Monday’s one per cent intraday move in GBPUSD is a notable event. The upward momentum in sterling marks it out as the market to watch as a range of fundamental and technical factors come into play.

When the global financial markets opened this week, sterling was trading at 1.399 and facing the challenge of breaking through the psychologically important 1.40 level. Apart from the temporary spike in prices in February of this year, GBP has been trading below 1.40 since April 2018.

GBPUSD – Weekly Price Chart 2018 – 2021

Source: IG

The initial break of the 1.40 level happened during the Asian trading session. By the middle of the London trading session, GBPUSD was printing as high as 1.415.

What Caused Dollar Weakness

The timing of the price surge points to the general weakness of the US dollar. The Non-Farm Payroll jobs numbers released on Friday were particularly disappointing, and they increase the likelihood of US interest rates staying lower for longer. Even with US elections being some way off, there appears little appetite at the White House to prioritise propping up the national currency at the expense of employment levels.

Sterling Boosted by UK Fundamentals

At the same time, GBP, the other side of the currency pair, benefitted from the election results in the UK. The right-of-centre and market-friendly Conservative party made surprising gains. The stability offered by the mid-term election results encouraged investors to back the pound.

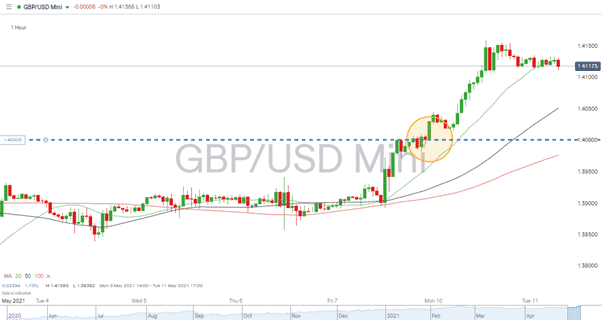

GBPUSD – Hourly Price Chart 7t –11th May 2021

Source: IG

The Scottish election results are harder to call. More importantly, for traders, they point to price volatility in GBPUSD remaining for some time. The pro-independence SNP won the most seats in the Holyrood parliament (64) but fell one seat short of claiming a majority. That means a referendum on Scottish independence remains firmly on the table, but when exactly is anyone’s guess. Some commentators suggest it’s definitely a question of “when, not if” a vote takes place, and it would be one that would have potentially seismic consequences. The issue looks set to drag on for months, if not years, and that could well result in many strong intraday price moves similar to the one seen yesterday.

Another geopolitical story to factor into the mix is Brexit. The reorganisation of the relationship between the UK and EU was always going to be a drawn-out affair, but tension hotspots are now appearing. The dramatic scenes of last week, when French trawlermen blockaded a Guernsey port, could be a taste of what’s to come with Gibraltar tipped as another potential trip-wire.

GBPUSD Technical Analysis

In the short-term at least, the path of least resistance for GBPUSD continues to be upwards. The amalgamation of a collection of fundamental price drivers, all pushing in the same direction, suggests that even after yesterday’s dramatic move, there is still enough momentum for cable to run.

Daily Pivot: 1.4105

GBPUSD Upside Scenario:

Long positions above the pivot. Target prices of 1.4155 and 1.4190.

Long-term positions to be based on the 1.40 and 1.4105 support levels.

GBPUSD Downside Scenario

Short positions below the pivot. Target prices of 1.408 and 1.405

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk