- The US Federal Reserve and European Central Bank both update the markets next week.

- Price volatility levels can be expected to pick up around the news.

- Nothing is guaranteed, but the long EURUSD strategy idea has an attractive risk-return ratio.

The markets are pricing in the US Federal Reserve taking a break from raising interest rates when it meets next week. The day after Jerome Powell updates the markets, it will be the turn of the European Central Bank to announce its own interest rate decision, which appears to hang more in the balance. With Eurodollar rates approaching key support levels, this could be the time to be positioning for the next euro bounce.

Euro Bull Market?

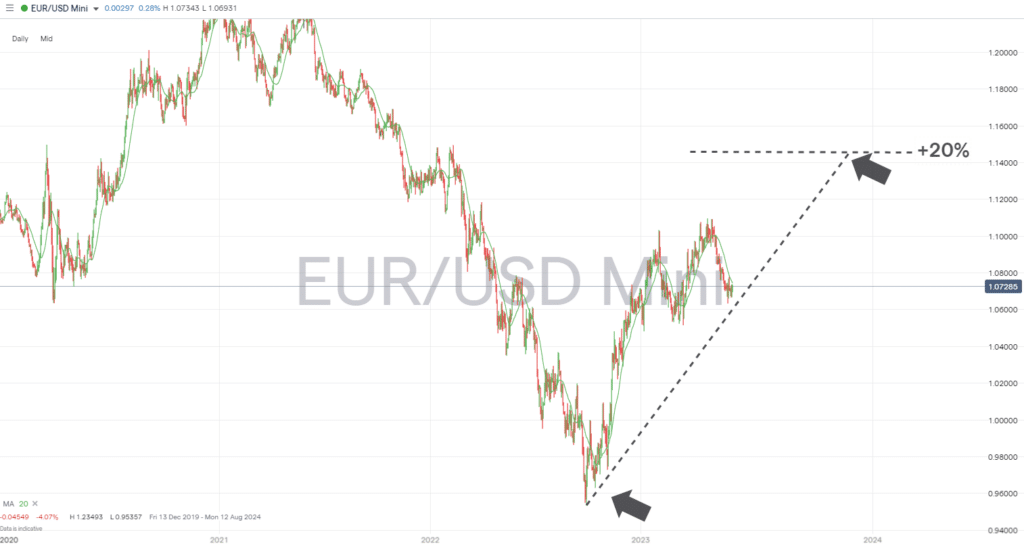

It’s worth remembering that the euro was trading against the dollar below the psychologically important price parity level as recently as November. The 12-month low of 0.95357 was printed on 28th September. It has subsequently been followed by a EURUSD price rally, which in May reflected a +16% rally from the lows.

EURUSD Daily Price Chart 2020 – 2023 – Bull Market?

Source: IG

With the standard definition of a bull market being a 20% rise, many analysts will have their eye on the 1.14447 price level representing a +20% gain and confirming an upward trend has formed. Even if price tests and then falls away from that key price level, it’s some way off the current price level of 1.0732.

Tight Stop Losses

Those looking to take long EURUSD positions will consider that enough headroom to justify trying to make gains from further price rises, particularly as there are two crucial support levels in close proximity offering a chance to set a relatively tight stop-loss on the trade.

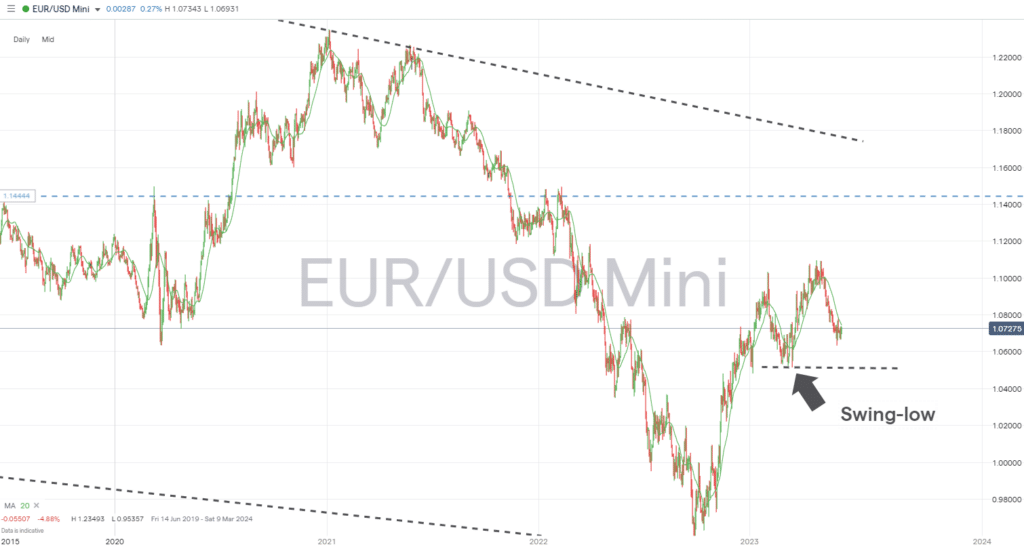

EURUSD Daily Price Chart 2020 – 2023 – Fib Retracement

Source: IG

The first potential stop loss level is at 1.05932, which acted as resistance between 22nd February and 17th March. It marks the 38.2% Fibonacci retracement of the multi-month sell-off in the euro, which started in May 2021 and continued into September 2022. That bear market is still the underlying long-term trend as it carved +22% out of the value of EURUSD over that period.

EURUSD Daily Price Chart 2020 – 2023 – Swing Low

Source: IG

A second stop-loss possibility sits at 1.05161. That intraday low printed on 15th March is now a key swing-low price point. As long as it holds, it will confirm price has followed the traditional bullish pattern of higher highs and higher lows, which started in September.

There is, of course, a plausible argument for EURUSD continuing to weaken and the long-term bear market remaining intact. Successful trading isn’t about always being right; it is more about ensuring gains on winning trades outweigh losses on bad ones. That means the long EURUSD strategy forming has a risk-return ratio which will be attractive to many of those adopting a medium to long-term approach.

People also Read:

- Forex Market Forecast for June 2023

- The Best and Worst Performing Currency Pairs in May 2023

- The Week Ahead – 6th June 2023

- WEEKLY FOREX TRADING TIPS – 2023.06.05

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk