion in liquidity will most likely drift overseas, not be invested for the future in domestic projects that could produce additional jobs.

While no one is ringing alarm bells at the moment, there is a general suspicion that “slow growth” could morph into no growth at the least provocation. Per one observer: “Economies generally move into what one calls a “vulnerable stage” before something pushes them into recession. We all pretty much agree that the US economy, not to mention the global economy, is in a vulnerable stage. It won’t take much of a shock to push it into recession.”

This continuing refrain that a recession is on the near-term horizon has been with us for several years. Bookstores are more than likely tiring of trying to push any more tomes on how to prepare for the big crash that is coming. Is now any different than the past? The chorus is mounting from a volume perspective. A few press accounts have begun to label 2020 as “The Year of the Next Big One”, which may be “click bait” on the Internet, but one gets the impression that momentum is beginning to build.

Under such puzzling conditions, what will currency markets do in August?

As noted previously, the U.S. Dollar tends to strengthen after Fed cuts in its benchmark rate, a surprising conclusion that seems to defy traditional thinking. There is research that has reviewed rate cuts over the past 30 years and the convincing conclusion is that the USD has responded with “a solid and pretty sustained rise”. The quizzical response has been explained by also taking a look at equity markets, which tend to jump when the prospect of additional liquidity is announced. Investment capital flows into the U.S. market, which on its own creates the pressure that drives the greenback higher.

This time around, however, the supposed “smart money” is banking on a gradual reversal of what this previous research would portend. The “snapshot” below of the USD Index was taken just before Powell’s press conference:

The index was already rising in anticipation of the Fed’ announcement of a cut. On July 31st, it jumped above 98.0, into territory it had not seen since May of last year. Analysts are now claiming that the USD “sponge” is too full. It is time for a flow of capital out of the USD and into other majors. If you buy into this narrative, then this analyst’s comment may be meaningful for you: “Proprietary sentiment indicators though, show smart money pointing convincingly towards a stronger euro and pound, and also, though less strongly, towards a higher aussie, kiwi, and loonie. The yen and franc are more mixed.”

The Bank of England is also set to declare a rate cut of its own in the coming days, and the ECB in the EU has also been talking about being more accommodative, but, perhaps, without a further reduction in its negative interest rate policy machinations. Financial markets are indeed at a crossroads. It is not a time to be holding onto positions for a longer term. The markets will become extremely sensitive to the slightest hint of a downturn. If earnings season disappoints, as many analysts believe it will, we could easily witness a massive exit of capital from the U.S. market, which would result in a sudden drop in the USD Index, as “smart money” professes.

Concluding Remarks

Fed Chairman Powell has delivered a 25 basis point interest rate cut, presumably as a precautionary measure and not as a response to political pressure from the Trump administration. Whatever the case may be, it may not have any impact on the domestic or global economy in the near or long term, other than to add to present asset bubbles.

Under these conditions, the wise counsel is: “We are in such bizarre times, all bets are off. It is certainly not the time for “buy and hold” unless your goal is to lose everything. If not, then you need an active, flexible, defensive investment strategy now more than ever.” Be cautious and sensitive to any negative economic announcements. Waters could get very choppy, as volatility picks up, a good time to polish off your best trading strategy and to be prepared for what the market is willing to give to you.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk