With economic and geopolitical concerns picking up once again in January (yes, it does feel like it’s chopping and changing every month), the USD made the most substantial gains and features heavily in the January 2024 list. Meanwhile, the GBP had a solid month.

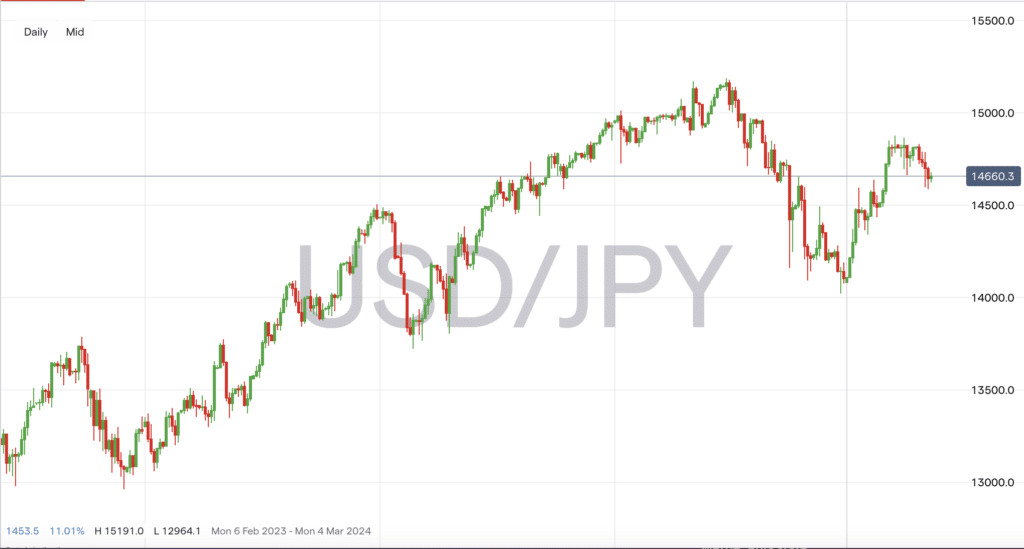

USDJPY +4.71%

- The yen strength seen in November and December didn’t last too long, with the USDJPY rising over 4% in January, climbing above 148.00.

- Strong economic indicators and a rise in geopolitical concerns boosted the USD.

- During the month, the BoJ kept investors in the dark regarding the potential scrapping of its ultra-loose monetary policy.

- Looking at the charts, the start of February has seen the USDJPY pull back slightly.

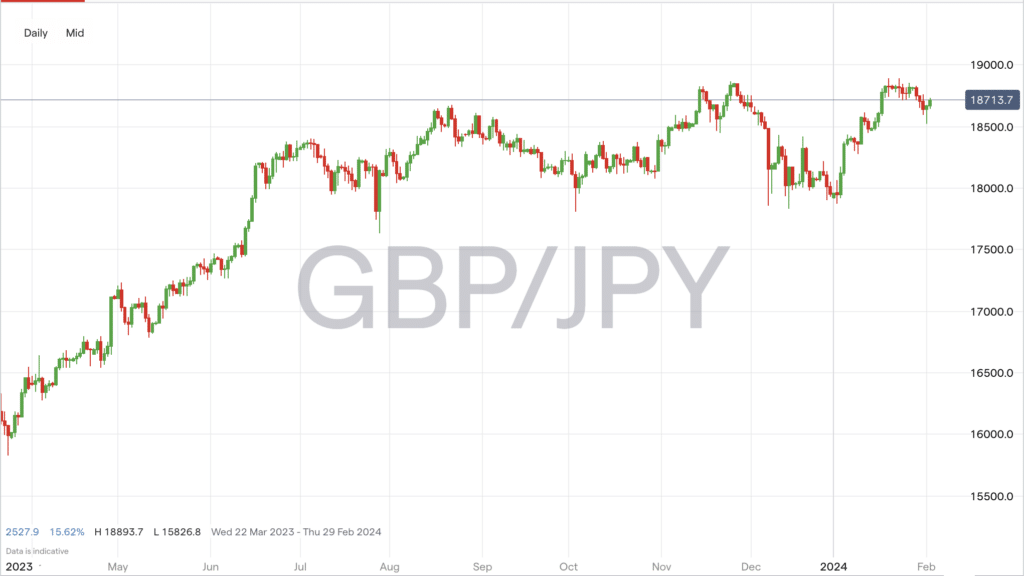

GBPJPY +4.31%

- Surprisingly, in January, the GBP remained resilient against the US dollar and made gains against some other major currencies, including the yen.

- In its latest rate decision, the BoE held rates steady and said it requires more evidence that inflation would continue falling before any potential rate cuts.

- Looking at the chart, the GBPJPY is steadily approaching its 2015 highs. Whether it can get there is another question.

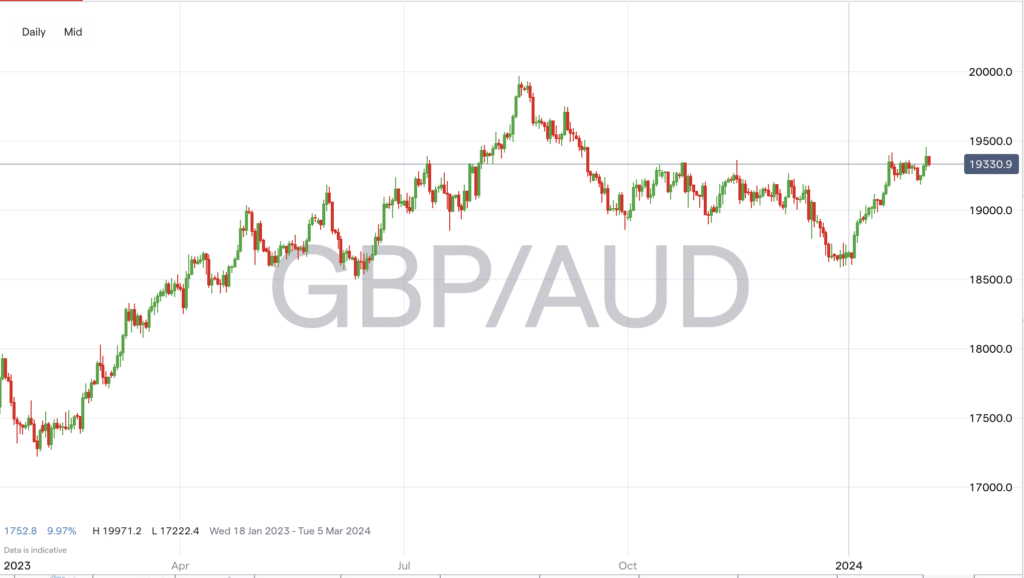

GBPAUD +3.70%

- The GBP pops up once again on the list, this time gaining over 3% against the Australian dollar during January.

- The pair touched a high of 1.9417 during the month before a period of consolidation.

- The Aussie dollar was impacted by weaker-than-expected consumer confidence.

- With the inflation rate in Australia falling, investors are hoping that rate cuts could soon be on the table.

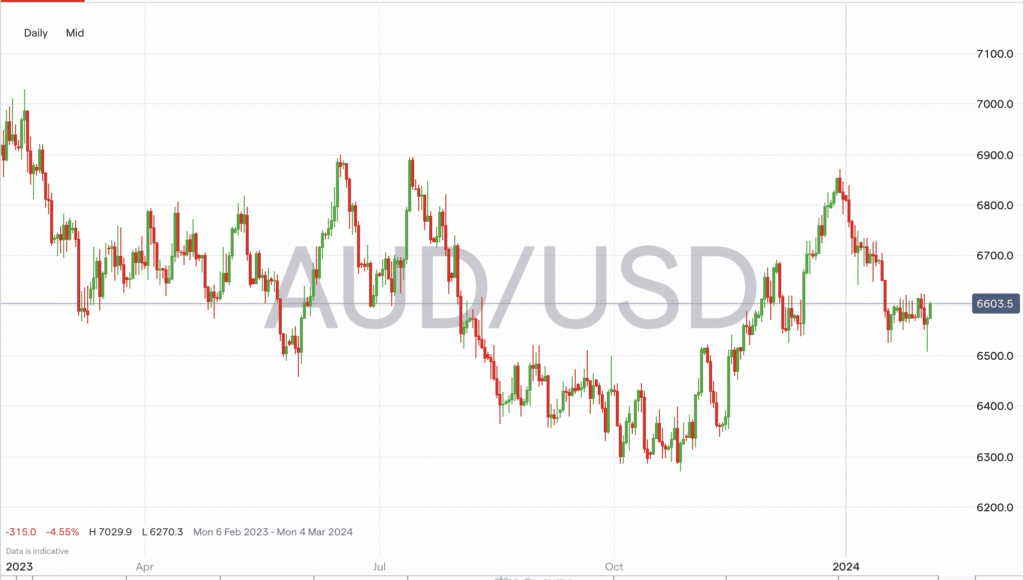

AUDUSD -3.14%

- Given the strengths and weaknesses listed above, it’s no surprise that the AUDUSD makes it onto the list.

- The pair fell as low as 0.6525 during the month after rising through November and December.

- However, the first day of February has been more favorable for the Australian dollar against the USD after an initial dip to 0.6508.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

People also Read:

- Forex Market Forecast for February 2024

- The Dynamics of EURHUF in January 2024

- USDPHP Trends and Projections for 2024

- Live Forex Charts and Analysis

Trade Forex with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||