- EURUSD trades at parity for the second time in two months

- Short-term scalping opportunities present themselves around the key 1.000 price level

- Medium-term prognosis points to a test of lower levels

The multi-month bearish price movement in EURUSD has brought the euro back to parity with the US dollar for the second time in two months. It raises the question of how to trade the world’s biggest currency pair when it trades near such a significant psychological price level. It’s time to look at the short-term strategies now in play for those following EURUSD.

Scalping EURUSD Near Parity

One obvious approach is to consider the 1.000 price point of EURUSD as such a critical price support/resistance level. Any sustained move through it will be preceded by a period of sideways trading. The movement down to parity has been relatively brisk, and there is still plenty of opportunity for short-term bounces in price.

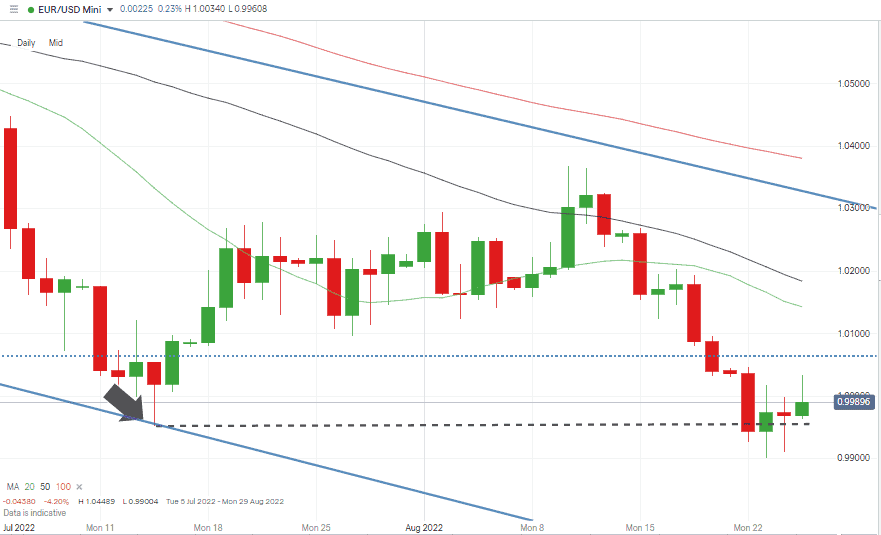

EURUSD – Daily Price Chart – July – August 2022

Source: IG

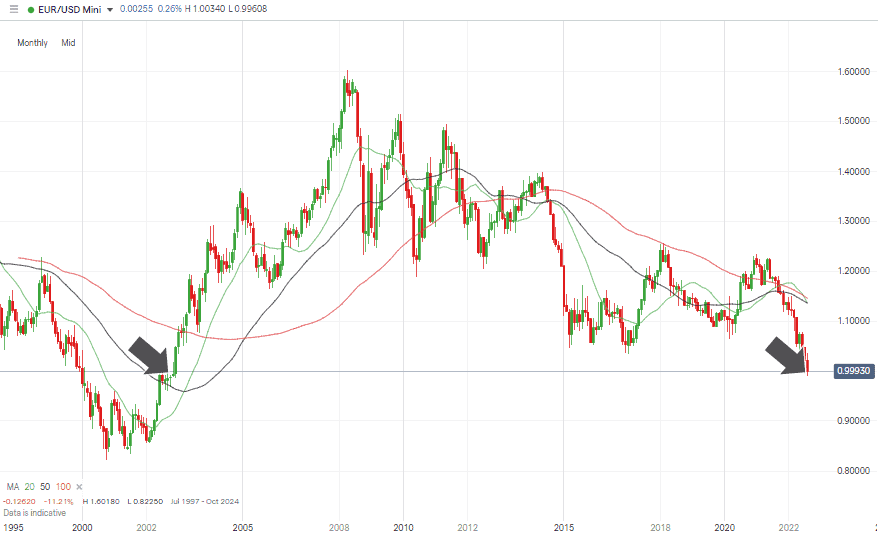

The opportunity for scalping comes from the fact that despite the enormous fundamental problems facing the eurozone, a seamless move below parity could be a step too far for some investors. The currency pair hasn’t traded below 1.000 since 2002, and only 12 months ago the forex pair was trading at 1.1899. No matter how bad the news for the eurozone region, a confirmed move by EURUSD to below 1.000 might take time to materialise.

Also Read: EURUSD Forecast and Live Chart

EURUSD – Monthly Price Chart 2000 – 2022

Source: IG

The Technical Analysis and Trading Ideas Report of 22nd August picked out the possibility of scalping strategies being the best way to play EURUSD at its current levels, at least until the next significant move gains momentum. The trade entry point on the short strategy wasn’t triggered – Monday’s price fall occurred without any pullbacks, but the target price of 1.000 was reached halfway through the European trading session on Monday. The long position trade entry point (1.000) did come into play, and those in that trade will be waiting to see if a short-term relief rally does materialise.

Short positions

- Entry Level 1: 00320 – Region of 20 SMA on the Hourly Price Chart. Scalping Strategy.

- Price Target 1: 0000 – Parity price level and hugely important price level.

Long positions

- Entry Level 1: 0000 – Anticipating buying pressure at the significant parity price level.

- Price Target 1: 01602 – 50% Fibonacci retracement of the price rally from 14th July to 10th August 2022.

- Stop Loss: < 1.0000 – Psychologically important price level.

Scalping Strategies – What To Look Out For

German GDP data is due out in the run-in towards the end of the week, and surprises in that report could distort the price consolidation process. There is also potential for other curve balls to be thrown by the Jackson Hole Economic Policy Symposium on Thursday and Friday. If the news from those events is anything other than alarming, then the 1.000 price level can be expected to continue to play a substantial role in guiding price and opening up more trading opportunities to both the upside and downside.

People Also Read

- Weaker US Inflation Data Changes the Outlook for Major Forex Pairs

- The Best and Worst Performing Currency Pairs in July 2022

- Deciphering Cable’s Contrarian Reaction To Major News

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk