According to analyst forecasts, Andrew Bailey, Governor of the Bank of England, is about to announce the largest interest rate hike since 1995. With UK inflation primed to reach double figures in Q3, the slowly, slowly approach to interest rate policy appears to be about to morph into slow, slow, quick, quick, slow.

A 0.25% rate increase has marked every Bank Monetary Policy Committee meeting since February, but anything other than a 0.5% rate shift in the August meeting will be a surprise. With Cable at a critical technical price point, GBPUSD could still head in either direction. At face value, a more significant increase should support the price of sterling, but this could well be a case of ‘buy the rumour’ sell the fact. Particularly as markets continue to price a 50% chance of the US Fed putting through another 0.75% rate rise when the FOMC meets in September.

GBPUSD Technical Outlook

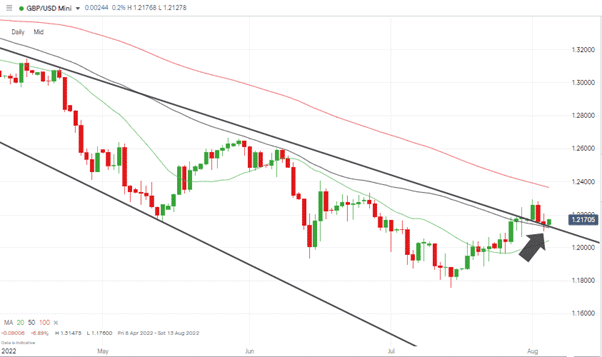

This week’s Technical Analysis and Trading Ideas Report purposefully set trade entry points at lower levels than were seen on Monday when the report was published. This was in anticipation of a short-term pullback in GBPUSD. After last week’s break of multi-month trendline resistance, a return to ‘kiss’ that key indicator (1.2166) was always a likely option. As it turns out, the second trade entry point of 1.214 – the region of 50 SMA on the Daily Price Chart was also triggered.

GBPUSD – Daily Price Chart – Trendline Break and Kiss

Source: IG

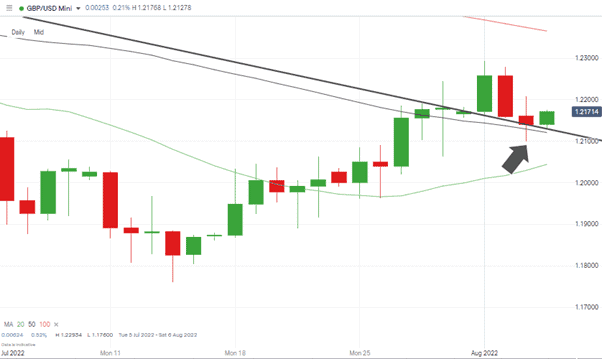

In the hours before the Bank making its call on rates, GBPUSD was nestled at 1.217. Both trade entry points showed a small profit, but the markets braced for potential fireworks.

GBPUSD – Daily Price Chart – Both Entry Points In Profit

Source: IG

This could be a time to take a small profit and watch from the sidelines, or at least scale back on some risk. Data released by IG shows that more than 68% of retail traders are now net-long GBPUSD, and the number of traders going long is building, with many expecting a bounce. But that trade looks crowded, and a contrarian view of crowd sentiment tends to be a winning trade.

Dollar Strength Will Prevail

Bailey and his team don’t face the same dilemma as Jerome Powell, Chair of the US Federal Reserve. The US tipped into a technical recession last week when it reported two consecutive quarters of reduced GBP. UK unemployment rates, in comparison, are low enough to offer the Bank of England a chance to prioritise taming inflation rather than economic growth. But the Fed looks dead-set on pursuing a super-hawkish policy until its inflationary problem is neutralised.

The short sharp-burst approach from the Fed has even been bought into by two FOMC members who were previously dovish. Minneapolis Fed President Neel Kashkari and San Francisco Fed President Mary Daly switched towards a more aggressive approach to rates in announcements made earlier this week. The BoE may be implementing a policy to bring inflation back toward its target levels. However, compared to developments in the States, it doesn’t look like one that will result in GBPUSD rallying significantly from here.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk