The easing of macroeconomic and geopolitical concerns, as well as traders pricing in potential rate cuts next year, resulted in the US dollar seeing some weakness during December, making it into three of the top four moving pairs during the month.

USDARS

Firstly, a special mention for the US dollar against the Argentine peso. The pair made a substantial move higher during December after Argentina, with a new president in charge, decided to devalue its currency by more than 50%.

The move was part of a package of large-scale spending cuts made to address the country’s economic crisis. The country weakened the official exchange rate to 800 pesos per US dollar. The pair now sits at above 808.

According to reports, Argentina is targeting a monthly devaluation of 2%, as the country works to slash its currently triple-digit inflation rate.

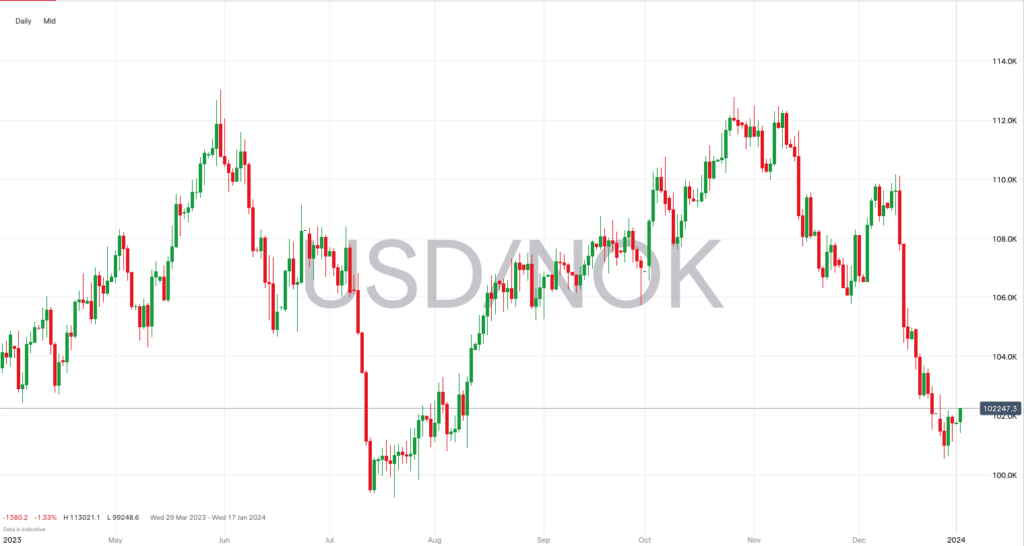

USDNOK -5.93%

- The Norwegian Krone (NOK) surged against the USD and some other major currencies in mid-December after the country’s central bank unexpectedly raised rates by 25bps.

- In December, the USDNOK pair fell as low as 10.050 before closing the year slightly higher, above the 10.1770 mark.

- Norges Bank noted the krone’s weakness, stating that it “is of concern” because a “weaker krone means higher imported goods inflation.”

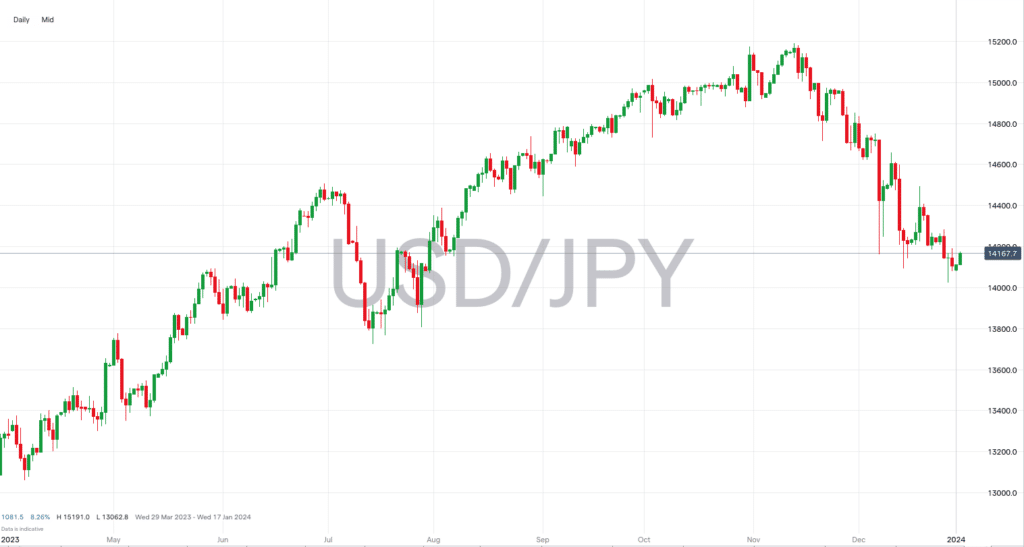

USDJPY -4.85%

- After rising to almost 152.00 in November, the Japanese yen has picked up some strength and currently trades above the 141 level.

- The yen’s strength was, in part, due to the BoJ providing a surprisingly clear hint at a shift in policy.

- With traders pricing in potential US rate cuts in 2024, the question now is if the yen’s rally can continue.

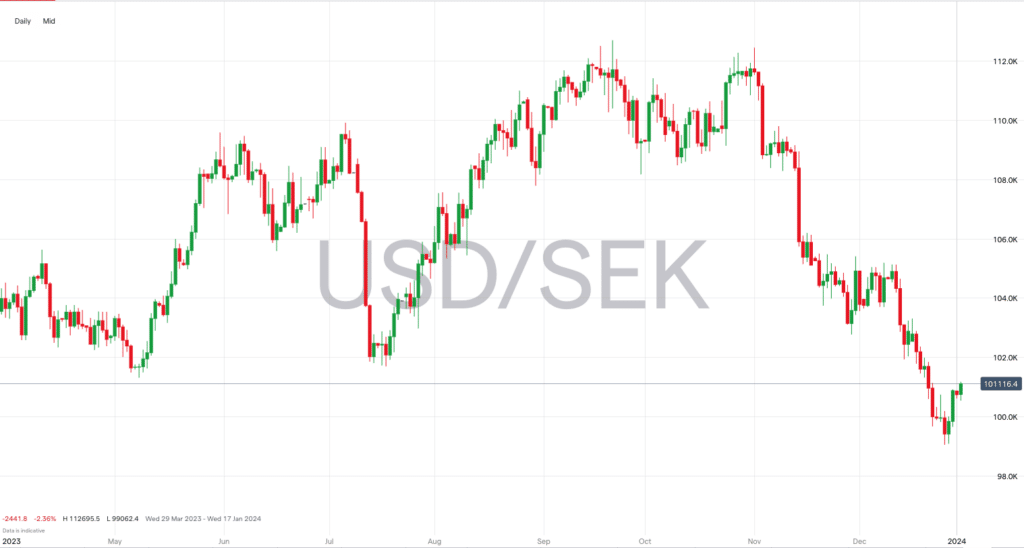

USDSEK -3.90%

- The USDSEK made it onto last month’s list of the biggest movers, falling more than 7%, and it added to that decline in December.

- The pair fell as low as 9.9055 after previously posting its best month against the US dollar in November.

- Analysts in the country believe the country’s rate hike cycle has peaked due to slowing growth and easing inflation concerns.

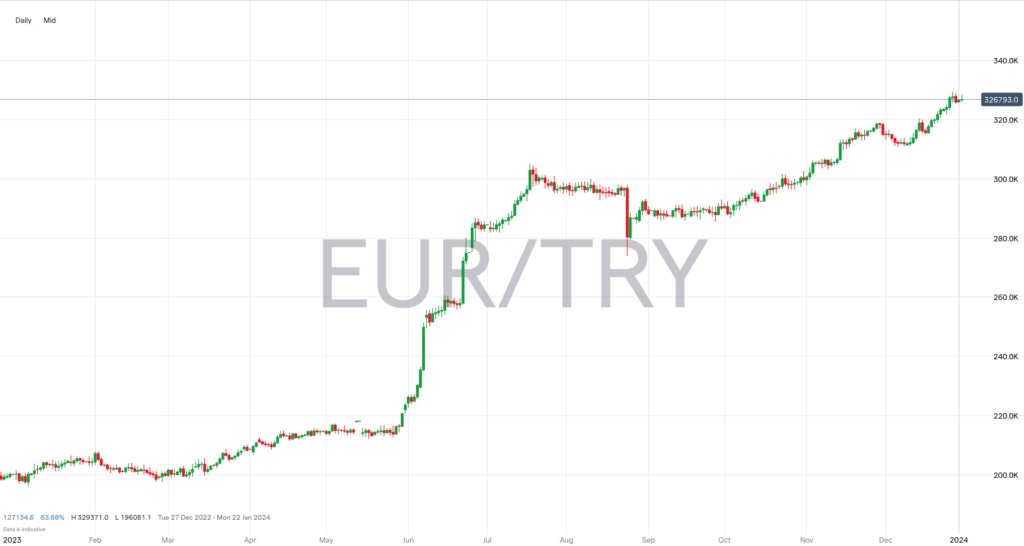

EURTRY +3.76%

- The EURTRY pair makes it onto the list for the third month in a row and takes the fourth spot for the second consecutive month.

- Inflation is still a massive concern for Turkey, and a minimum wage hike further fueled worries about the soaring inflation rate.

- The EURTRY hit a high of 32.8810 in December.

- Once again, general euro strength during the month, alongside the fact it is seen as a safer currency, helped it rise against the Turkish lira.

People also Read:

- Market Report – 2nd January 2024

- Declining German Producer Prices Pushes the Euro to Further Decline

- Future of GBP/USD Post UK Inflation Decline

- Choosing A Forex Broker

- How to Become a Successful Forex Trader

Trade Forex with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||